Muntinlupa LGU urges public to avail of real property tax amnesty

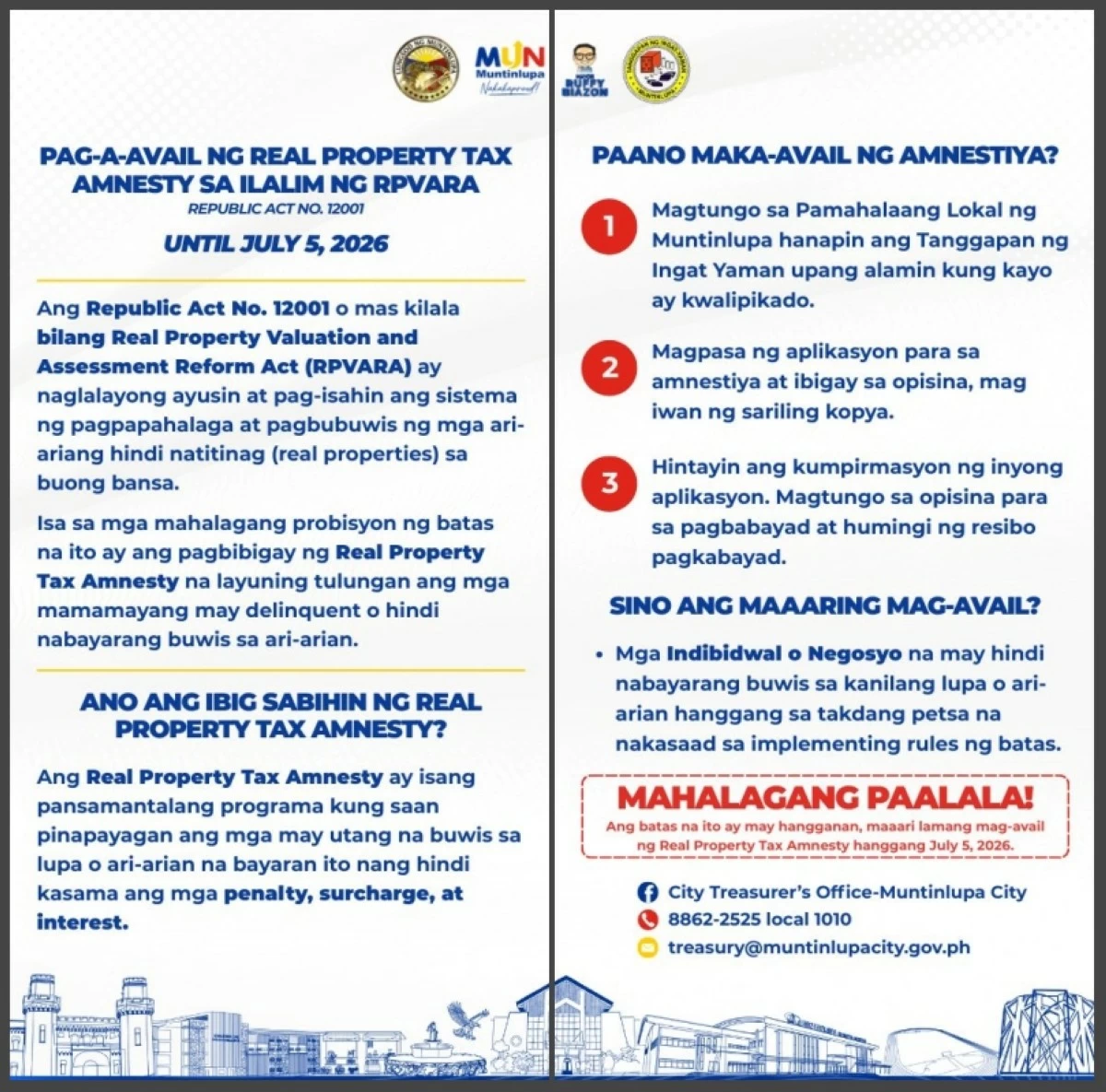

The Muntinlupa City government encouraged the public to avail of the real property tax amnesty being offered under Republic Act 12001.

The law, otherwise known as the Real Property Valuation and Assessment Reform Act, approved in June last year, stated that the amnesty will “cover penalties, surcharges, and interests from all unpaid real property taxes, including Special Education Fund, idle land tax, and other special levy taxes, prior to the effectivity of this Act.”

The real property tax amnesty can be availed of within two years after the effectivity of the law or until July 5 next year, the Muntinlupa City government said.

“This relief may be availed by a delinquent property owner with the option of one-time payment or installment payment of the delinquent real property taxes within two (2) years from the effectivity of this Act,” according to the law.

To avail of the amnesty in Muntinlupa, people need to go to the Muntinlupa City Treasurer's Office to know if they are qualified.

They need to submit an application for amnesty to the Treasurer’s Office and keep one copy. They need to wait for the confirmation of their application. If approved, they will go to the Treasurer’s Office to pay.

Under the law, excluded from the amnesty are the following:

- Delinquent real properties which have been disposed of at public auction to satisfy the real property tax delinquencies;

- Real properties with tax delinquencies which are being paid pursuant to a compromise agreement; and

- Real properties subject of pending cases in court for real property tax delinquencies.