ERC suspends spot market, but consumers warned of 'electric bill shocks'

At A Glance

- The ERC and even WESM operator Independent Electricity Market Operator of the Philippines (IEMOP) don't typically release data on market gainers on descent of extreme tight supply conditions, but the pampered generation companies (GenCos) – despite their simultaneous and series of forced outages – would often vouch of rise in profitability due to elevated spot market prices to the detriment of the suffering consumers.

The Energy Regulatory Commission (ERC) has ordered suspension of the Wholesale Electricity Spot Market (WESM) - but only after two weeks from the incursion of yellow and red alerts in the Luzon and Visayas grids, hence, consumers are being warned of forthcoming bill shocks.

Referencing on data gathered from the WESM, the regulatory body emphasized that “prices per day increased by an average of 11% in Luzon and 53% in Visayas, which will translate to a significant impact in the consumers’ electricity bill.”

The ERC expounded that the WESM suspension will only be lifted “if the regional available capacity, less actual regional demand, reaches above zero for 24 consecutive hours.”

As it is, the ERC’s belated order on the suspension of the spot market was generally perceived as a dangerous regulatory play which could have first opened floodgates of profiteering in the past two weeks when WESM prices have been consistently surging.

The ERC and even WESM operator Independent Electricity Market Operator of the Philippines (IEMOP) don’t typically release data on market gainers on descent of extreme tight supply conditions, but the pampered generation companies (GenCos) – despite their simultaneous and series of forced outages – would often vouch of rise in profitability due to elevated spot market prices to the detriment of the suffering consumers.

The spot market operates in real time, and it gives clear signals on price fluctuations based on supply and demand that could prompt regulators for warranted swift action to prevent adverse market disarray that could set the stage for exploitation by players that are just out to gain massively from the crisis situation – and that in the process will be inflicting financial harm on the unsuspecting consumers.

ERC Chairperson Monalisa C. Dimalanta claimed that “the Commission is working doubly hard to alleviate the impact of El Niño on our power system, and we are finding ways to mitigate the impact of the extremely high demand resulting from the high heat index as these ultimately affect our consumers.”

The ERC chief similarly put forward a call on the distribution utilities (DUs) that are sourcing supply from the WESM” to be proactive in exploring ways to lessen their exposure.”

Given the relatively helpless plight of consumers during this El Niño-stricken summer months, the token offer of the ERC will be for them to take advantage of some existing programs that could alleviate their budget woes on exorbitant electric bills – such as the ANTI BILL SHOCK lending portfolio of the Land Bank of the Philippines, that will allow them to “pay through installment the incremental increases in their electricity bill.”

The regulatory body conveyed that it is temporarily breaking off the spot market’s routine settlements “under certain conditions, triggered by the series of red alert notices in the past weeks due to the significant increase in demand owing to the high heat index.”

Within the duration of the WESM suspension, the ERC stipulated that the “administered price shall apply” – that is in reference to a price that shall be imposed by the market operator to trading participants as the basis of settlement in times of market intervention.

The Commission, nevertheless, qualified that another pricing system will be enforced “if a dispatch interval is subject to both a price mitigation -- such as the secondary price cap and the administered price, the lower of the two prices shall apply in the settlement of transactions for such interval.”

The secondary price cap is pegged at P6.245 per kilowatt hour (kWh) and that is determined based on the threshold set by ERC within prescribed trading intervals.

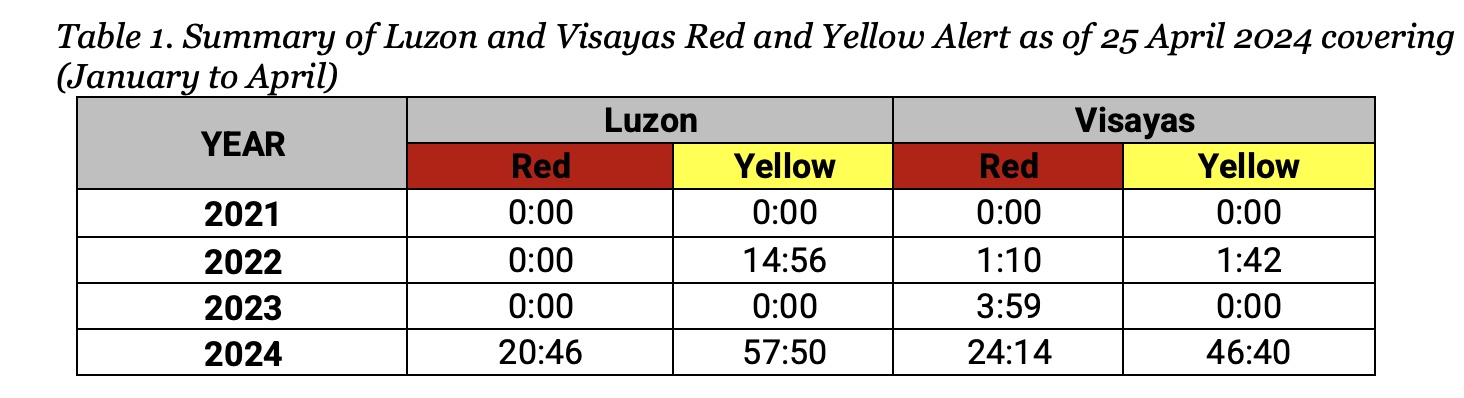

The industry regulator further acknowledged that “the alert issuances this 2024 are significantly affecting the condition of the power system.”

The ERC is empowered under Section 30 of the Electric Power Industry Reform Act (EPIRA) “to suspend the operation of the WESM or declare a temporary WESM failure in cases of national and international security emergencies or natural calamities,” although it is apparent that the regulator had been slow on the draw in determining what was already manifest as a state of ‘national emergency’ in the power system.