SEC orders Microdot to stop lending operations for violation of rules

SEC Chairman Francis Lim

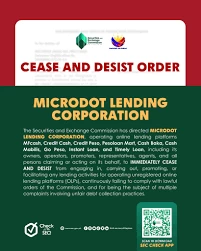

The Securities and Exchange Commission (SEC) has ordered Microdot Lending Corp. to stop operations due to its unfair debt collection practices and its failure to disclose the operations of some of its online lending platforms (OLPs).

The SEC Financing and Lending Companies Department (FinLend) issued a cease-and-desist order for Microdot and its OLPs, including their owners, operators, representatives, agents, and any and all persons acting in their behalf, to immediately stop promoting and facilitating any lending activity or transaction.

The OLPs covered by the order include MF Cash, Credit Cash, Credit Peso, Pesoloan Mart, Cash Baka, Cash Mabilis, Go Peso, Instant Loan, and Timely Loan.

Microdot is registered as a lending company with the Commission under SEC Registration No. CS201951287 and Certificate of Authority No. 2921.

The investigation by FinLend showed that Microdot failed to disclose the operations of Credit Peso Pro and MF Cash, in violation of Section 3 of SEC Memorandum Circular (MC) No. 19, series of 2019, which requires financing and lending firms to submit a report of all their existing OLPs to the Commission.

The SEC has also received multiple complaints against the company since 2024 for its alleged involvement in unfair debt collection practices, which violates the implementing rules and regulations (IRR) of Republic Act (RA) No. 11765, or the Financial Products and Services Consumer Protection Act (FCPA).

Microdot was also found to have violated Rule 8(c) of the IRR of RA 9474, or the Lending Company Regulation Act, for its continuous noncompliance with the orders of the SEC, such as the issuance of show cause letters, assessment letter, and walkthrough audit findings.

“[Microdot’s] operation of the undisclosed OLPs, blatant disregard of the SEC’s regulatory authority over it, and practice of unfair debt collection, may unjustly cause grave or irreparable injury or prejudice to the borrowing public, thereby imperiling their rights as enshrined in the FCPA,” the order read.

It added that, “Additionally, its employment of unfair debt collection practices, shown and established by substantial evidence, is a violation of the SEC FCPA IRR and should be immediately halted to safeguard the rights of its borrowers.”