CMEPA encourages more Filipinos to invest in PH capital market—Marcos

The Republic Act No. 12214 or the Capital Markets Efficiency Promotion Act (CMEPA), which became effective on July 1, was designed to encourage every Filipino to invest their hard-earned money to build a better future, President Marcos said.

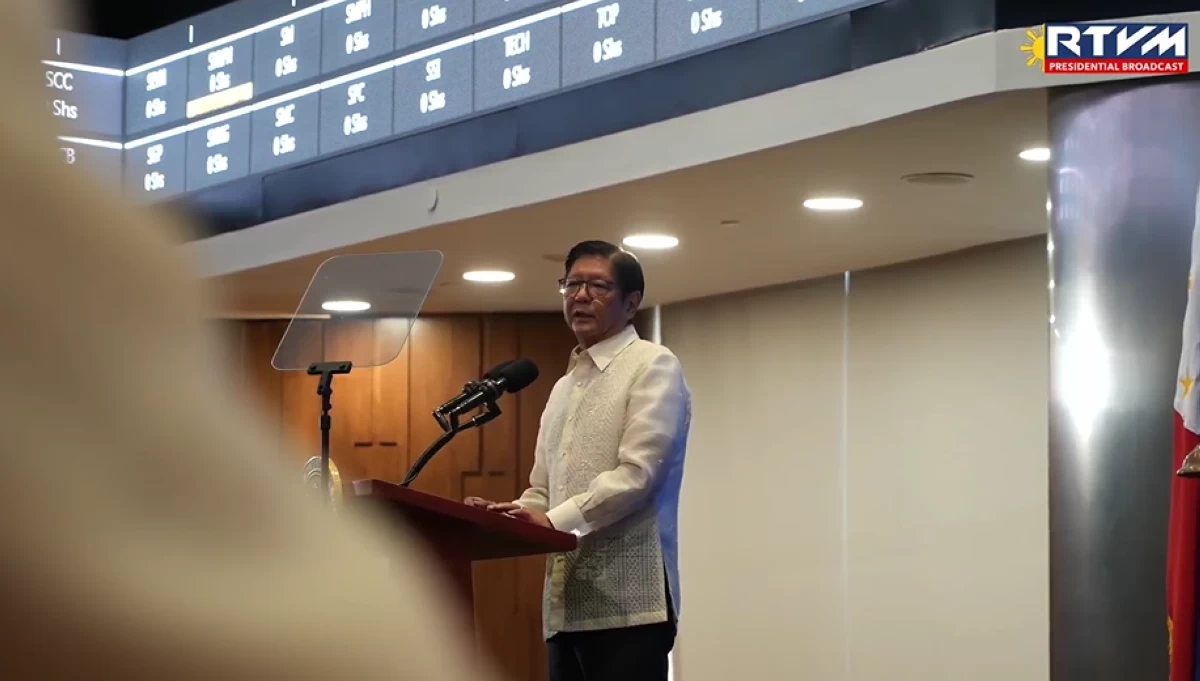

President Ferdinand R. Marcos Jr.

As Marcos led the special bell-ringing at the Philippine Stock Exchange (PSE) tower in Bonifacio Global City, Taguig City on Tuesday to mark the effectivity of the law, he stated that the Act allows Filipinos to be true participants in the nation’s economic growth.

“The reform is not just for the well-off and for the professionals, for the stock traders. It is for every Filipino who dreams of better financial security,” Marcos said.

“It empowers the small business owner, the young professional, and the overseas Filipino worker to start investing their hard-earned money to build a better future,” he added.

He explained that the “timely and strategic tax reform” redefines and transforms how Filipinos invest, build, and grow their hard-earned savings.

He said that before this law, investing in stocks meant paying a tax of 0.6 percent, which was six times higher than Philippines' neighbors Singapore and Malaysia. It was also the highest in the region.

Under CMEPA, that rate has been reduced to 0.1 percent.

“For a first-time investor buying a P10,000 worth of stock, this means paying P10 in tax instead of P60. This will encourage more Filipinos to invest in our capital market,” he said.

According to Marcos, the law also removed the documentary stamp tax on mutual funds and unit investment trust funds—investment tools widely used by young professionals and middle-class savers. The adjustment on rates lowers barriers and opens the market to more investors.

Under the law, a uniform final tax rate of 20 percent on interest income was introduced, simplifying compliance, removing confusion, and leveling the playing field.

It also offers incentive for companies that help employees save for their retirement.

Private employers that match or exceed their workers’ contributions to the Personal Equity and Retirement Accounts or PERA, are now entitled to an additional 50 percent tax deduction on their actual contributions, Marcos said.

The CMEPA also removed certain exemptions to enhance fairness in the tax system. Government-Owned or Controlled Corporations are now generally subject to the same passive income taxes as other institutions.

“From now until 2030, CMEPA is projected to generate over P25 billion in net revenue—a substantial sum that can help fund the building of roads, bridges, hospitals, schools, other social safety net programs as well,” Marcos said.

“But beyond revenue, CMEPA reinforces confidence. It shows that our financial system is becoming more equitable and structured for long-term stability,” he added.

Market integrity is shared responsibility

Stressing that “ that market integrity is a shared responsibility,” the President ordered the Securities and Exchange Commission to streamline its procedures and reduce transaction costs.

He also urged market participants and stakeholders to uphold transparency, fairness, and good governance.

“To ensure the successful implementation of this reform, I direct the Securities and Exchange Commission to streamline its procedures, remove bureaucratic bottlenecks, [and] reduce transaction costs within its control. Undertake the necessary changes to fulfill your responsibilities in these changing times,” Marcos said.

“I urge all market participants and stakeholders to uphold transparency, fairness, and good governance,” Marcos added.

He stressed that “by working together in good faith, we can build an industry that earns the market’s trust both here and abroad.”