Washington: Persistent corruption in Philippines keeps US investment at bay

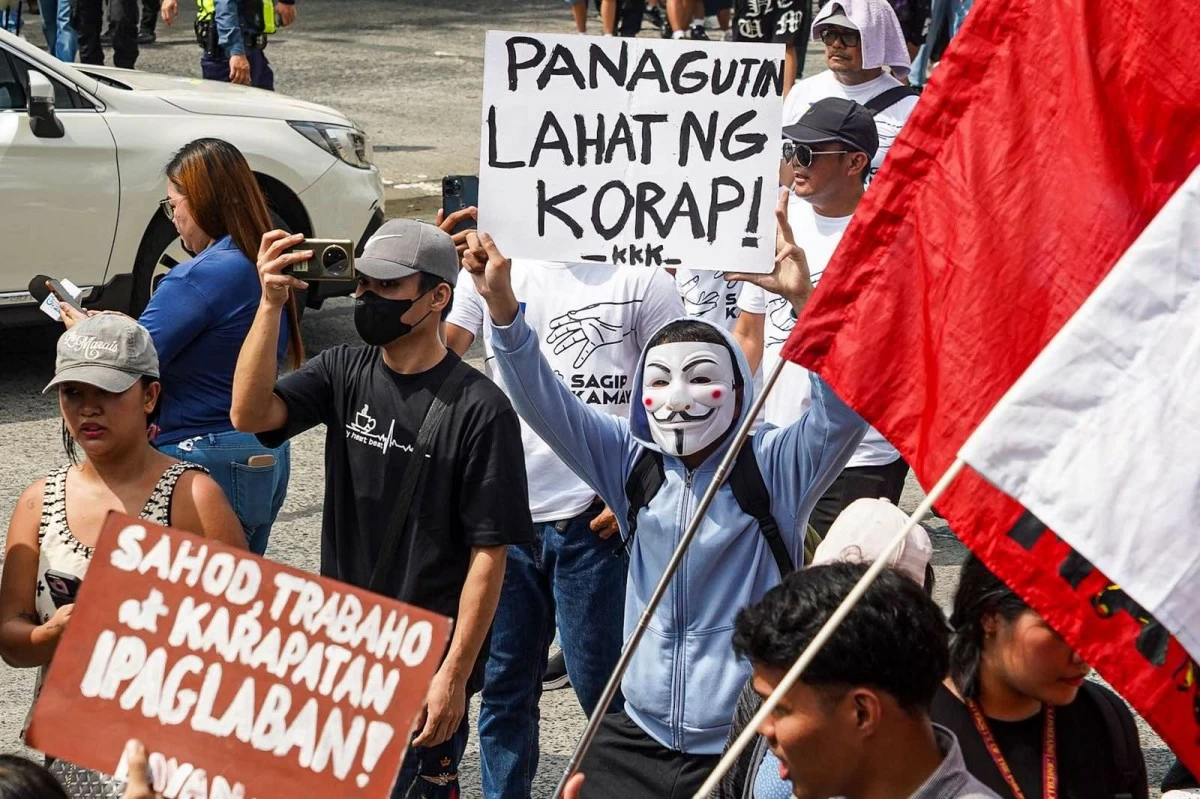

Progressive groups stage a protest march from EDSA Shrine to the EDSA People Power Monument on Sept. 13, 2025, calling for accountability over corruption in flood control projects. (John Louie Abrina)

The United States (US) has once again flagged the long-standing issue of corruption in the Philippines as one of the biggest hurdles to attracting American and other foreign investments.

In its annual investment climate statement published over the weekend, the US Department of State (DOS) listed corruption among several other barriers to foreign investment into the Philippines.

Prepared by the US Embassy in Manila, the report serves as an overall review of the investment climate in the country, enabling US companies to make informed business decisions.

It also serves as the US government’s recommendations to the Philippine government on addressing these barriers to “ensure fair treatment” for American investors and companies.

According to the report, corruption has been a “pervasive and long-standing problem” in both the public and private sectors in the Philippines.

Specifically, it mentioned that the country ranked 114th out of 180 countries on Transparency International’s Corruption Perceptions Index in the previous year. The report flagged that the Philippines has remained around that level since 2019.

“Various organizations, including the World Economic Forum, have cited corruption among the top problematic factors for doing business in the Philippines,” the report read.

The US DOS identified the Bureau of Customs (BOC), in particular, as “one of the most corrupt agencies” in the country.

To this extent, the foreign agency questioned the unnecessary complexity of the country’s regulatory environment, reporting that some investors are finding it difficult to complete business registration, customs, and immigration processes.

“Customs processes, in particular, can present challenges, and the Embassy has received multiple reports from US businesses of overly invasive searches, inconsistent customs charges, and solicitations of ‘facilitation fees’ (e.g., bribes) from some customs officials,” the US DOS said.

Business registration, meanwhile, was described as an “irritant” to investors, given that multiple government agencies are involved in the process.

The report noted that this problematic regulatory enforcement is directly tied to corruption issues in the country’s judicial system.

The US DOS highlighted the supposed inefficiency and uncertainty of the judicial system as “a significant barrier to investment.”

“Investors often decline to file cases in court because of slow and complex litigation processes and fears of corruption,” it said.

Last year, foreign direct investments (FDI) into the Philippines reached $8.9

Billion, roughly the same level as in 2023.

Corruption has also been cited as a factor in prolonging and increasing the cost of investment dispute processes, as well as in the enforcement of real property rights.

The US DOS stated that the political and security environment in the Philippines is stable and “does not present an ongoing concern for most foreign investors.”

Corruption has been at the forefront of public outrage in the country in recent weeks after revelations that funding for flood control projects was allegedly pocketed by contractors, engineers, and government officials. Nationwide protests have been held to demand transparency and justice.

Apart from corruption, the US DOS pointed to poor infrastructure, high power and logistics costs, regulatory inconsistencies, and bureaucratic inefficiencies as hurdles to foreign investment.

The foreign agency also cited the country’s economic landscape, dominated by large family-owned conglomerates, for hindering growth for smaller and even international businesses.

Traffic in major cities and congestion in the ports were also mentioned as barriers to doing business.

Despite these issues, the US DOS said the Philippines has made significant steps in improving the overall investment climate and promoting economic growth.

The foreign agency stated that one of the most salient reforms is the passage of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act.

Under CREATE MORE, the report highlighted the law’s introduction of new fiscal and non-fiscal incentives to investors, alongside tax incentives and tax deductions.

The law was also recognized for streamlining local tax policies, particularly through simplified value-added tax (VAT) refund processes and the imposition of a local tax of up to two percent.

Further, the US DOS added that while bureaucracy in the country has been cumbersome to investors, the business environment “been better in special economic zones.”

It specifically lauded the Philippine Economic Zone Authority (PEZA) for its transparent regulations, no red-tape policy, and its role as a one-stop shop for investors.

“PEZA administrators have earned a reputation for maintaining a clear and predictable investment environment within their zones,” the report read.

The US DOS also commended the government’s 2022 Strategic Investment Promotion Plan (SIPP) for outlining the industries and economic activities that can qualify for fiscal and tax perks aligned with the CREATE MORE Act.

The Board of Investments (BOI), which administers the SIPP, expects the updated version of this three-year investment framework to be approved before the end of the year.