FROM THE MARGINS

Congratulations to the Microfinance Council of the Philippines, Inc. (MCPI) for the successful holding of its annual conference at the Manila Hotel last Aug. 15-16. It was a momentous occasion, coinciding with the celebration of MCPI’s 25th anniversary. The event brought together over 500 practitioners and stakeholders in Philippine microfinance, like a reunion of sorts for those of us who have been working in the industry since the late 1980s.

We have much to celebrate. Our combined efforts carved a path for microfinance in our financial ecosystem. We successfully lobbied for the passage of R.A. No. 10693, “An Act Strengthening NGOs Engaged in Microfinance Operations for the Poor,” which recognizes the indispensable role of microfinance in fostering local enterprise development and entrepreneurship. We now have the Microfinance NGO Regulatory Council (MNRC), and State support of pro-poor credit policies and mechanisms is assured. Financial inclusion has been adopted as a key government policy.

We are grateful to those who helped us along the way – our legislators, regulators, and stakeholders who supported our advocacy to help our marginalized sector.

Poverty solution

Through the years, MCPI has been at the forefront of transforming the country’s financial landscape toward helping the poor. This network of microfinance practitioners and allied service institutions champion sustainable, innovative, and client-responsive solutions to poverty. Its programs include advocacy, capacity-building, and knowledge management – all geared toward achieving the highest global standards of excellence in governance, stewardship, and service to its client-members.

MCPI accounts for 80-90 percent of the microfinance sector’s total active outreach. It is composed of 66 institutions, including 55 regular members and 11 support institutions. Its regular members include 33 microfinance non-government organizations, 12 rural banks, seven cooperatives, one finance company and two regional networks.

Changing the landscape

MCPI grew out of a USAID-funded program called “Developing Standards for Microfinance Project (DSMP).” We -- the microfinance institutions (MFIs) that were part of DSMP -- formed the MCPI in 1999 because we believed that access to financial and non-financial services could drive significant change in the lives of socio-economically-challenged families. We wanted to document our best practices and promote standards to protect our stakeholders, especially the clients and communities that we serve.

In 2002, MCPI with the support of the Citi Foundation launched the Citi Microentrepreneur of the Year Awards (CMA). Recognizing the successful microentrepreneurs whose lives were transformed by microfinance provided inspiration to many people. This initiative was eventually replicated in several countries.

Likewise, in 2002, MCPI launched its Social Performance Management (SPM) Advocacy Program, which assisted MFIs in refining their mission statements and converting them into social goals. Then, in May 2015, it led 21 MFIs into signing a Memorandum of Agreement to facilitate underprivileged communities’ access to health care services through the Microfinance for Health Initiative.

MCPI has been unwavering in its dedication to develop a financial ecosystem that safeguards the interests of clients. By implementing and promoting best practices, we created a framework where low-income individuals can access financial services without falling into the trap of over-indebtedness. This protective environment fosters trust and encourages more people to engage with formal financial systems, paving the way for greater economic growth.

From this initiative came the microfinance credit bureau called MIDAS, which facilitates credit information sharing among MFIs. MIDAS assists MFIs in evaluating clients' credit histories and repayment abilities more accurately, thus helping to reduce the risks for both the MFI and their clients.

Looking ahead

Innovation has been at the heart of MCPI's approach to microfinance. From leveraging technology to enhance service delivery to designing products tailored to the unique needs of different client segments, MCPI has consistently ensured that microfinance remains relevant.

The integration of digital platforms in microfinance operations has enabled institutions to reach remote areas, reduce operational costs, and provide faster and more efficient services. This not only improved access to finance; it also empowered people with tools and knowledge to make more informed financial decisions.

MCPI also spearheads the annual Digital Financial Inclusion Awards (DFIA) to recognize microfinance institutions and clients who succeed in bringing up their businesses to the next level through digital platforms. Like its precursor, the CMA Award, this is supported by BSP and the Citi Foundation.

It is important to look ahead even as we reflect on the past 25 years. We will continue our journey toward truly inclusive and responsible finance, and the role of MCPI is crucial. It must lead efforts to innovate, adapt, and advocate for policies and practices that will support the sustainable growth of the microfinance sector. By doing so, we will not only honor the legacy of microfinance pioneers but also ensure that our mission will endure for generations to come.

