Efforts by supporters of former President Rodrigo Duterte to disrupt overseas remittance flows through a self-declared “no remittance week” in March failed to dent inflows, as cash sent home by Filipinos rose by 2.6 percent that month, data from the Bangko Sentral ng Pilipinas (BSP) showed.

March remittances up 2.6%, defying 'no remittance week' campaign — BSP data

By Derco Rosal

At A Glance

- Money sent in by Filipinos working and living overseas increased to $2.81 billion in March from $2.74 billion in the same month last year, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Money sent in by Filipinos working and living overseas increased to $2.81 billion in March from $2.74 billion in the same month last year, data from the BSP showed.

Cash remittances also grew by 2.7 percent to $8.44 billion in the first quarter of 2025, up from $8.22 billion during the same period in 2024.

Remittances remained robust and continued to grow despite a threat by supporters of the jailed former President to stop sending money back home in March.

In March, diehard Duterte supporters called for a “no remittance week” following his arrest and prosecution at The Hague, Netherlands. However, the move appeared ineffective, as data showed a year-on-year increase in remittances.

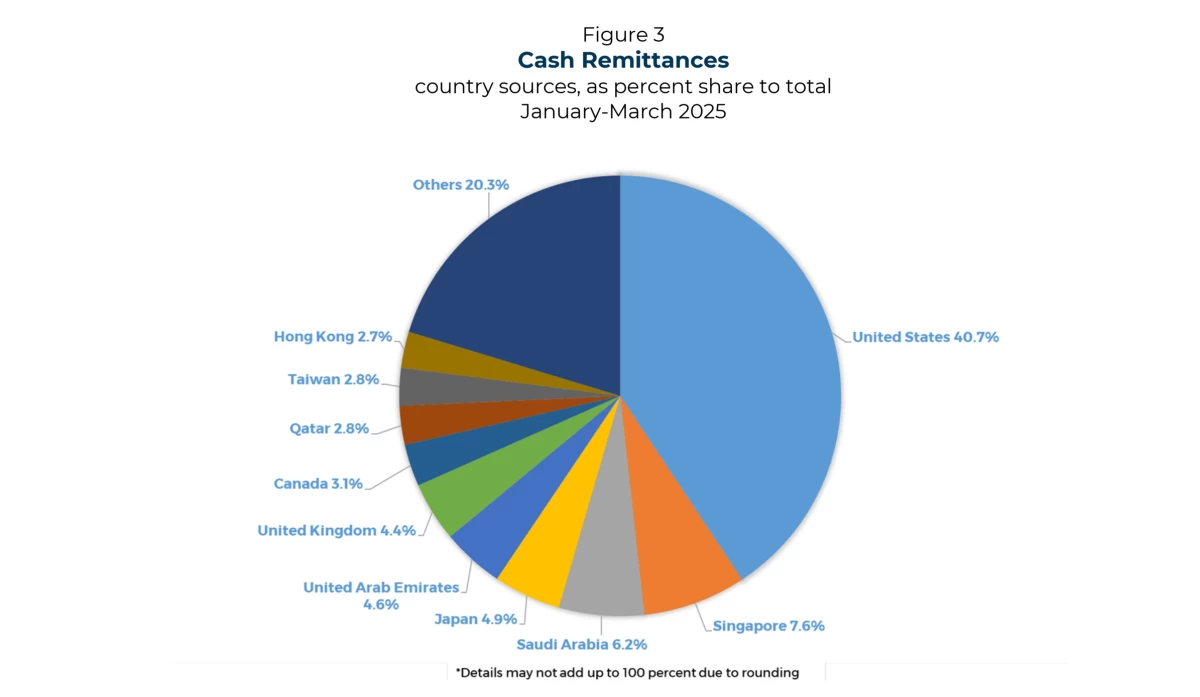

According to the BSP’s statement released Thursday, May 15, the main contributors to the first quarter’s cash remittances were funds sent in from United States (US), Singapore, Saudi Arabia, and the United Arab Emirates (UAE).

By source, the US remained the top source of cash remittances in the first quarter at 40.7 percent, followed by Singapore (7.6 percent), and Saudi Arabia (6.2 percent).

Several money transfer centers in countries abroad send money through partner banks, known as correspondent banks, most of which are based in the US, the central bank noted.

It added that remittances sent through money couriers are recorded under the country where their main offices are based—often the US—rather than the actual source country.

“Therefore, the US would appear to be the main source of OF [overseas Filipino] remittances because banks attribute the origin of funds to the most immediate source,” the BSP said.

Personal remittances, or the sum of transfers sent in cash or in-kind via informal channels, also increased by 2.6 percent to $3.13 billion in March from $3.05 billion in the previous year.

“Both land-based and sea-based workers contributed to the increase in remittances,” the central bank noted.