Moody's flags 'double-edged' conglomerate ties for Philippine banks

By Derco Rosal

While closer ties to large conglomerates provide Philippine banks with ample capital and lending opportunities, these direct connections also increase lending risks within the groups, and financial distress at the conglomerate level could have a profound impact on the banks.

“Financial distress in a conglomerate could have a cascading effect on its subsidiaries, including the banks they own; this would amplify shocks and lead to broader financial instability,” the debt watcher Moody’s Ratings said in a report about the double-edged effect of Philippine banks’ ties with conglomerates.

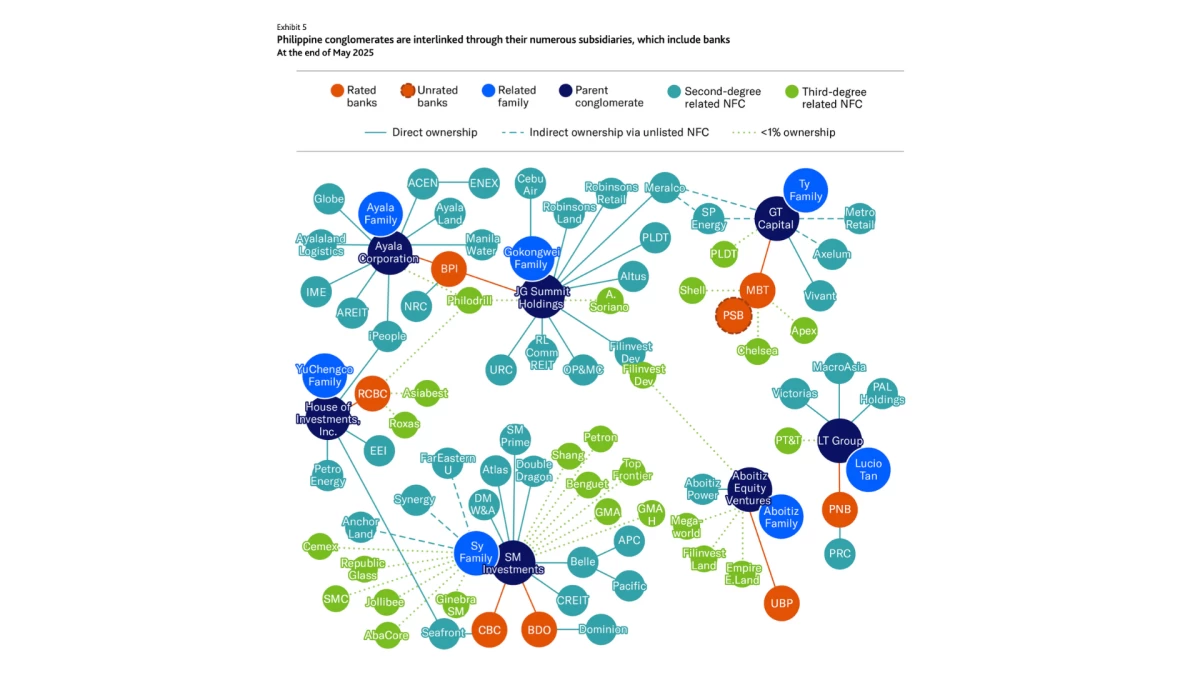

This report, published on Wednesday, June 19, revealed the interlinking of Philippine conglomerates with their subsidiaries, including banks. It featured several parent groups, such as Ayala Corporation (linked to the Ayala family), JG Summit Holdings (Gokongwei family), House of Investments (Yuchengco family), GT Capital (Ty family), SM Investments (Sy family), Aboitiz Equity Ventures (Aboitiz family), and LT Group (Lucio Tan).

Rated banks directly or indirectly owned by these conglomerates include the Bank of the Philippines Islands (BPI), Rizal Commercial Banking Corp (RCBC), Banco de Oro (BDO), China Banking Corporation (Chinabank), Philippine National Bank (PNB), Metropolitan Bank and Trust Company (Metrobank), and Union Bank of the Philippines (UnionBank).

Moody’s argued that if a conglomerate grapples with a crisis, its bank could take the hardest hit as it might be forced to provide support by lending more money to save the parent company. This could hurt the bank’s financial strength and stability, Moody's noted.

“Any challenge to NFCs’ [non-financial corporations] financial health and debt repayment abilities would have a material credit impact on Philippine banks’ asset quality, solvency, and liquidity,” it said.

The credit rater argued that these “interlinkages exacerbate risks from related-party lending” or lending within big business groups.

On average, loans within the business groups in the Philippines account for 20 percent of a bank’s core capital—the “highest” in the Association of Southeast Asian Nations (ASEAN), said Moody’s.

Bank loans to NFCs account for about 77 percent of the total bank lending in the country, as they prefer borrowing from local banks over issuing bonds because the local bond market remains small.

Relative to ASEAN countries, lending to big businesses accounts for a “larger share” in the financial system.

“NFCs’ heavy reliance on banks for funding means that defaults would disproportionately impact banks, rather than other creditors,” Moody’s said.

Meanwhile, the report noted that “the large conglomerate parents of rated banks maintain healthy corporate leverage, despite some weakening. Currently, banks’ related-party loans are largely to the operating NFCs within their conglomerate groups, with which banks have second-degree relationships.

Moody’s views this a “relatively more favorable from a credit perspective as these are cash flow-generating, and the banks have relatively lower loan exposures to their parent holding companies.” In this sense, bank lending to their parent companies is much riskier.

However, “a payment default could trigger a cross-default on the group's other obligations, or those of other group companies.” In this case, the parent company might have to cover those debts.

Lending to third-degree firms is “often opaque” and harder to track, which raises the likelihood of undetected risks.