Profit-taking, political uncertainty hit local stocks

The local stock market finally gave way to profit-taking after its four-day rally last week, as political noise against corrupt government officials mount.

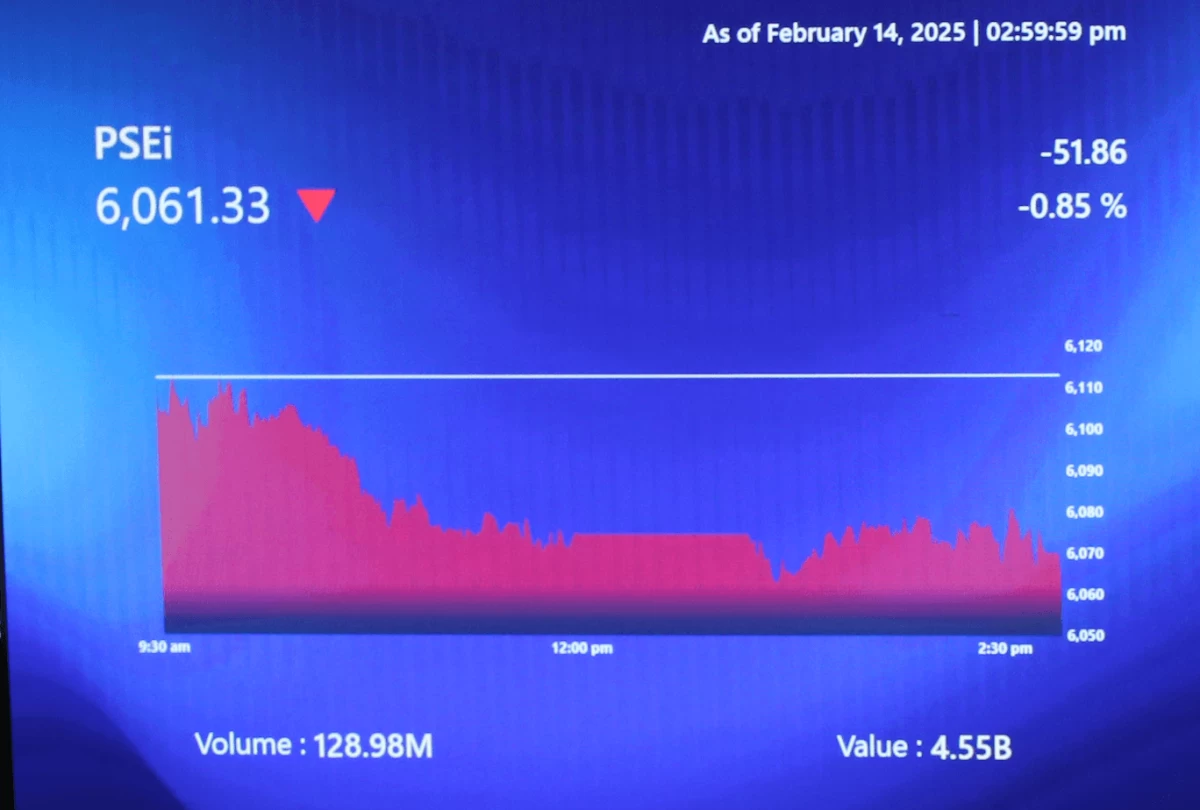

The main index dropped 49.66 points, or 0.79 percent, to close at 6,214.83 on Monday, Sept. 22. Sectoral indices were evenly divided. Volume weakened to 1.19 billion shares worth ₱5.01 billion, as gainers still outnumbered losers at 113 to 90, with 51 unchanged.

“The market started the week by breaking its four-day streak of green candles from last week. Investors appear cautious ahead of several scheduled speeches from the Fed [United States Federal Reserve],” said Regina Capital Development Corp. managing director Luis Limlingan.

He added that, “Moreover, ongoing political uncertainties are likely weighing on market sentiment at the moment.”

Philstocks Financial research manager Japhet Tantiangco said, “The local market declined as investors took profits following a four-day rally. The peso’s weak position against the United States (US) dollar also weighed on the bourse.”

Rizal Commercial Banking Corp. chief economist Michael Ricafort said, “The Philippine Stock Exchange Composite Index (PSEi) corrected lower, considered a healthy profit-taking after gaining for four straight trading days, after the protest rallies versus corruption allegations were relatively peaceful, except for a few isolated incidents.”