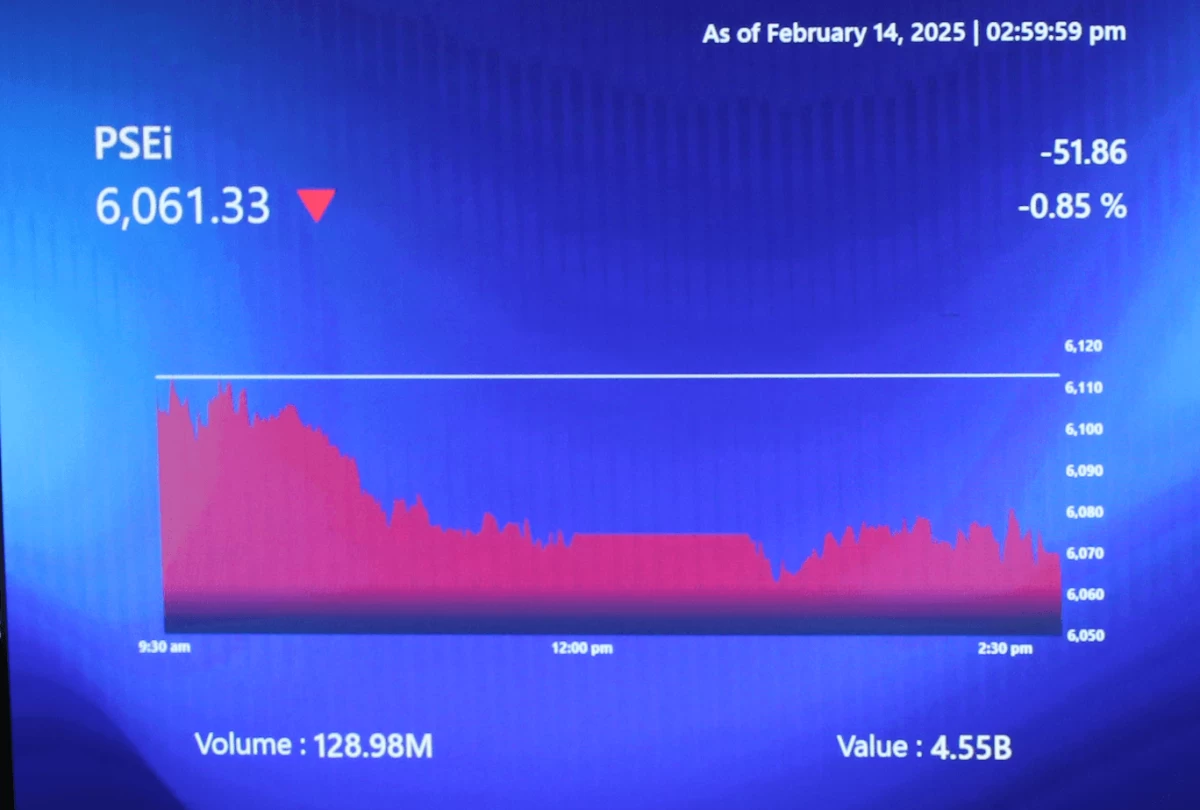

Local market slides for third day on US policy uncertainty

The Philippine Stock Exchange index (PSEi) continued to weaken on Thursday, July 17, as investors worried about US President Donald Trump’s proposed tariffs and reports of his plan to change leadership at the US Federal Reserve.

The main index lost 41.93 points, or 0.66 percent, to close at 6,295.55. Mining stocks led the retreat, which was felt across the board. Trading volume was firm at 2.41 billion shares valued at P7.33 billion. Losers outnumbered gainers 112 to 75, with 56 unchanged.

"Philippine shares continue to tumble as concerns surfaced from a rumor regarding a potential Fed leadership change," said Luis Limlingan, managing director at Regina Capital Development Corporation.

"Stronger-than-expected earnings from major financial institutions, particularly in trading and investment banking, helped to drive positive sentiment," he noted.

Limlingan added that, "investor sentiment was also impacted by the latest US inflation report, which fueled concerns about the Federal Reserve's interest rate trajectory and its potential implications for global markets."

Philstocks Financial Research Manager Japhet Tantiangco said, "The local market extended its decline as uncertainties over the US’ tariff policies continued to weigh on investors' sentiment. The peso's further depreciation also contributed to the market's drop."

According to Rizal Commercial Banking Corporation Chief Economist Michael Ricafort, the PSEi declined for the third straight trading day "after Trump’s recent threats of higher US import tariffs last week that could lead to a pickup in US inflation. This, in turn, could reduce the urgency of future Fed rate cuts."