Weak peso, corruption fears drag PSEi below 6,000 mark

The Philippine Stock Exchange index (PSEi) dropped for the sixth straight session, breaking below the 6,000 level, as investors worried about the weak peso, the impact of corruption on infrastructure spending, and general weak investor confidence in the economy.

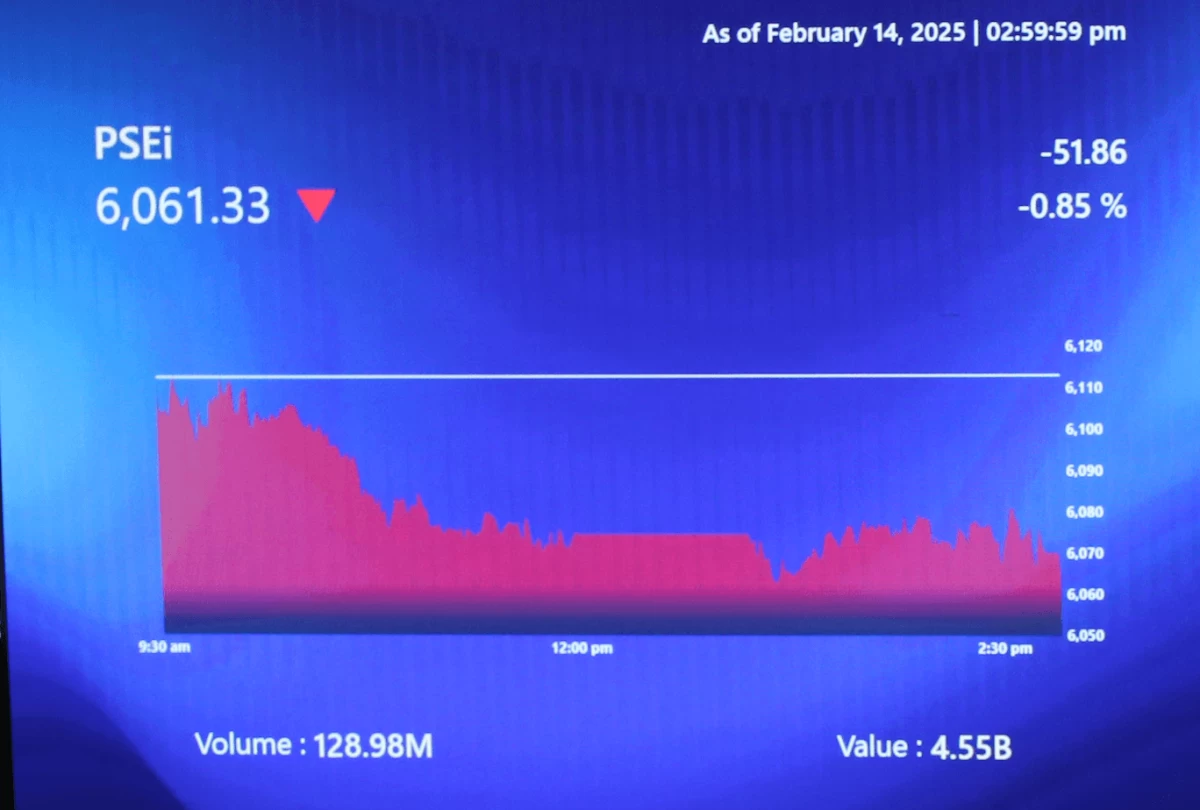

The main index shed 29.52 points, or 0.49 percent, to close at 5,997.60 on Monday, Oct. 29. It was weighed down by the Services and Banks sectors, though most others finished in the green.

Volume declined to 1.37 billion shares worth ₱4.72 billion. Losers outnumbered gainers 106 to 100, with 58 unchanged.

“The PSEi fell below the 6,000 mark as prices continued to decline despite last week’s all-red performance. Selling pressure remains strong, with the market still lacking any positive catalyst,” said Luis Limlingan, Managing Director of Regina Capital Development Corp.

He noted that, “Adding to the bearish sentiment are the ongoing uncertainties in the country and the continued depreciation of the peso against the US dollar, which is dampening confidence among both local and foreign investors.”

Philstocks Financial Research Manager Japhet Tantiangco said, “The local market extended its decline to a sixth straight day still due to lingering concerns over the Philippines' corruption issues.”

“The market is also pricing in the impact of the said issues on the country's economic growth prospects, including inefficient public spending and loss of investors' confidence. The peso's weak position against the US dollar also weighed on the bourse,” he added.

Rizal Commercial Banking Corp. Chief Economist Michael Ricafort said, “The Philippine Stock Exchange Composite Index (PSEi) declined for the sixth straight trading day after the latest external risk factors such as the risk of a shutdown in the US government and mostly cautious signals from Fed officials.”