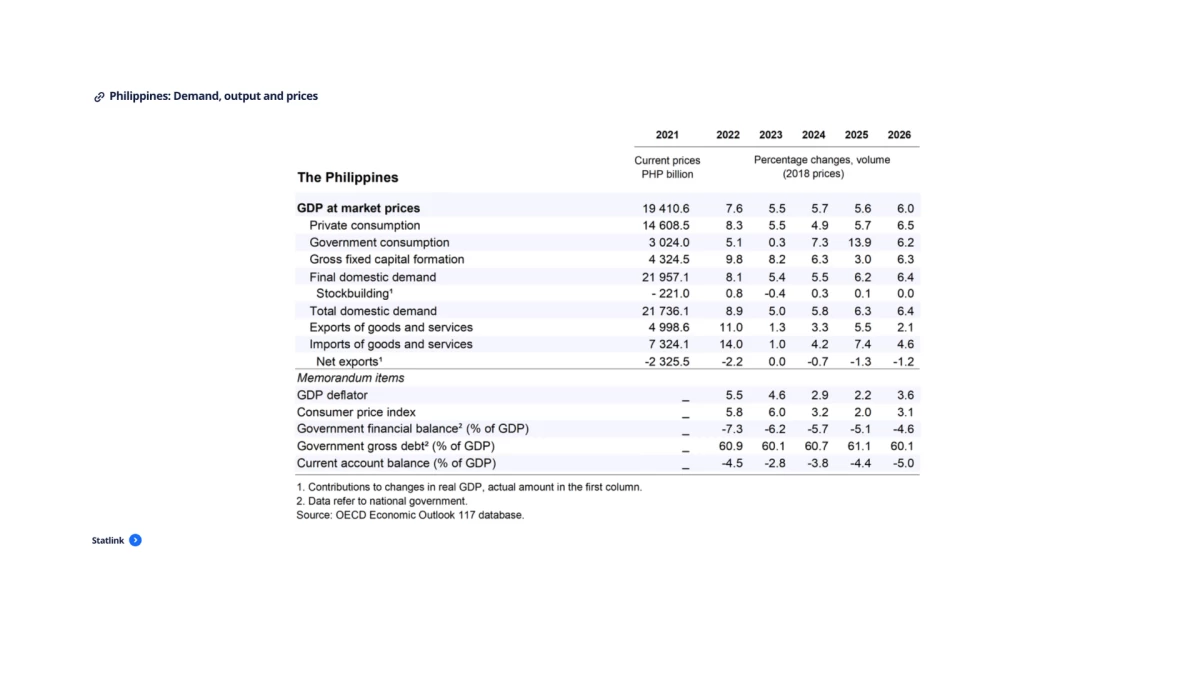

After a disappointing 5.7-percent gross domestic product (GDP) growth rate last year, the Philippines is expected to post an even slower growth rate of 5.6 percent for 2025, which would once again fail to reach the government’s growth target of six to eight percent.

Philippine growth to slow further in 2025, missing gov't target for third year—OECD report

By Derco Rosal

At A Glance

- After a disappointing 5.7-percent gross domestic (GDP) growth rate last year, the Philippines is expected to post an even slower growth rate at 5.6 percent for 2025, which would once again fail to reach the government's growth target of six to eight percent.

Growth would only accelerate at a six-percent rate by 2026, the Organization for Economic Cooperation and Development (OECD) revealed in its report, published on June 3, titled “OECD Economic Outlook, Volume 2025 Issue 1: Philippines: Tackling Uncertainty, Reviving Growth.”

To recall, the country missed its economic target for the second year in a row in 2024, following a 5.5-percent expansion in 2023—short of the six- to seven-percent goal. Growth exceeded the target ceiling in 2022, at 7.6 percent.

OECD pointed to a potential “larger-than-expected slowdown in major economies, including the United States (US) or China” as a development that could “reduce demand for Philippine exports and affect remittance inflows, impacting domestic consumption and investment.”

Exports of local goods and services are projected to expand by 5.5 percent by year-end, faster than the 3.3 percent in 2024. However, OECD has also forecast that this would eventually slow at 2.1 percent, even slower than the previous year.

In turn, the trade deficit is expected to ease slightly as net exports are now projected to decline by 1.2 percent, a slower drop compared to the projected 1.3 percent in 2025.

The Department of Economy, Planning, and Development (DEPDev) had said earlier that the 19.8-percent contraction in net exports has a massive impact on the country’s lackluster first-quarter performance. The economy grew by a lower-than-expected 5.4-percent rate.

Meanwhile, OECD has projected consumer spending to grow from 4.9 percent in 2024 to 5.7 percent in 2025, and even faster at 6.5 percent in 2026.

“On the upside, recent reforms to reduce barriers to foreign direct investment (FDI) could boost investment,” OECD noted.

Total real investment, which measures the volume of gross fixed capital formation (GFCF) across the economy, is seen to expand by three percent in 2025, just more than half its pace in 2024. But this is expected to rebound in 2026, similar to the movement in 2024.

The projected recovery of investment in the first half of 2025 could be attributed to the decline in borrowing costs. The Bangko Sentral ng Pilipinas (BSP) recently decided to trim the key borrowing cost by a quarter point to 5.5 percent, and the market expects further cuts in the coming months.

OECD noted, however, that the “recent escalation of global trade tensions is expected to weigh on external demand and export revenues.”

For a holistic economic growth, OECD suggested that local policymakers should continue improving reforms that encourage competition.

It cited the amended Public Services Act (PSA) that “reduced barriers to foreign investment in services.”

“Further streamlining regulations across key network sectors, such as energy, telecommunications and transport, can reduce barriers to entry and encourage private investment,” it added.

OECD stressed that tackling labor market issues is a major move to raising productivity and giving workers more stability. This involves lowering non-wage labor costs and making labor rules more flexible, which could encourage businesses to offer more formal jobs.

“Enhancing women’s participation in the labor force through improved access to affordable childcare and flexible work arrangements would enable the Philippines to leverage its substantial human capital, thereby fostering economic growth and reducing gender disparities in employment,” the report further said.