Philippines is second best among emerging markets in investor relations, debt transparency—IIF

The Philippines remained one of the world’s best in investor relations (IR) and debt transparency, even as it lost to Indonesia this year the top spot it held last year in the annual ranking of the Washington-based Institute of International Finance (IIF).

In the 2025 IIF Investor Relations and Debt Transparency Report published on July 9, the global financial industry association scored the Philippines 49.3 out of 50 this year in its annual assessment of IR and debt transparency practices—higher than last year’s 48.8 and 2023’s 47.8.

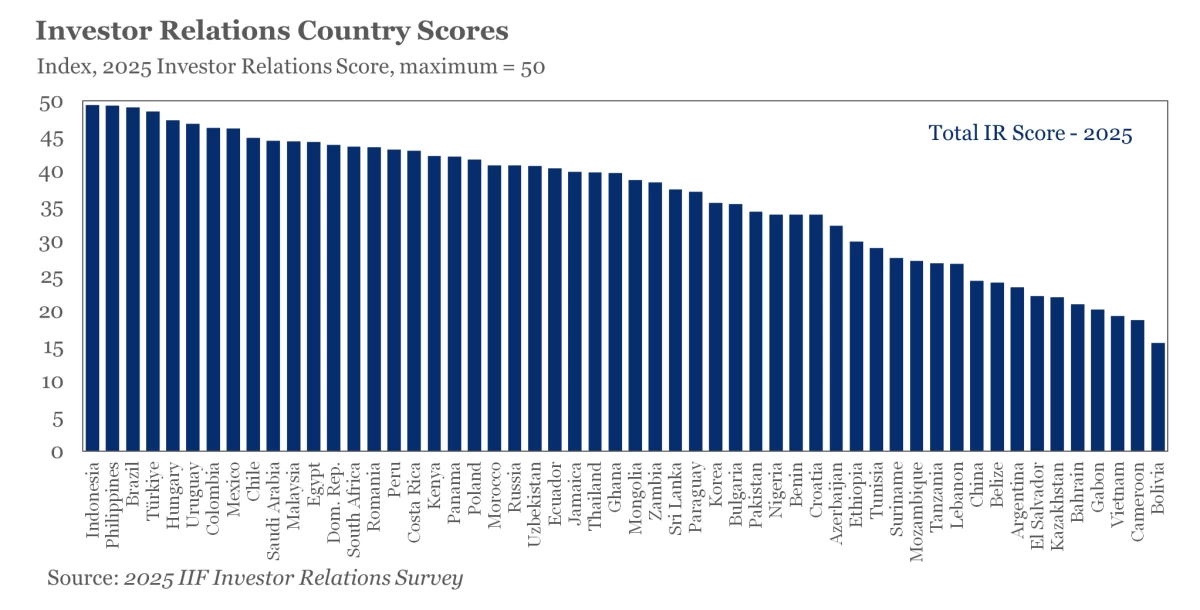

However, Indonesia soared to the top of this year’s rankings with a score of 49.4, barely surpassing the Philippines.

Brazil, Türkiye, and Hungary completed the five best-performing countries, while Gabon, Vietnam, Cameroon, and Bolivia landed in the bottom rung.

The Philippines has belonged among the top five countries with the highest IR scores for three consecutive years now, or since 2023.

“We find that countries with strong IR and debt transparency practices tend to have better credit ratings and be more resilient to trade shocks,” the IIF said in a statement.

The Philippines enjoys investment-grade credit ratings from the so-called Big Three debt watchers: Fitch Ratings, Moody’s Ratings, and S&P Global Ratings.

In particular, the IIF assessed the country’s IR program being overseen by the Bangko Sentral ng Pilipinas (BSP).

The IIF cited the Philippines’ investor conference calls as an example of best practices in IR programs.

It lauded the Philippines for archiving investor conference calls on a government website.

In all, “91 percent of all IR assessment criteria are fully met by the Philippines,” the IIF said.

In terms of debt transparency, the Philippines scored 12.3 out of 13, similar to the scores of Brazil and Chile, and only outranked by Türkiye’s 12.8 and Indonesia’s 12.4.

Also, “the highest ESG data and policy dissemination scores in 2025 were attained by the Philippines, Türkiye, Hungary, Uruguay, and Chile,” the IIF noted, referring to environmental, social, and governance standards.

The IIF cited that the Philippines maintains a specific Excel file with ESG bond issuance figures.

Compared to last year, the Philippines also improved as it now distributes macroeconomic and policy information to its investor list via email at least every two weeks, the IIF said.

The IIF nonetheless listed two key areas for improvement, urging the Philippines to disclose available data on non-resident holdings of private debt issued domestically, as well as update its social media accounts at the bottom of the BSP website landing page.

Globally, the IIF said that “with multilateralism under strain, governments face the simultaneous demands of boosting competitiveness, strengthening national security, and raising productivity—pressures that will keep public borrowing needs elevated and intensify the competition for affordable capital.”

“Against this challenging macroeconomic and political landscape, enhancing the flow of information available to both private and public creditors, which can be supported by robust investor relations, paired with transparent debt data and policy disclosures,” the IIF said.

This year’s report reviewed IR and debt transparency practices across 54 developing countries and emerging markets (EMs).