Beyond paychecks: Filipino companies re-calibrate compensation strategies for 2026

Jobseekers line up as they wait for their turn to apply during the Kalayaan Job Fair held at SM City Marikina on June 12, 2025. (Photo by Mark Balmores I MB)

Companies in the Philippines are making a clear strategic move, as recent findings showed they are focusing on careful financial management and maintaining stable workforces, even as they plan for employees to receive steady pay raises.

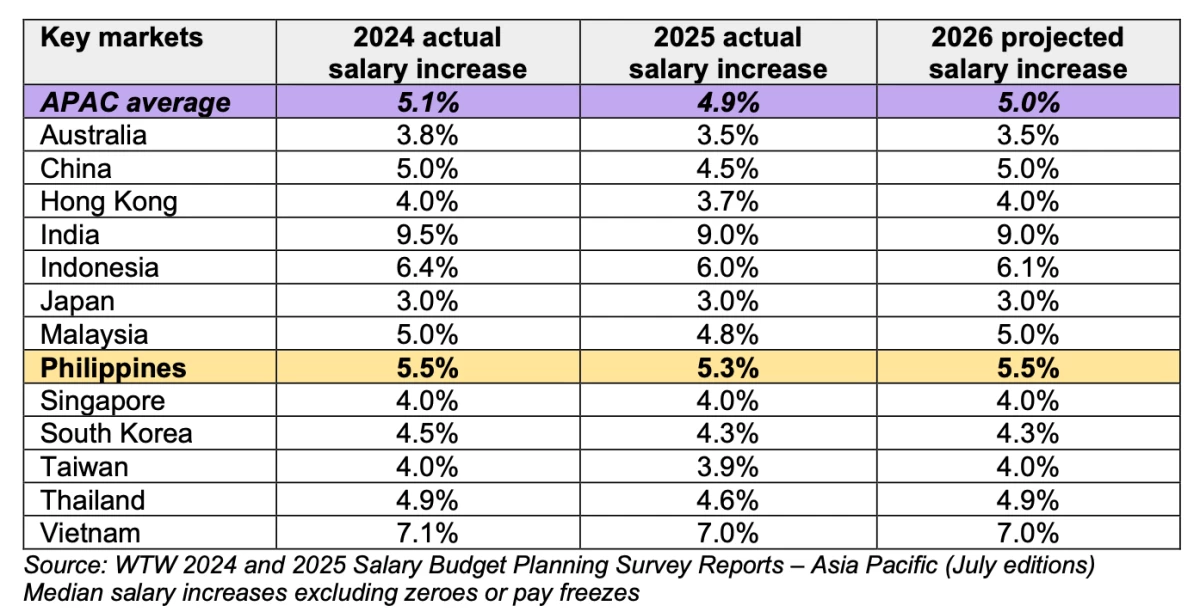

Wage hikes in the country are projected to remain steady at a median of 5.5 percent in 2026, continuing a trend observed since 2024. Despite this seemingly modest increase given the rising cost of living, Filipino wage earners are still relatively well-positioned.

The latest WTW Salary Budget Planning Report indicated that the projected 5.5 percent average increase for the Philippines is higher than the broader Asia Pacific (APAC) region.

According to global advisory firm WTW, average salary increase budgets in the APAC region are expected to rise from 4.9 percent in 2025 to 5.0 percent in 2026.

The Philippines’ projected 5.5 percent median salary increase for 2026 also places it within the APAC region, ranking fourth among 13 countries, trailing only India (nine percent), Vietnam (seven percent), and Indonesia (6.1 percent).

This stable outlook for Philippine salaries unfolds against a backdrop of diverse corporate strategies. While nearly half of Filipino companies (47.8 percent) have reduced their salary budgets, primarily citing anticipated recession or weaker financial performance and cost management concerns (43.5 percent), a smaller but notable segment (14.3 percent) is projecting higher budgets.

WTW said these increases are largely driven by inflationary pressures (26.1 percent), persistent tightness in the labor market (19.6 percent), and expectations of stronger financial results (19.6 percent).

Despite overall stability, there’s a subtle shift in how companies approach compensation reviews.

In 2024, 96.1 percent of organizations conducted regular salary reviews, a figure that slightly decreased to 92.6 percent this year.

