'Pambawi sa kinorap?': Solon seeks 3-month national tax holiday for Pinoy workers

At A Glance

- In a move seemingly meant to quell the anger of Filipinos over the flood control projects mess, Kamanggagawa Party-list Rep. Elijah "Eli" San Fernando filed a measure that would grant Filipino workers a three-month national tax holiday on compensation income.

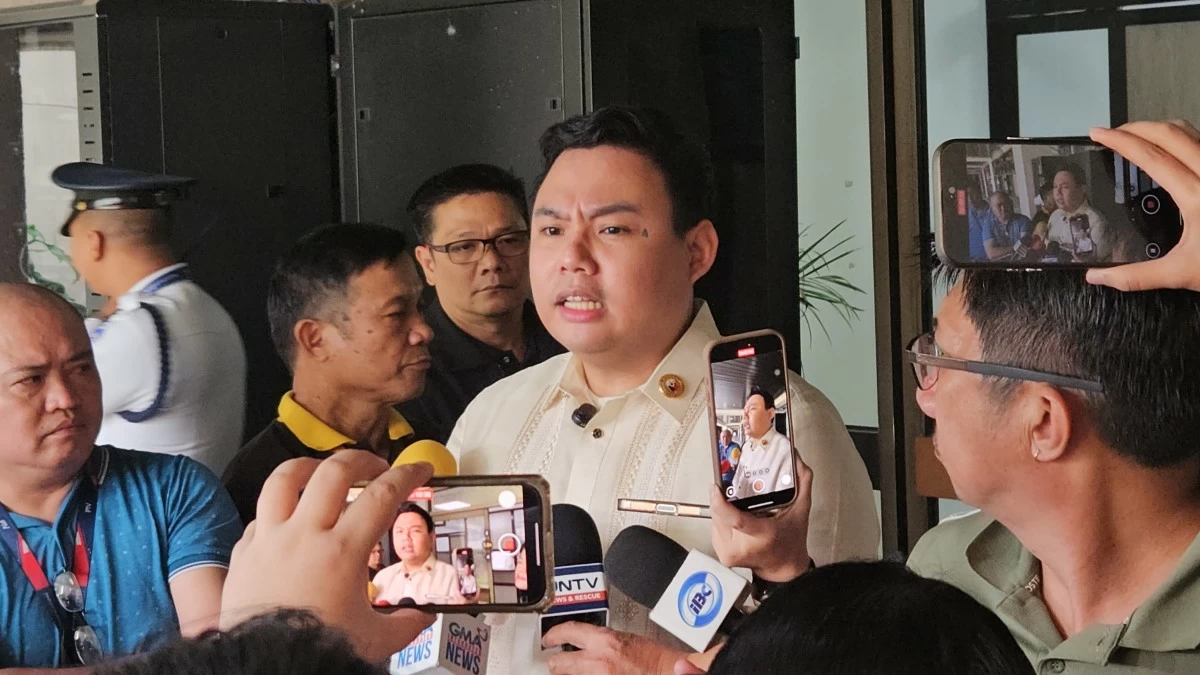

Kamanggagawa Party-list Rep. Elijah “Eli” San Fernando (Ellson Quismorio/ MANILA BULLETIN)

In a move seemingly meant to quell the anger of Filipinos over the flood control projects mess, Kamanggagawa Party-list Rep. Elijah “Eli” San Fernando filed a measure that would grant Filipino workers a three-month national tax holiday on compensation income.

Embodied in House Bill (HB) No.6205, the proposed tax holiday aims to provide direct economic relief to wage earners while addressing the growing public outrage over systemic corruption in public spending, particularly in flood control and infrastructure funds.

Calling for both fairness and accountability, San Fernando says the proposal is a necessary response to the erosion of public trust:

“Taxation is a shared responsibility between the State and its citizens grounded in mutual trust. But recent investigations have shown that billions in public funds were misused: lost to corruption, to substandard or non-existent projects, to political dealmaking," the minoriry solon said in obvious reference to anomalous flood control projects.

He says this "breach of trust cannot be ignored...At a time when our workers are already carrying so much".

San Fernando emphasized that ordinary Filipinos have been “unfairly burdened twice”: first by economic hardship, and second by the discovery that their taxes were mishandled.

“A responsive and meaningful intervention is necessary not only to provide immediate relief, but also to acknowledge the burden unfairly placed on ordinary taxpayers,” he said.

Under the proposed Three-Month Tax Holiday Act of 2025, all income tax on compensation will be suspended for three payroll months, once the bill is approved.

During this period, workers will receive 100 percent of their compensation without any income tax deductions. On the other hand, employers will temporarily stop withholding taxes for the duration of the holiday.

The tax holiday will apply uniformly to all workers receiving compensation income, regardless of sector or salary grade. The holiday may only be granted once per taxable year, and cannot be carried over.

Meanwhile, mandatory contributions (SSS, GSIS, PhilHealth, Pag-IBIG) will continue, ensuring regular benefits are not disrupted.

The measure also requires the Department of Finance (DOF) and Bureau of Internal Revenue (BIR) to submit a full transparency report within 60 days of implementation. It details foregone revenue and the number of beneficiaries, and ensures that accountability remains central to the proposal.

This intervention is uniquely insulated from corruption, according to the neophyte solon. “Unlike traditional social protection programs that rely on multi-layered systems vulnerable to political discretion and bureaucratic inefficiencies, this form of tax relief is direct, immediate, and far less susceptible to corruption.”

San Fernando says the measure is a moral acknowledgement from government: “Hindi lang ito tungkol sa pera (Tnis is not just about money). It’s about honesty. It’s about telling workers: ‘Naririnig namin kayo. Hindi kayo ang dapat magbayad sa kasalanan ng mga korap na pulitiko (We hear you. You shouldn't be made to pay for the transgressions of corrupt politicians)."

“This tax holiday doesn’t erase the systemic problems we need to fix. But it gives workers breathing room now, while we continue pushing for structural reforms in public finance, procurement, and anti-corruption,” he pointed out.

The proposed national tax holiday, he said, is both a practical and symbolic response to a crisis of confidence in public institutions.

“When corruption drains the national budget, the very least the government can do is give back what workers should never have lost in the first place,” concluded San Fernando.