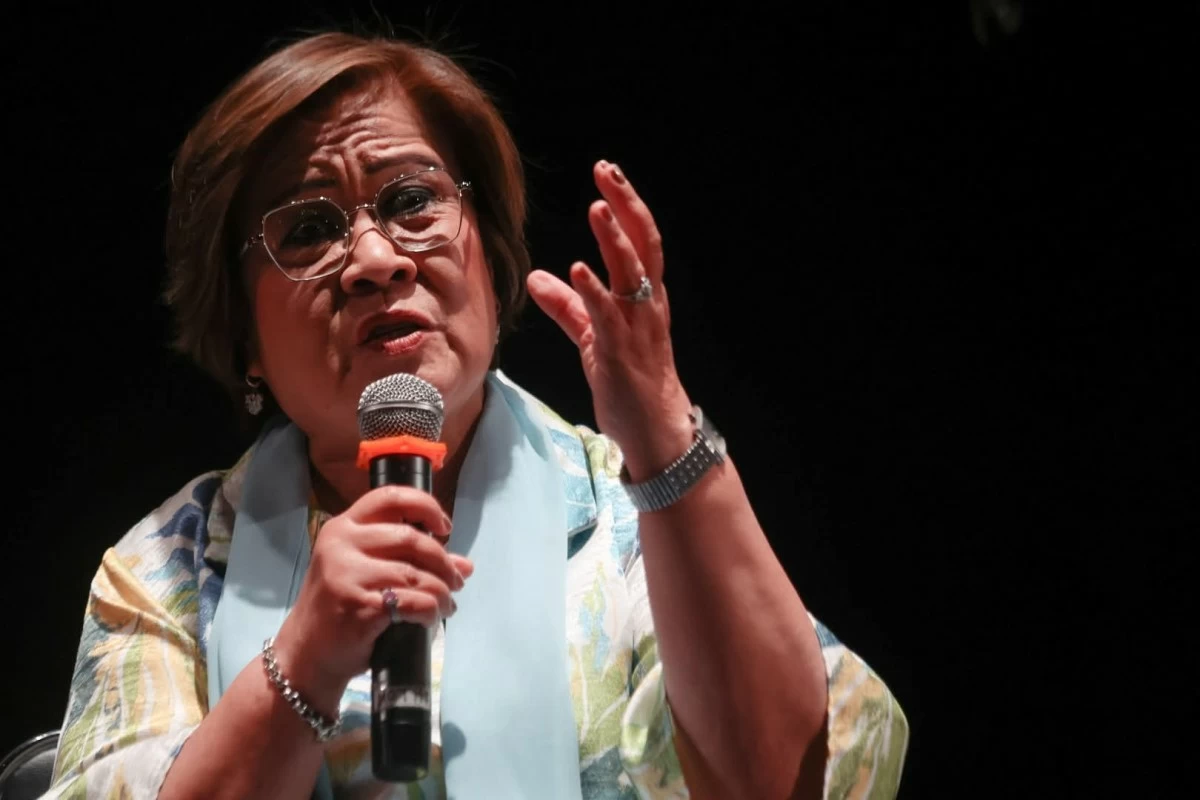

Mamamayang Liberal (ML) Party-list Rep. Leila de Lima has echoed calls for the House of Representatives to investigate the alleged risky transactions and poor investment decisions made by the Government Service Insurance System (GSIS), which resulted in losses amounting to P8.8 billion.

De Lima, a House deputy minority leader, filed House Resolution (HR) No. 414, which sought the probe on the GSIS and the actions of its President and General Manager Jose Arnulfo “Wick” Veloso.

De Lima's fellow members of the minority--ACT Teachers Party-list Rep. Antonio Tinio, Gabriela Party-list Rep. Sarah Elago, and Kabataan Party-list Rep. Renee Co--were the first to call out the GSIS and Veloso amid the controversies.

“These are the hard-earned money of Filipinos who have dedicated their productive years to serving the government and our people. Isn’t it a disservice to past, current, and future government employees if their money is being placed in risky and questionable investments that could jeopardize their benefits?” the ML Party-list solon said in filing HR No.414.

“Ngayon pa nga lang, nariyan na ang agam-agam ng mga kawani ng gobyerno kung may sapat bang pondo para masuportahan sila sa kanilang pagreretiro, tapos may mga ganito pang kaduda-dudang transaksyon ang GSIS?” asked De Lima.

(Even now, government employees already have doubts about whether there are enough funds to support them in their retirement, and yet GSIS is involved in these questionable transactions?)

“Para bang isinusugal ng GSIS ang hindi nila pera sa kwestyonableng mga transaksyon—kung lumago, magpasalamat na lang ang mga taga-gobyerno dahil may balatong pang-benepisyo. Eh paano sa mga nalugi? Hindi naman sila ang talo. Talo ang milyon-milyong Pilipino,” she added.

(It’s as if GSIS is gambling with money that isn’t theirs on dubious deals—if they profit, government workers should just be thankful there’s something left for benefits. But what about the losses? It’s not GSIS that suffers. It’s the millions of Filipinos who lose.)

HR No.414 cited a letter dated Oct. 14, 2025 where a group of current and former members of the Board of Trustees of the GSIS called for the immediate resignation of Veloso, alleging that his poor investment decisions led to losses amounting to ₱8.8 billion.

Questionable dealings mentioned in the said letter include those with Monde Nissin Corporation, Nickel Asia Corporation, Bloomberry Resorts Corporation, DigiPlus Interactive Corp., Alternergy Holdings Corporation, Figaro Culinary Group, Inc., Private Equity Investments, Udenna Land, Inc., 8990 Housing Development Corporation, and Acquisition of The Centrium.

The measure also noted reports that certain GSIS investment transactions were deliberately divided into smaller tranches to evade board oversight exceeding ₱1.5 billion, as well as allegations that Veloso bypassed governance procedures and falsified records to conceal irregular transactions.

“We need to delve into these serious accusations, as well as the transactions made by the GSIS, to determine whether these comply with the fundamental requirements of liquidity, safety, and yield necessary to maintain the actuarial solvency of the fund. We must assess if these actions were carried out in the proper exercise of the agency’s fiduciary duties and within the bounds of the law,” De Lima said.

“These are the issues that must be urgently addressed in this probe to genuinely observe prudence and ensure checks and balances in investing and safeguarding public funds,” the Bicolano added.