SEC orders BZR and Magic Peso to stop illegal lending operations

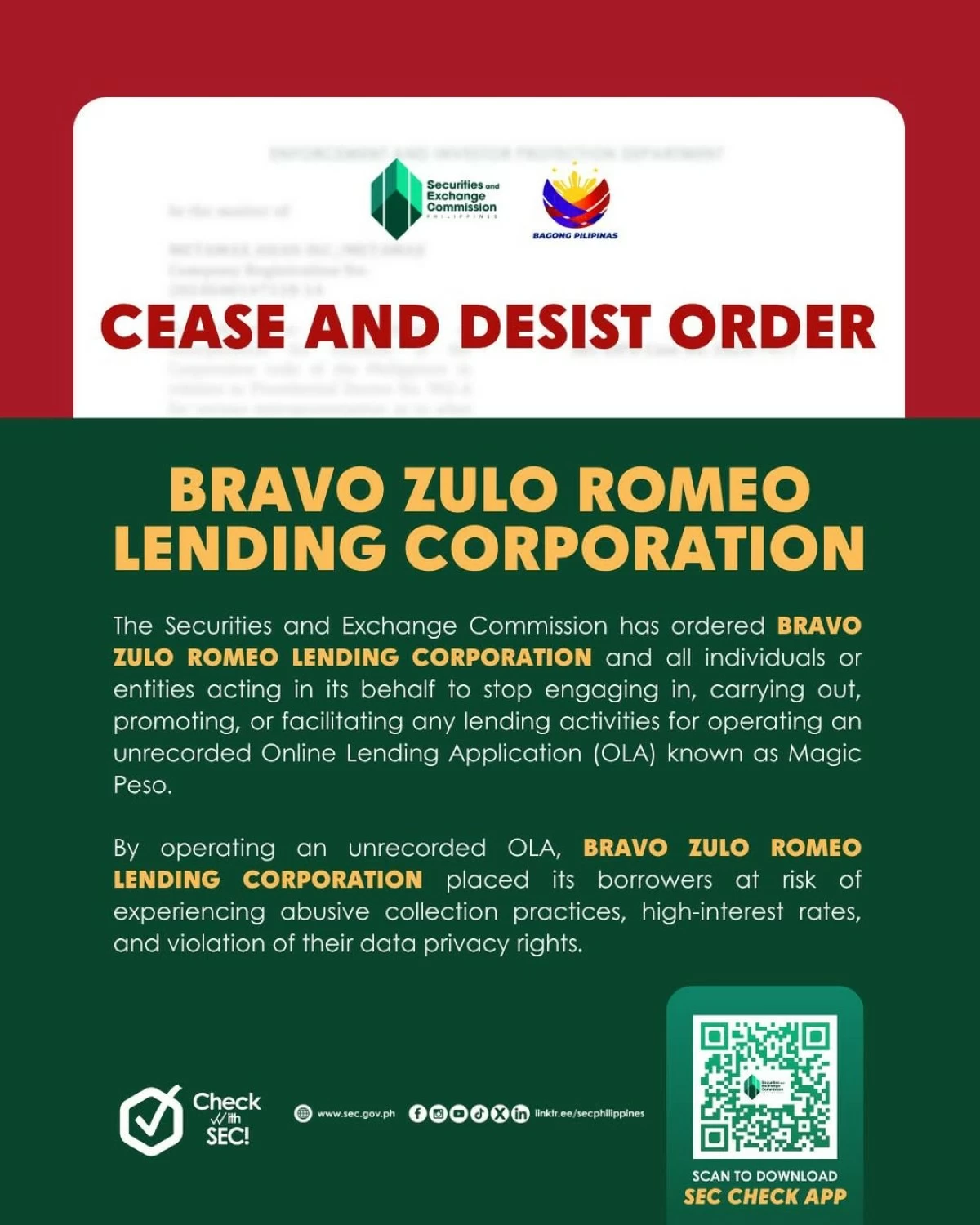

The Securities and Exchange Commission (SEC) has issued cease-and-desist orders (CDO) against Bravo Zulo Romeo Lending Corp. (BZR Lending) for unauthorized lending operations and Magic Peso for illegally operating an online lending platform and for unfair debt collection practices.

In a June 24, 2025, order, the SEC Financing and Lending Companies Department (FinLend) directed BZR Lending, including its owners, operators, promoters, representatives, agents, and all persons claiming and acting for and, on their behalf, to immediately cease and desist from facilitating any lending activity or transaction.

This follows complaints filed by borrowers who reported abusive collection practices from the online lending platform (OLP) Magic Peso.

Investigations conducted by the FinLend showed that Magic Peso is owned and operated by BZR Lending. While BZR Lending is registered with the SEC as a lending company, it failed to file a disclosure pertaining to any OLP.

This constitutes a violation of SEC Memorandum Circular No. 19, Series of 2019, which requires full disclosure and reporting requirements for financing and lending companies using OLPs, according to the order.

“On account of [BZR Lending’s] continuing operation of Magic Peso, the Commission holds that the issuance of a CDO is warranted…not only to penalize the [company], but also to prevent fraud, injury, or harm to the public and financial consumers who are at the [company’s] mercy,” the order read.

Meanwhile, FinLend issued a CDO against Magic Peso also last June 24 and directed the company, including its owners, operators, promoters, representatives, agents, and any person claiming and acting for and, in their behalf, to immediately stop from engaging in, carrying out, promoting and facilitating any lending activity.

The order came following reports and complaints received by the SEC from borrowers of Magic Peso for its alleged unfair debt collection processes.

Magic Peso is not among the recorded OLPs under the Commission’s records, in violation of SEC Memorandum Circular No. 19, Series of 2019, which requires OLPs to disclose their corporate name, SEC registration number, certificate of authority to operate a financing/lending company number, among others, in a portion of their platforms.

Its continued operation also violates SEC MC No. 10, Series of 2021, which imposed a moratorium on new OLPs on Nov. 2, 2021.

“[Magic Peso’s] borrowers are at risk of experiencing abusive collection practices, high-interest rates and violation of their data privacy rights,” the order read.