Again, congratulations to the Microfinance Council of the Philippines!

* * *

“I alone cannot change the world, but I can cast a stone across the waters to create many ripples.” – Mother Teresa

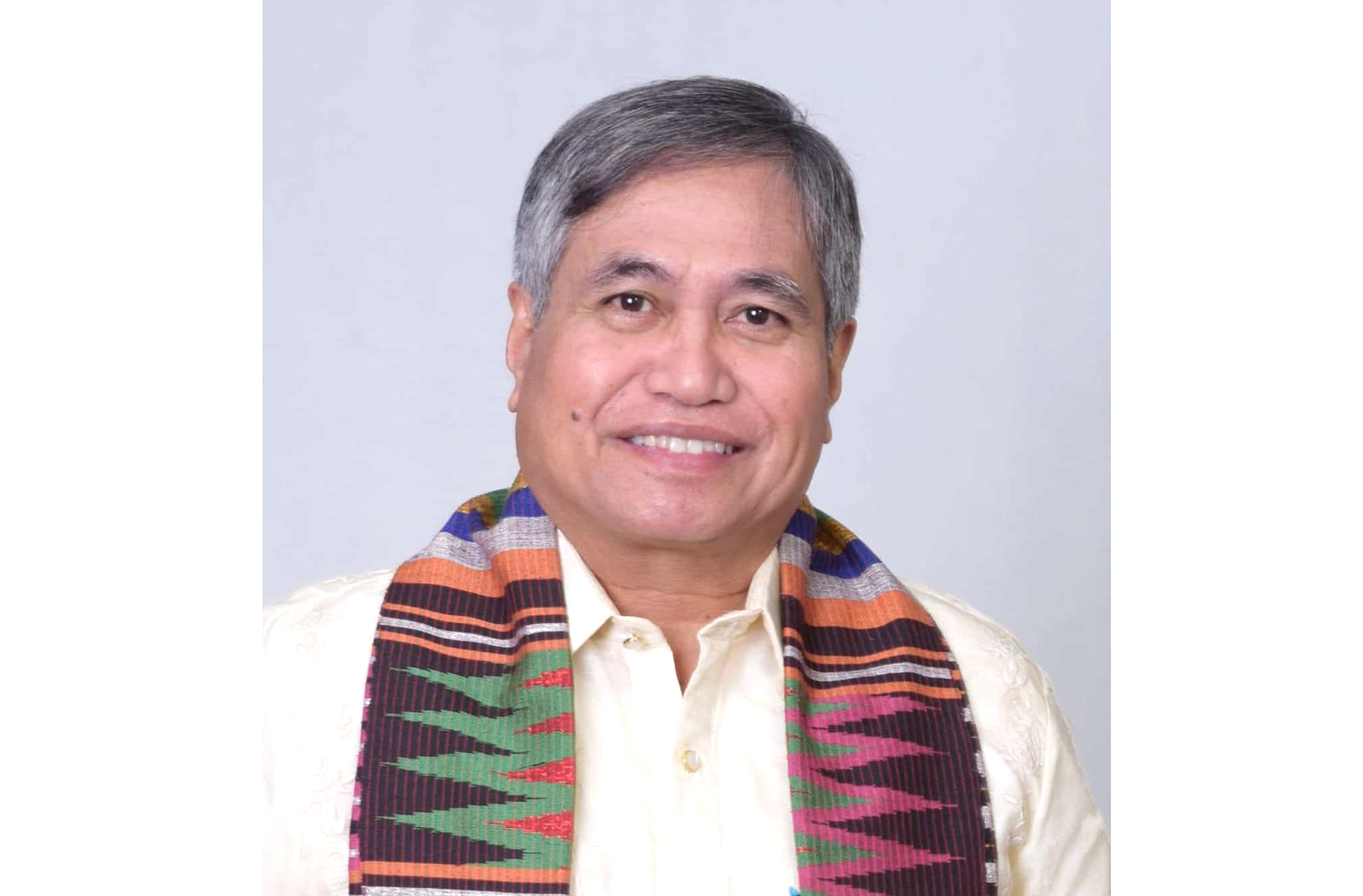

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI).)