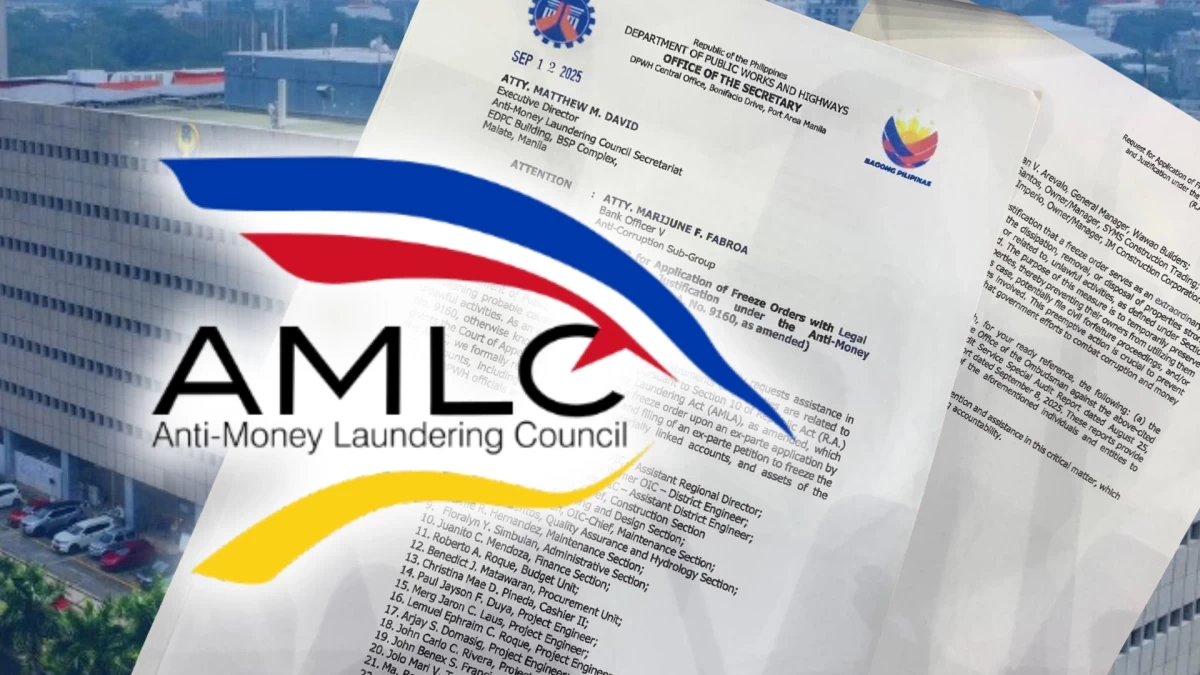

AMLC freezes 2,399 bank accounts, assets in flood control mess

By Derco Rosal

As the probe into controversial flood control projects continues, more than 800 new bank accounts have also been identified as having questionable transactions, leading authorities to add them to the growing list of frozen accounts.

According to the Anti-Money Laundering Council (AMLC), it secured its third freeze order from the Court of Appeals (CA) on September 30, targeting 836 bank accounts, bringing the cumulative total to 1,563 bank accounts previously frozen.

In total, the three freeze orders have so far rendered 2,399 bank accounts immobile.

The AMLC said the third order “expands its crackdown on suspected money laundering activities involving public infrastructure funds tied to the flood control project controversy. It covers a broad range of assets potentially linked to individuals and entities subject to ongoing investigations.”

Apart from the frozen bank accounts, 12 e-wallets, 24 insurance policies, 81 motor vehicles, and 12 real estate properties have also been frozen. The AMLC said this emerged as “the most extensive asset freeze since the probe began.”

To recall, there were 1,563 bank accounts, 54 insurance policies, 154 vehicles, 30 properties, and 12 e-wallets collectively covered under the first two court orders.

The AMLC reported that the estimated value of the frozen assets stands at ₱2.9 billion, which the interagency body expects to further “increase as the investigation deepens.”

AMLC Executive Director Matthew M. David said freezing a wide range of assets allows the AMLC to “disrupt the financial channels used in corrupt activities.”

“Our goal is straightforward: prevent stolen public funds from being dissipated and misused, recover them for the national government, and ensure that those involved in money laundering are held accountable,” David said.