Bureau of the Treasury opens bond investments to millions of Filipinos via GBonds

Unlocking wealth for all

By MBrand

At A Glance

- The Bureau of the Treasury (BTr) makes investing in government securities more inclusive and accessible to millions of Filipinos with the launch of GBonds.

In line with strengthening the Philippine government's financial inclusion agenda, the Bureau of the Treasury (BTr) makes investing in government securities more inclusive and accessible to millions of Filipinos with the launch of GBonds.

Powered by Philippine Digital Asset Exchange (PDAX), Inc. and Bonds.ph, in partnership with the Bureau of the Treasury, GBonds will be available to millions of Filipinos on GCash starting July 25. Fully-verified users can access fixed-return government securities with a minimum investment of ₱500 and no need for a bank account.

Previously, potential investors needed to have a bank account and were often required to do a branch visit in order to invest in government bonds. Now, with the launch of GBonds, Filipinos can place their bond investment order and get confirmation in a few minutes through GCash. This represents a significant milestone in democratizing and digitizing investments in government securities, among the safest financial instruments with zero default risk.

Issued by the Republic of the Philippines through the Bureau of the Treasury, government bonds are among the safest financial instruments. They are often preferred by more conservative investors to generate fixed return income or even by risky investors looking to diversify their portfolios.

“The introduction of GBonds is in line with the Bureau of the Treasury’s goal of increasing the participation of retail investors in Government securities and our overall goal of greater financial inclusion through innovation in the finance industry in the Philippines. We hope that by making investments easier and more convenient to Filipinos, they now have more options to grow their wealth and protect their future,” said the Treasurer of the Philippines, Sharon Almanza.

“We are thrilled to launch GBonds as part of our ongoing efforts to provide innovative and inclusive financial solutions for Filipinos, especially the unbanked and the underserved. We are honored to work with the Bureau of the Treasury as we continue to help Filipinos achieve their financial aspirations right at their fingertips,” said GCash General Manager of Wealth Management Arjun Varma.

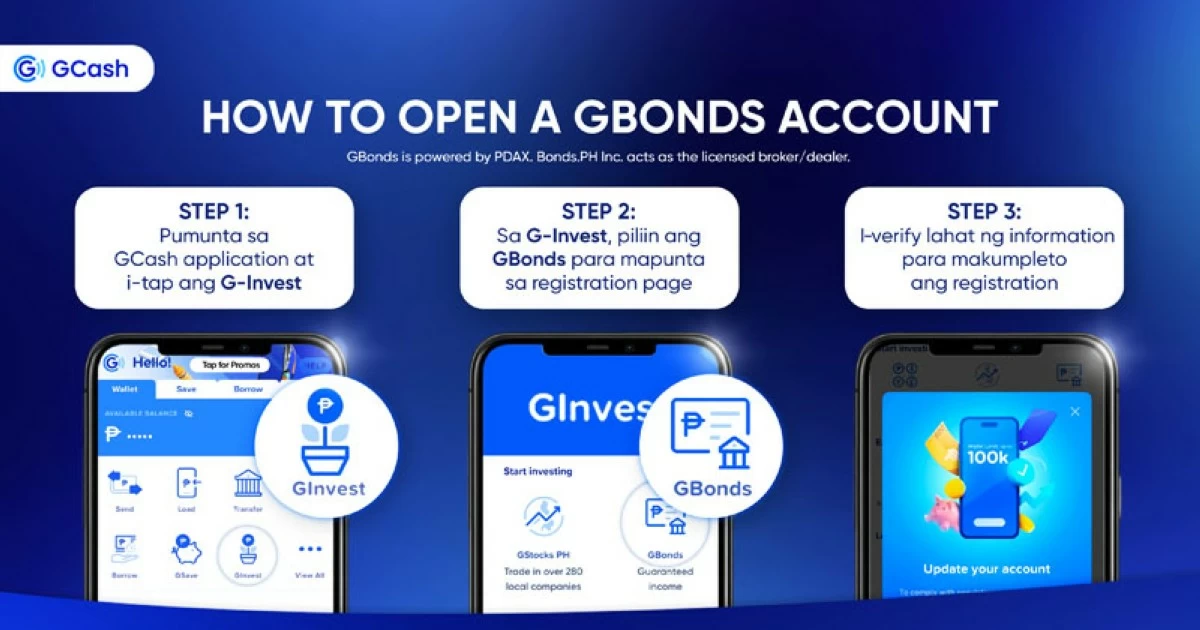

Getting started on GBonds is easy and simple. Fully verified GCash users with an updated KYC within the past 3 years just need to open the app, go to GInvest, select GBonds, and register for a PDAX account, subject to their terms and conditions, to complete the registration process.

To get a fully verified GCash account, users are encouraged to go through the KYC process within the app ahead of starting on GBonds. This involves providing personal information, uploading a valid government ID, and completing a selfie scan.

With quick account setup, GBonds provides users an additional avenue to achieving their financial goals. With just a minimum investment of ₱500 and no bank account requirement, Filipinos can start investing in government bonds today. For more information, visit the Help Center.

For updates regarding the Bureau of the Treasury’s latest offerings, visit www.treasury.gov.ph and like/follow their Meta Page at TreasuryPH.

The information provided is for informational purposes only and does not constitute financial, investment, or professional advice. You should always consult a qualified financial professional before making any investment decisions. All investments carry inherent risks, including the potential loss of principal. Past performance is not indicative of future results. Any reliance you place on the information provided is strictly at your own risk.