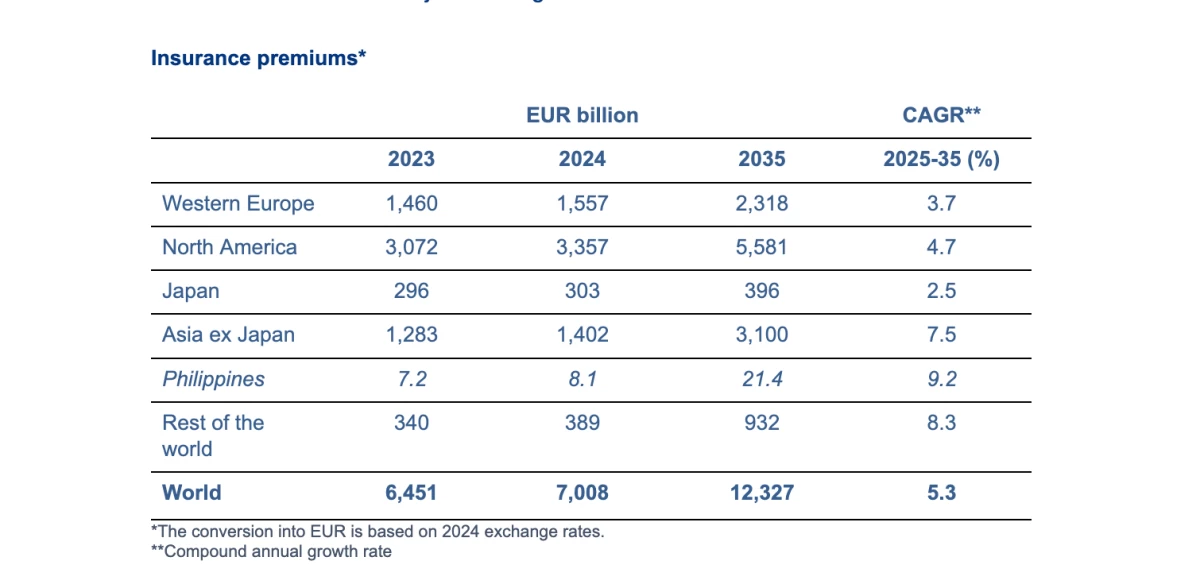

With 8.1-billion-euros worth of insurance premiums last year in the Philippines, Germany-based Allianz predicts it will bloat by 9.2 percent annually over the next decade, reaching 21.4 billion euros or about ₱1.33 trillion by 2035.

Allianz sees Philippine insurance premiums tripling by 2035, with life sector growing by 9.5%

By Derco Rosal

At A Glance

- With EUR 8.1 billion worth of insurance premiums last year in the Philippines, Germany-based Allianz predicts it will bloat by 9.2 percent annually over the next decade, reaching EUR 21.4 billion or about ₱1.33 trillion by 2035.

Allianz Research said in its Global Insurance Report 2025 published Wednesday, May 27, that it “remains confident about life insurance [globally], which can expect annual growth of five percent thanks to higher interest rates.” It is looking at 9.5-percent growth for the Philippine life insurance industry.

For property and casualty (P&C) belonging to the non-life sector, Allianz Research expects an annual growth of 8.3 percent through 2035, faster than the global average of 4.5 percent.

“The segment will show solid growth rates in almost all markets, as the increasing need for protection is a global phenomenon,” the report said.

Reports showed that the gross written premiums (GWP)—total premium income before deductions like reinsurance or cancellations—of the country’s life insurance industry stood at 5.56 billion euros in 2024. This accounted for 68.6 percent of the total premiums last year.

Based on the Allianz Global Insurance Map, this translates to about 46.7 euros per individual during the year.

Life insurance premiums accounted for 1.2 percent of 2024 gross domestic product (GDP).

Life insurance posted the highest annual growth of 13.4 percent in three years, since the 22.8-percent growth rate seen during the height of the Covid-19 pandemic. There were slight contractions in 2022 and 2023.

Meanwhile, the P&C insurance segment had collected a total of 2.16 billion euros in 2024, making up 26.7 percent of the total. This translates to just 18.1 euros per policy holder.

The P&C insurance segment expanded by 10.5 percent, faster than the 8.6-percent growth in 2023, but a tad slower than the 10.6-percent growth in 2022. It has been accounting for 0.5 percent of the country’s GDP since 2007.

Additionally, the industry’s premium income for the health insurance segment stood at 400 million euros, accounting for the remaining five percent of the total. It translates to just 3.3 euros per account holder.