Marcos economic czar says tax holiday proposal needs to be studied

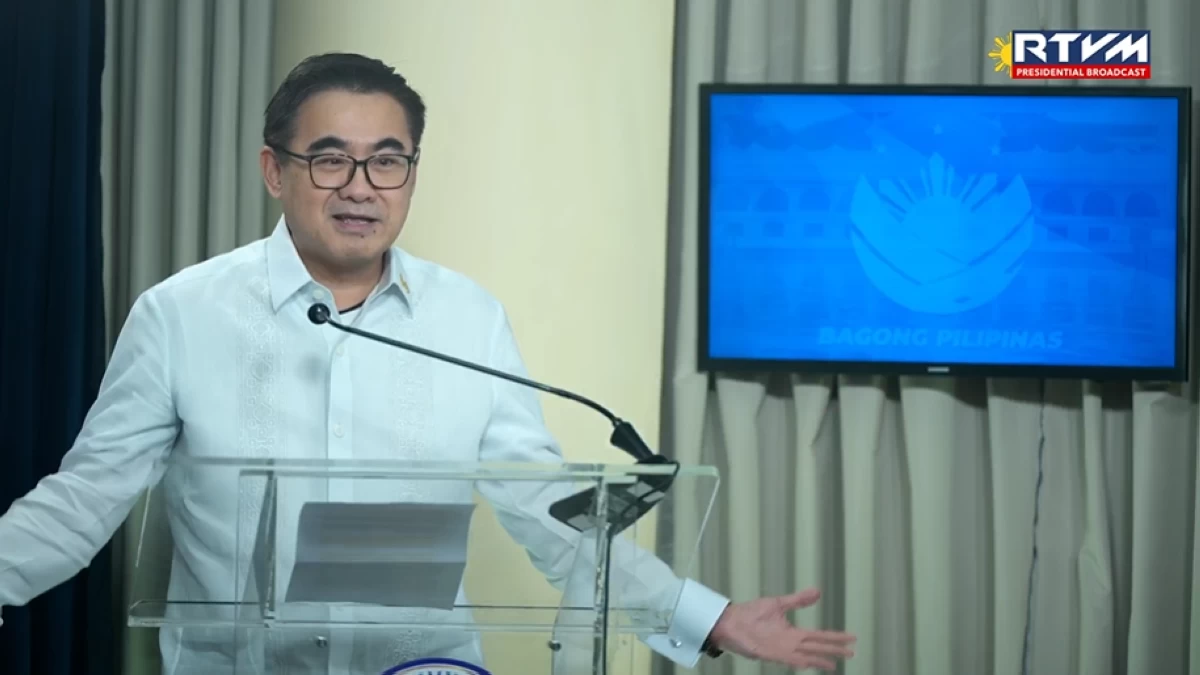

Special Assistant to the President for Investment and Economic Affairs Secretary Frederick Go (RTVM)

The proposal to grant a one-month income tax holiday for workers must undergo a thorough review to determine whether it is doable or not, Special Assistant to the President for Investment and Economic Affairs Secretary Frederick Go said.

Go said the proposal is "very new," so it should be thoroughly studied first by concerned government agencies such as the Department of Finance (DOF) and Department of Budget and Management (DBM).

"Bagung-bago po ito. Kailangang pag-aralan ito nang mabuti ng Department of Finance at ng DBM po (This is very new. The Department of Finance and the DBM need to study it carefully)," Go said in a Palace briefing on Thursday, Oct. 9.

"This is quite a big matter ‘no, and I think it’s best to give the DOF and the DBM time to carefully study this proposal," he stressed.

When asked whether the proposed tax holiday could help boost public confidence in government amid ongoing corruption controversies related to flood control projects, Go deferred to the judgment of the concerned agencies.

“I’d like to defer this matter to the Department of Finance and DBM because this really has to be studied carefully. I would hesitate to make a response that’s probably not very well thought about,” he said.

Senator Erwin Tulfo recently filed Senate Bill No. 1446, also known as the “One-Month Tax Holiday of 2025,” which seeks to provide direct financial relief to Filipino workers.

Under the bill, a one-time, one-month income tax exemption would be granted to individual taxpayers receiving compensation income. The tax holiday would take effect on the first payroll month immediately following the bill’s approval.

For mixed income earners, only the compensation income portion would be exempted from income tax.

The proposed exemption, however, would not apply to mandatory contributions to the Government Service Insurance System (GSIS), Social Security System (SSS), PhilHealth, and the Pag-IBIG Fund, and loan amortizations and other deductions voluntarily authorized by the employee.