FDA removes VAT exemption for Covid-19 medicines, devices

The Food and Drug Administration (FDA) issued an advisory on Friday, March 8, regarding the delisting of Covid-19 medicines and devices from the list of Value-Added Tax (VAT)-Exempt Health Products.

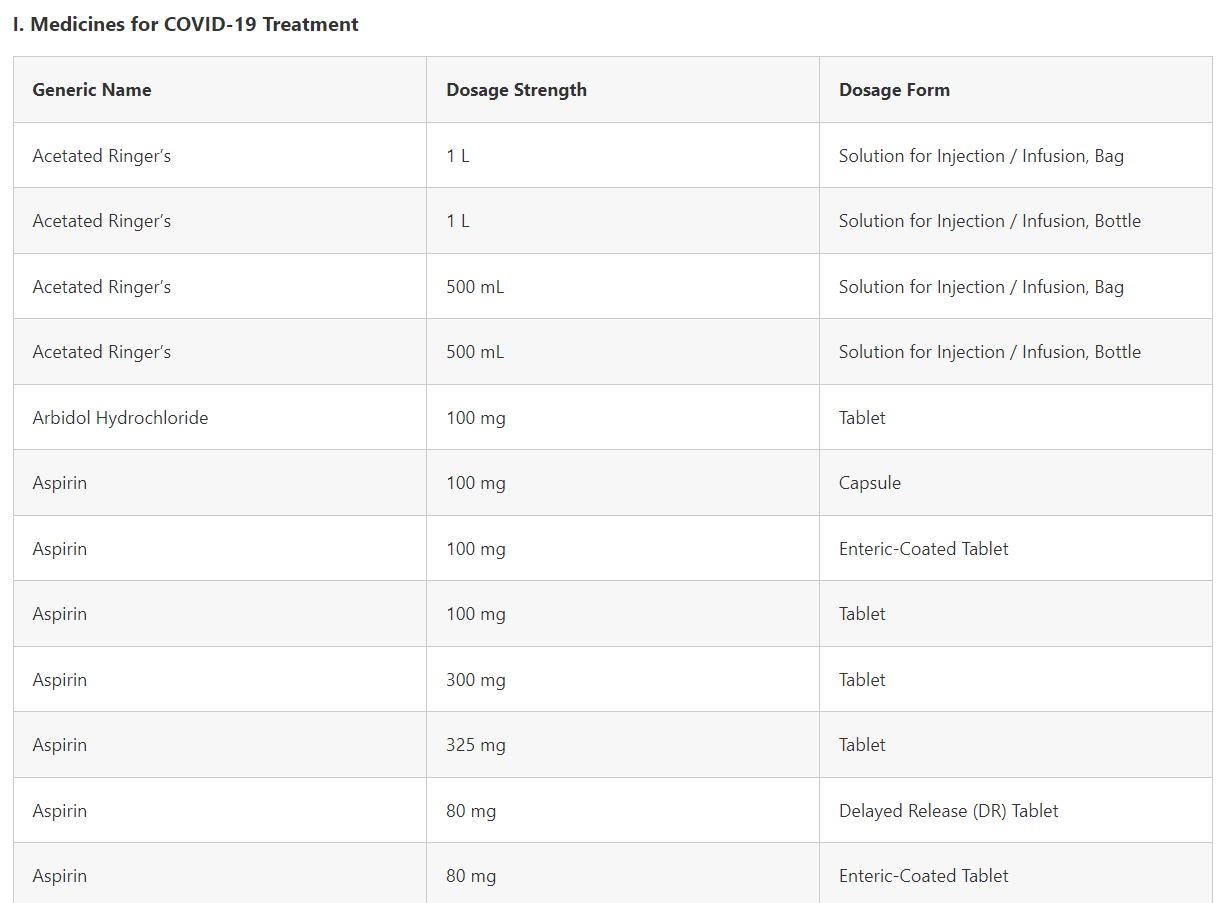

Among the delisted medicines are various treatments for Covid-19, including Acetated Ringer’s Solution, Arbidol Hydrochloride Tablets, Aspirin Capsules and Tablets, Atracurium Solutions for Injection, Azelastine Hydrochloride + Fluticasone Propionate Nasal Suspension, Balanced Multiple Replacement Solution + 5 percent Dextrose, Baricitinib Tablets, Beclometasone dipropionate + Formoterol fumarate dihydrate, Bivalirudin Lyophilized Powder for Injection (IV), Budesonide Metered Dose Inhaler, Casirivimab + Imdevimab, Cefotaxime (as sodium), ChAdOx1-S [recombinant] (Covid-19 Vaccine AstraZeneca) Solution for injection, Clonazepam tablet, Clopidogrel capsule and tablet, and among others.

Read this link for the complete list of delisted medicines and devices.

READ: https://www.fda.gov.ph/fda-advisory-no-2024-0498-delisting-of-covid-19-medicines-and-devices-from-the-list-of-vat-exempt-health-products/

The FDA stated that this move comes following the provisions of Republic Act (RA) No. 11534, also known as the "Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act."

Under RA No. 11534, the agency noted that certain health products, including drugs for various conditions and Covid-19 medicines and medical devices, were initially granted VAT exemption.

However, under this law, the FDA is mandated to identify and transmit VAT-Exempt Health Products to other implementing agencies.

Section 12 of RA No. 11534 stipulates that the VAT exemption for medical devices, drugs, and vaccines used for Covid-19 treatment shall be valid until Dec. 31, 2023.

The FDA said that accordingly, the Bureau of Internal Revenue (BIR) has issued Revenue Memorandum Circular No. 7-2024, announcing that these products “will no longer be VAT-Exempt effective Jan. 1, 2024.”

In line with this directive, the FDA has delisted several Covid-19 medicines from the VAT-Exempt Health Products list, as detailed in Revenue Memorandum Circular No. 7-2024.

"The FDA Verification Portal will be updated accordingly to reflect these changes," it stated.