Flood control scandal to break 20-year gov't spending streak, punish peso—MUFG

By Derco Rosal

At A Glance

- Japanese financial giant MUFG said the Philippine peso could suffer from the controversial flood control scandals, which are seen to break the upward momentum of government spending in two decades.

Japanese financial giant MUFG Bank Ltd. said the Philippine peso could suffer from the controversial flood control scandals, which are seen to break the upward momentum of government spending on water resources and flood mitigation in two decades.

“We adjust our Philippine peso forecast profile somewhat weaker, reflecting risks from flood control project corruption issues, but still forecast the United States (US) dollar-peso moving lower over time with other domestic positives remaining in place,” MUFG Global Markets Research said in its latest monthly foreign exchange (forex) outlook, published on Wednesday, Oct. 1.

MUFG has projected that the Philippine peso will still fare well against the US dollar in the coming months, noting that the macroeconomic backdrop for the local currency remains “decent.”

To recall, the growth of the Philippine economy averaged 5.4 percent in the first half of the year, following a modest uptick to 5.5 percent in the second quarter. Still, this fell short of the downscaled full-year growth target of 5.5 to 6.5 percent.

Headline inflation also hit a five-month high in August, at 1.5 percent, but it remained tame, clocking in below the government’s goal of two- to four-percent annual price increases deemed manageable and conducive to economic growth.

As such, MUFG sticks to its rosier outlook for the peso, expecting the US dollar-peso forex rate to “come down over time partly reflecting our global forecasts for a weaker US dollar.”

It can be noted that the peso “was weaker against the US dollar in September” as it depreciated to the ₱58:$1 level during the month. The local currency ended September at ₱58.171 from ₱57.12 at end-August.

But for MUFG, the peso could gradually gain footing against the greenback over time, with it seen to appreciate to the ₱56:$1 level by the third quarter of 2026.

The Japanese bank expects the local currency to end the fourth quarter of 2025 at ₱56.5 versus the greenback, before reaching ₱56.1 in the first quarter of next year and ₱56.2 in the second quarter of 2026.

Meanwhile, a threat spilling over from the global scene is the 19-percent tariff slapped by US President Donald Trump on Philippine exports. In particular, MUFG has projected this protectionist policy to drag local output growth by 0.2 to 0.4 percentage points (ppt) over time.

This means the Philippines could grapple with hitting even its downscaled growth target over the next three years of six to eight percent.

MUFG also expects “some risks arising from the implementation of electronics sectoral tariffs, and draft legislation in the US to curb the BPO [business process outsourcing] sector.”

Apart from the serious impact of flood control scandals on the peso, government disbursements are also seen to slow down.

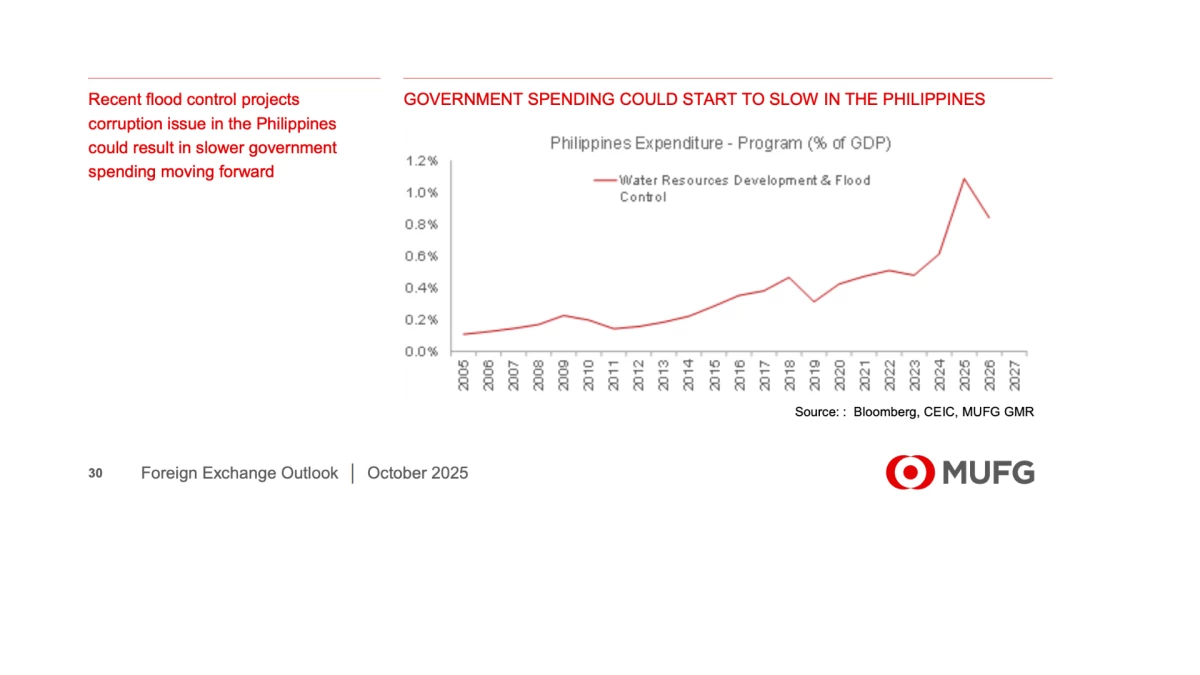

In the graph presented in the MUFG report, government spending on water resources development and flood control would peak in two decades this 2025 at a little over one percent of gross domestic product (GDP). Government corruption, however, would likely cause this to drop to below one percent of GDP in 2026.

“Recent flood control projects corruption issue in the Philippines could result in slower government spending moving forward,” MUFG warned.

On a positive note, MUFG said domestic factors remain supportive, with rice prices staying low due to tariff cuts and manageable inflation expected through 2026.

The Bangko Sentral ng Pilipinas (BSP) is projected to lower policy rates to 4.5 percent, which, combined with easing inflation, should boost consumption and investment, the bank said.

Meanwhile, a strong pipeline of infrastructure projects, particularly in renewable energy (RE), and the Philippines’ likely inclusion in the JPMorgan Government Bond Index-Emerging Markets (JPM GBI-EM) index could attract $2 billion to $3 billion in foreign bond inflows next year, it added.

“We forecast the US dollar-peso forex rate moving lower and see the BSP cutting rates two more times,” MUFG said. The BSP has so far reduced the key interest rate by 1.5 ppt to five percent from 6.5 percent before the easing cycle started in August last year.