In response to global trade disruptions and geopolitical tensions, the Marcos administration has adjusted its economic growth targets, the Development Budget Coordination Committee (DBCC) announced.

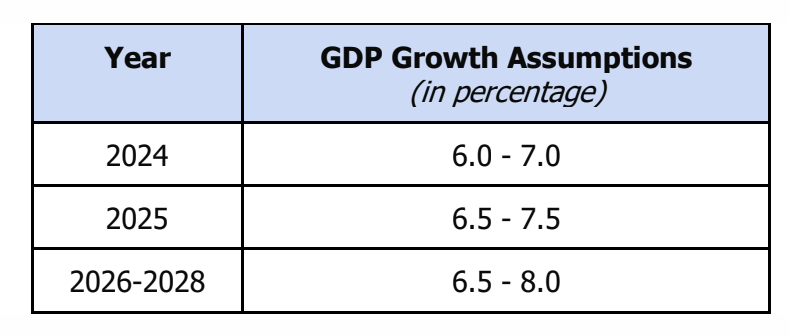

The DBCC, an inter-agency body responsible for setting the country's macroeconomic assumptions, has revised downwards the gross domestic product (GDP) target bands for 2024 and 2025. These revised targets have been approved by President Marcos on Wednesday, April 3.

For the current year, the DBCC now expects the country's economy to grow between 6.0 percent and 7.0 percent, a slower pace compared to the previous projection of 6.5 percent to 7.5 percent.

If achieved, this year's growth would still exceed the 5.6 percent expansion recorded in 2023.

Looking ahead to 2025, the GDP target has been narrowed to a range of 6.5 percent to 7.5 percent from the initial projection of 6.5 percent to 8.0 percent.

According to the DBCC, these adjustments have been made in consideration of the latest trade outlook provided by the Bangko Sentral ng Pilipinas and the International Monetary Fund.

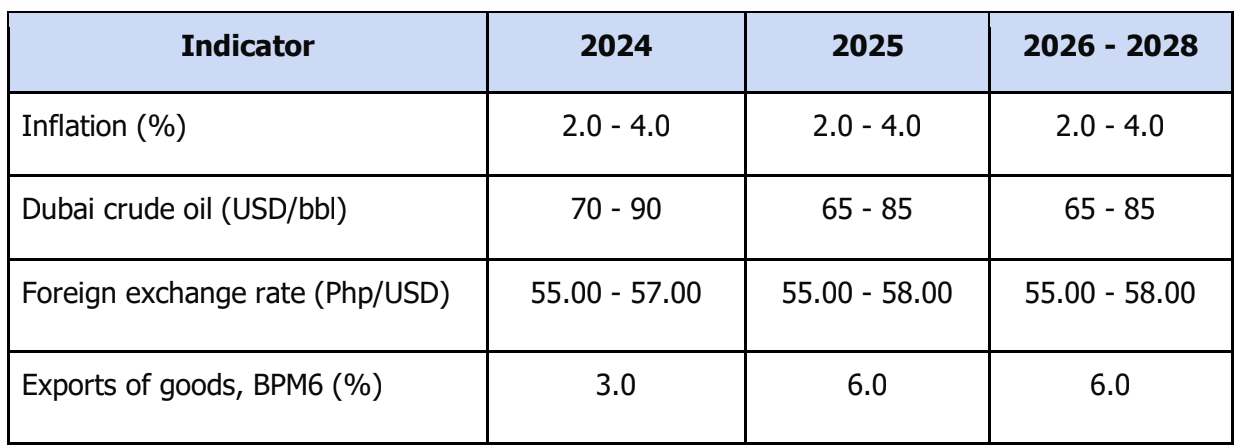

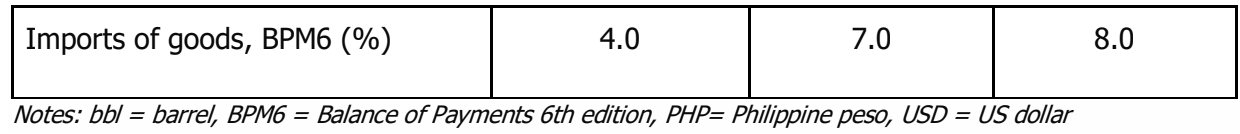

The DBCC expects a moderation in goods imports growth for the current year, with its projection set at 4.0 percent, a decrease from the previous target of 7.0 percent.

Looking ahead, imports growth is projected to rise to 7.0 percent next year and further to 8.0 percent from 2026 to 2028.

“Goods imports are expected to be propped up by investments in public infrastructure,” the DBCC said in a statement.

Meanwhile, the DBCC noted that escalating trade distortions and geoeconomic fragmentation would constrain goods exports growth this year to 3.0 percent, a reduction from the earlier target of 5.0 percent.

Nevertheless, the DBCC is optimistic about the country's exports the following years, expecting them to rebound with an annual growth rate of 6.0 percent from 2025 to 2028.

Additionally, the DBCC has adjusted its peso-US dollar exchange rate projection for 2024, narrowing the range to 55 to 57 from the previously set 55 to 58.

Nevertheless, the inter-agency committee has decided to keep the foreign exchange assumption unchanged at 55 to 58 for the period spanning 2025 to 2028.

“The peso will continue to be supported by structural foreign exchange inflows and firm macroeconomic fundamentals of the country,” the DBCC said.

Despite soaring commodity prices driven by geopolitical tensions, trade constraints from key rice-exporting nations, and constrained availability of essential goods, the DBCC has also chosen to retain its inflation targets for the coming years.

“Inflation rate targets were retained at 2.0 to 4.0 percent for 2024 until 2028,” the DBCC said.

“To ensure that inflation remains within the target band, the government will accelerate the implementation of strategies under its Reduce Emerging Inflation Now (REIN) Plan,” it added.

Lastly, the DBCC kept the assumptions for the Dubai crude oil price unchanged at $70 to $90 per barrel for 2024, and at $65 to $85 per barrel for the years 2025 through 2028.

The body said these figures align with the current futures prices and projections, indicating expectations of subdued global crude oil prices in the medium term.