Good news for retirees: SSS announces multi-year pension increase

By Derco Rosal

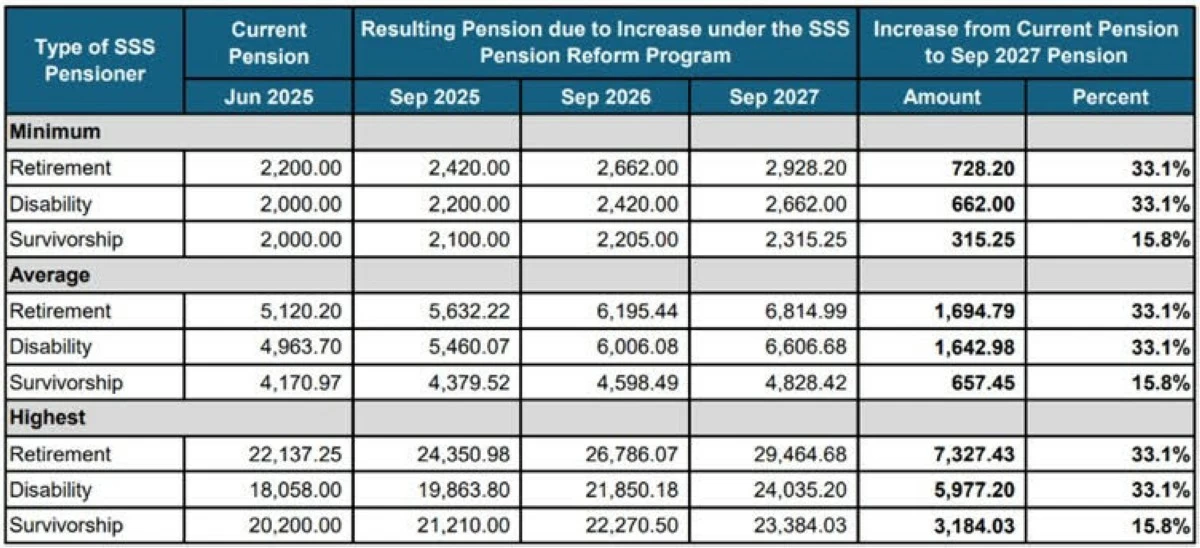

State-run Social Security System (SSS) will roll out a pension reform program (PRP) starting September, granting higher monthly pensions, with a total 33 percent increase for retirement and disability beneficiaries over three years.

Retirement and disability private pensioners under SSS will receive a total 33 percent increase in their monthly pensions from 2025 through 2027, while death or survivor pensioners will get a 16-percent increase.

In a July 31 statement, SSS said this reform answers the long-standing call for higher pensions. This move is also based on the Social Security Act of 2018, empowering the SSC to adjust pension benefits.

According to the state insurer for private-sector employees, the hike will be implemented in three tranches every September starting 2025.

In particular, pensioners as of Aug. 31 each year will receive a 10-percent (retirement/disability) or five-percent (death/survivor) increase annually during the three-year period.

SSS clarified that this reform will not necessitate any contribution increase, unlike the ₱1,000 additional benefit allowance given to all pensioners starting 2017, which immediately required contribution increases to restore financial stability to the SSS fund.

“According to the SSS Chief Actuary, the reform will result in only a manageable reduction of fund life from 2053 to 2049, offset by stronger cash flows from previous contribution reforms and enhanced collection efforts,” the state insurer said.

SSS Commissioner Robert Joseph M. De Claro also stressed, quoting the actuary team, that the fund “remains financially sound,” assuring further that the agency is “committed to restoring fund life back to 2053 through coverage expansion and improved collection efficiency.”

The reform will cover more than 3.8 million pensioners—2.6 million under retirement and disability, and 1.2 million survivor pensioners—and is expected to pump ₱92.8 billion into the economy from 2025 to 2027.

The pension hike program is aimed at ensuring inclusive benefit adjustments for all pensioners, protecting purchasing power by addressing inflation, and encouraging the values of working, saving, investing, and long-term financial growth.

GSIS emergency loans

Meanwhile, the Government Service Insurance System (GSIS) has released over ₱1.5 billion in emergency loans, providing financial support to government workers and pensioners affected by Tropical Storms Crising, Dante, Emong, and other calamities across the country.

Data from the GSIS showed that this benefited more than 44,000 emergency loan applications from active members and pensioners.

“As soon as the loan window opened, thousands of our members and pensioners turned to GSIS for help. This reflects how deeply the recent calamities have affected their lives and how urgently they need support,” said GSIS Officer-in-Charge (OIC) Juliet M. Bautista.

The program provides a one-time loan of up to ₱40,000 for active members and ₱20,000 for pensioners, with a fixed annual interest rate of six percent computed in advance.

It is payable over 36 equal monthly installments and comes with Loan Redemption Insurance (LRI), which fully settles the loan in case of the borrower’s death, as long as payments are up to date.

The emergency loan is open to GSIS members and pensioners living or working in areas declared under a state of calamity. The application period depends on when the calamity was declared and when the required documents are submitted by the local government.

As of now, the emergency loan is available in several areas with varying deadlines. It is open until August 15 in Siquijor; until August 23 in Calumpit, Bulacan, and Umingan, Pangasinan; and from July 24 to October 23 in Cavite, Manila, and Quezon City.

Other locations, including parts of Metro Manila, Palawan, Batangas, Bulacan, Pangasinan, Bataan, Pampanga, and Rizal, have deadlines ranging from August 25 to October 26, depending on the date of the calamity declaration and required document submissions.