The marginal decline reflects a more cautious stance, with more companies opting to either freeze (up from 2.3 percent to 3.9 percent) or postpone (up from 0.9 percent to 3.5 percent) their reviews, largely attributed to current global economic uncertainties.

“Although overall budgets remain stable, the real transformation is happening behind the scenes. Employers are becoming more strategic in how they distribute compensation, prioritize investments, and define the results they aim to achieve,” Chantal Querubin, Rewards Data Intelligence Practice Leader, Philippines at WTW.

“Rather than simply reacting to economic trends, companies are proactively reshaping their approach to better align with broader business objectives, even in uncertain times,” he added.

Stabilizing Philippine labor market

The local labor market is also showing signs of stabilization. A substantial 76.9 percent of organizations plan to maintain their current headcount over the next 12 months, a 12.7 percent increase compared to 2024. This indicates a pivot towards workforce stability rather than aggressive expansion.

While 15.4 percent of companies intend to increase their headcount, this is significantly less than those planning to keep it steady, and double the percentage of those looking to reduce their workforce (7.7 percent).

Furthermore, the talent acquisition and retention landscape appears to be easing in 2025, with 57 percent of organizations reporting little to no difficulty, an improvement from 50 percent in 2023.

In response to rising operating costs and labor market pressures, employers are also augmenting traditional salary reviews with additional compensation programs.

Common strategies include comprehensive compensation reviews for all employees (54 percent), targeted reviews for specific employee groups (49 percent), raising starting salaries (44 percent), utilizing retention bonuses and spot awards (39 percent), and more aggressively adjusting salary ranges (38 percent).

Beyond direct compensation, organizations are also focusing on broader employee support and talent development, with complementary actions such as improving employee experience (73 percent), increasing training opportunities (62 percent), enhancing health and wellness benefits (60 percent), and offering more workplace flexibility (58 percent).

APAC trends and economic outlook

The broader APAC region reflects this cautious yet adaptable approach. Shai Ganu, Managing Director and Global Leader of Executive Compensation and Board Advisory at WTW, observed that employers throughout APAC are worried about losing vital talent, with change management, talent attraction, and employee experience emerging as key concerns.

A recent WTW survey across APAC revealed that nearly half of companies are considering operational and headcount reductions as a key cost reduction strategy.

Interestingly, there is a shift towards intra-Asia resilience, with 37 percent of companies exploring new markets within Asia and 33 percent considering diversifying their supply chains from the West to within Asia.

Half of the surveyed companies are not planning significant changes to their compensation plans, while those considering changes are looking at modifying incentive metrics (26 percent) or adjusting performance goals to account for volatility (25 percent).

Ganu said that these adjustments aim to align compensation with new economic realities and maintain employee motivation and performance, anticipating that the “From Asia – For Asia” strategy will likely impact trade and talent flows, affecting compensation outcomes within the region.

The Philippine government also projects a stable economic outlook. The International Monetary Fund (IMF) has raised its 2026 Philippine growth forecast to 5.9 percent from a previous 5.8 percent, placing it ahead of regional peers like Indonesia (4.8 percent), Malaysia (four percent), and Thailand (1.7 percent).

For 2025, the IMF maintains its 5.5 percent gross domestic product (GDP) growth forecast for the Philippines, which falls within the government's target range of 5.5 percent to 6.5 percent.

The Asian Development Bank (ADB) also foresees the Philippines remaining a “bright spot” in Southeast Asia, with GDP projected to expand by 6.0% in 2025 and 6.1% in 2026, driven by strong domestic demand, sustained investments in social services and public infrastructure, and modest inflation.

Inflation in the Philippines has also shown signs of moderation. In May 2025, the annual inflation rate eased to 1.3%, the lowest since November 2019. While it slightly ticked up to 1.4 percent in June 2025, it remains below market expectations.

The Bangko Sentral ng Pilipinas (BSP) and the Development Budget Coordination Committee (DBCC) have consistently maintained the inflation target at 2.0 percent to 4.0 percent for 2025-2028, reflecting a commitment to price stability.

BSP's baseline forecasts for average inflation are 3.1 percent for 2025 and 3.2 percent for 2026, well within the government's target range.