Bulacan taxpayers told: File 2023 annual ITR; no extension of April 15 deadline

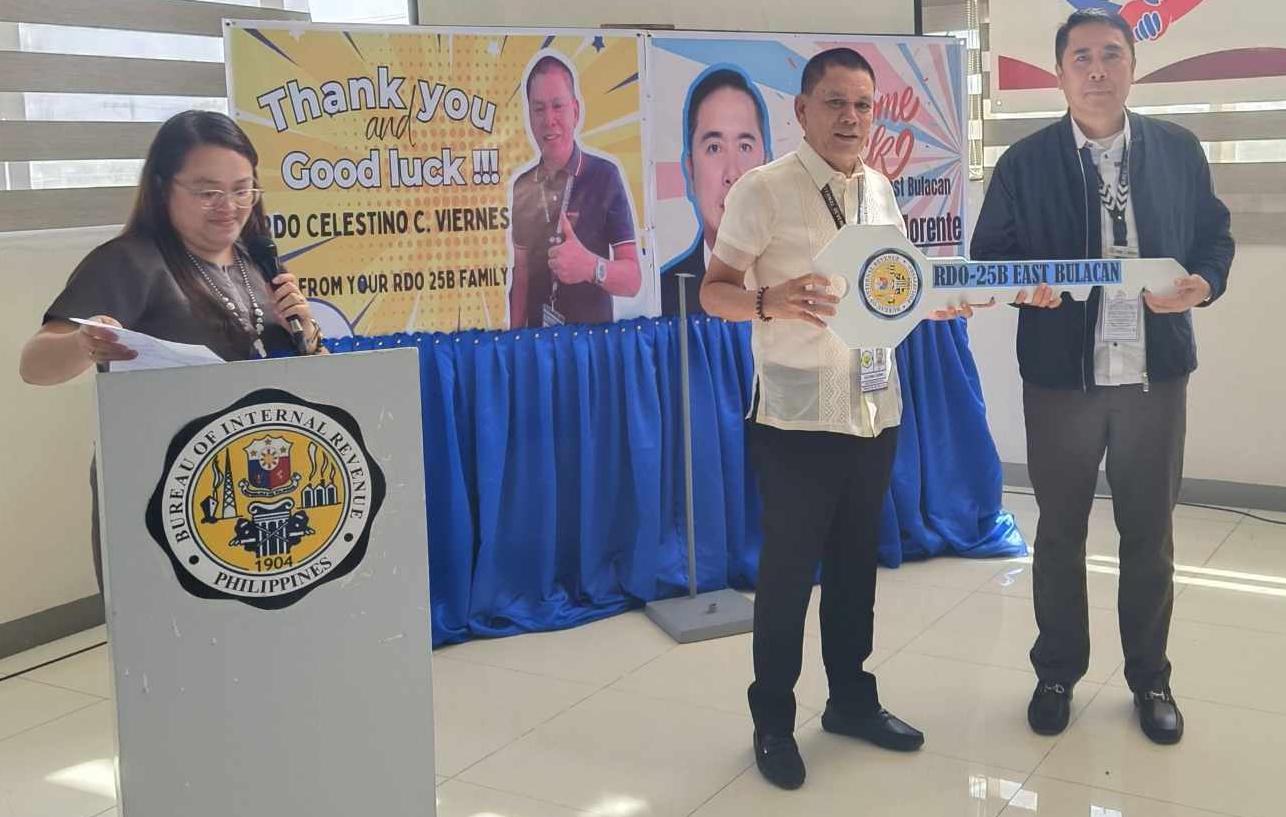

RDO-25B East Bulacan chief Rommel Morente (right) and former BIR-RDO25B chief Atty. Celestino Viernes with Atty. Nina Diana Federizo, assistant chief of RDO25B, (left). (Photo courtesy of BIR-RDO-25B East Bulacan)

Taxpayers in the province of Bulacan were reminded by the Bureau of Internal Revenue (BIR) Revenue District Office (RDO)-25A (West Bulacan) and RDO-25B (East Bulacan) on Wednesday, April 3, to file their 2023 Annual Income Tax Return on or before the April 15 deadline.

Romel H. Morente, BIR-RDO chief of East Bulacan, said taxpayers should file their ITR and pay the correct tax on time to prevent incurring penalties. He said there will be no extension of the April 15 deadline.

“I urge our Bulakenyo taxpayers to pay their taxes early to avoid the inconvenience of long queues in banks and other Revenue Payment Centers in the different cities and municipalities, especially in these very hot and humid days of summer,” Morente said.

RDO-25A Chief Raymund V. Ranchez of West Bulacan, likewise, aired his appeal to taxpayers to beat the April 15 deadline to avoid paying unnecessary fines and penalties.

He called on taxpayers from the cities of Malolos and Baliwag and from the municipalities of Balagtas, Bocaue, Bulakan, Bustos, Calumpit, Guiguinto, Hagonoy, Pandi, Paombong, Plaridel and Pulilan which comprise the West Bulacan Revenue District Office to pay their taxes on time.

The East Bulacan-RDO has jurisdiction over the cities of Meycauayan and San Jose Del Monte and the towns of Angat, Doña Remedios Trinidad, Marilao, Norzagaray, Obando, San Ildefonso, San Miguel, San Rafael, and Sta. Maria.

The main offices of the two RDOs in Bulacan are housed in one building located along the Plaridel-Balagtas ByPass Road in Barangay Tiaong, Guiguinto, Bulacan. They are open from 8:00 a.m.to 5:00 p.m. including on the two Saturdays (April 6 and 13) before the April 15 deadline.

RDO-25B Chief Morente and his assistant RDO Atty. Nina Diana Federizo encouraged Bulacan taxpayers to visit their BIR office and other Tax Tulungan Centers (TTC) that were set up to assist taxpayers in preparing their tax returns. These are located at Waltermart – Sta. Maria, SM City-Marilao and SM City-San Jose Del Monte City.

Morente and Ranchez appealed to Bulacan taxpayers to continue filing and paying their correct taxes which act as the lifeline in supporting infrastructure and economic development of the government.