PH tourism enters 'new era' as domestic travel surges

LPC Director of Hotels, Tourism, and Leisure Alfred Lay

Although Asian tourist arrivals decline, the Philippine tourism industry is still perceived to be entering “a new era of opportunity” because of the growth in domestic tourism, improved flight connectivity, and the 99-year lease reform.

Leechiu Property Consultants said in its third-quarter media briefing that, as investors refocus on long-duration assets, the country’s hospitality and leisure industries are expected to see renewed capital flows and expanded capacity through 2026.

“With the anticipated growth in domestic and long-haul tourism, along with increased hospitality FDIs (foreign direct investments) driven by the newly-approved 99-year lease to foreign investors, the tourism sector is poised to strengthen its position as a key investment area and a vital pillar of the Philippine economy,” said LPC Director of Hotels, Tourism, and Leisure Alfred Lay.

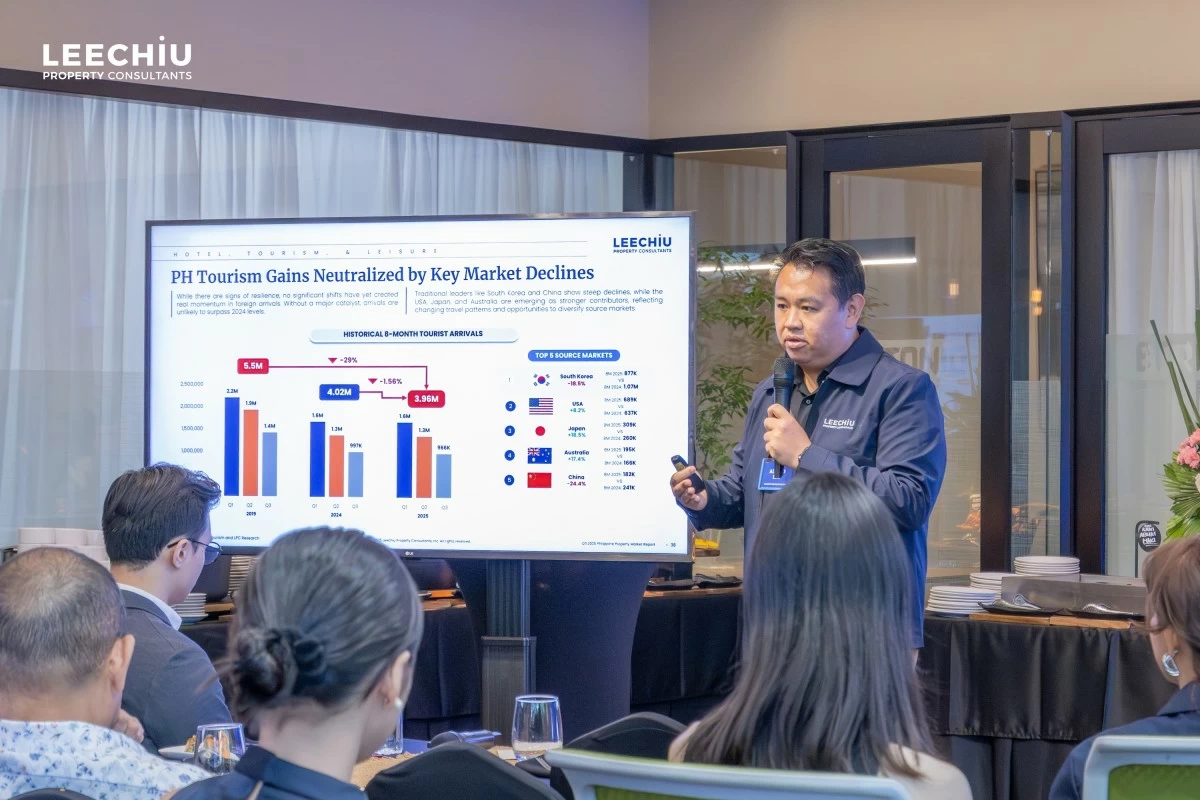

He said the sector continued its steady recovery in the third quarter of 2025, but “while there are signs of resilience, no significant shifts have yet created real momentum in foreign arrivals. Without a major catalyst, arrivals are unlikely to surpass 2024 levels.”

Traditional leaders, such as South Korea and China, show steep declines, while the USA, Japan, and Australia are emerging as stronger contributors, reflecting changing travel patterns and opportunities to diversify source markets.

While international arrivals remain below pre-pandemic peaks, Lay said “domestic travel is surging toward historic highs, establishing a solid foundation for long-term tourism growth and investment confidence.”

Domestic tourists are projected to reach 58.7 million in 2025, rising further to 62.2 million in 2026, a trajectory supported by the country’s forecast gross domestic product growth by 7.63 percent and 5.8 percent in 2025 and 2026, respectively.

Over the past two decades, domestic tourism spending has outpaced GDP, underscoring the sector’s resilience and capacity to drive nationwide economic activity.

Meanwhile, rising travel demand has spurred a wave of hotel developments nationwide, with a total of 5,210 new keys to be added in 2025—over 4,300 of which are expected to open in the fourth quarter.

A majority of these projects are led by domestic operators, reflecting local developers’ agility in capturing demand across destinations such as Metro Manila, Cebu, Boracay, Davao, and Palawan.

Lay said the newly approved 99-year lease law has created a strong foundation for long-term tourism investment as it provides global investors with the security to pursue large-scale resort and mixed-use developments.

Over time, the law is expected to stimulate foreign direct investment in tourism and hospitality, similar to the trends observed in the Maldives, where long-term leases have transformed the sector into a global investment hotspot.

Meanwhile, more global family offices, private equity firms, and sovereign wealth funds are expected to start exploring opportunities in Philippine tourism assets, drawn by the country’s young demographics, natural beauty, and improving investment framework.

New capital is expected to target branded resorts, lifestyle communities, and hotel portfolios ready for real estate investment trust (REIT) in well-connected growth nodes such as Cebu, Clark, and Palawan.