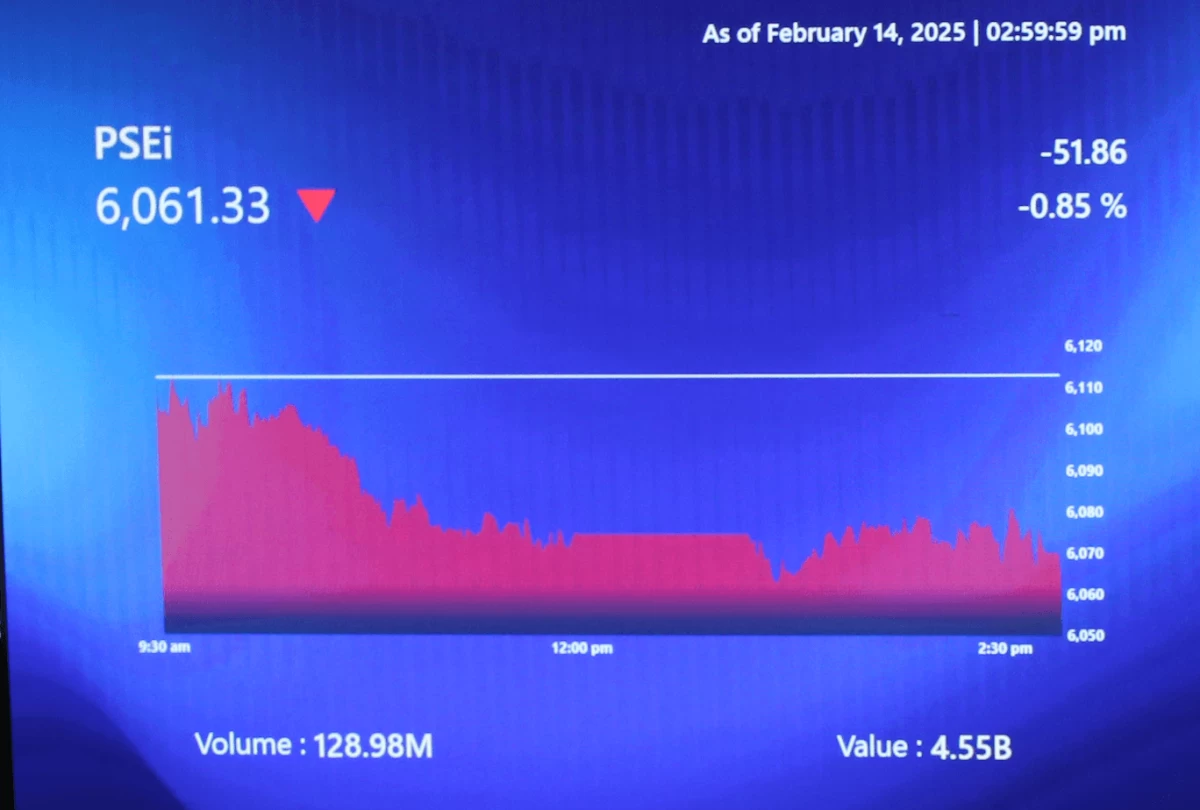

Stocks tumble as 'hotter' US inflation ignites sell-off

The Philippine Stock Exchange index (PSEi) plunged following news of a higher United States (US) inflation rate for June.

The main index fell by 121.99 points, or 1.89 percent, to close at 6,337.48 on Wednesday, July 16. Miners and conglomerates led the retreat of all sectors. Volume excluding block sales rose to ₱7.94 billion, as losers outnumbered gainers—122 to 67, with 59 unchanged.

“Philippine shares succumbed to profit taking as investors digested hotter-than-expected [US] June inflation data,” said Regina Capital Development Corp. Managing Director Luis Limlingan.

He added that, “many remained on the sidelines amid anxiety stemming from the latest developments regarding US tariffs.”

Philstocks Financial Research Manager Japhet Tantiangco said “The local market plunged this Wednesday as investors dealt with the rise in the US’ inflation last June and its implications on the Federal Reserve’s policy outlook. The US latest inflation print may cause the Fed to prolong their pause in their policy rate adjustments.”

“Investors also digested the US’ latest tariff rate on Indonesia at 19 percent which is somehow more competitive than the Philippines’ 20 percent.

“Finally, the Peso’s continuous depreciation against the US Dollar weighed on the market,” he noted.

Rizal Commercial Banking Corporation Chief Economist Michael L. Ricafort said the PSEi declined for the second straight trading day, lower for the fourth day in five trading days after reports of some block sales and after the US dollar-peso rate closed at P57.085.

He also cited the slightly higher US CPI data partly due to effects of higher US import tariffs in recent months.