FROM THE MARGINS

The Philippine model of microinsurance mutual benefit association (Mi-MBA) is quite unique, providing the poor not only access to risk protection, but opportunities to own and manage their microinsurance organizations. Apart from the social and economic benefits, microinsurance MBAs also facilitate women empowerment since they are usually composed of microfinance clients, who are mostly women. Many microinsurance MBAs in the country were founded by, and are being led by women.

Before Women’s Month ends, let me tell you the story of the country’s first microinsurance MBA and the first woman worker of the industry.

In 2001, there was only one microinsurance provider in the country, and that was the Center for Agriculture and Rural Development (CARD) MBA. In 2005, CARD MBA, together with seven other MFIs, established a microinsurance and MBA resource center called Risk Management Solutions Inc. (RIMANSI), which successfully lobbied for the adoption of microinsurance regulations in 2006 and helped in the establishment of many Mi-MBAs in the country. It eventually became the Microinsurance MBAs Association of the Philippines (MiMAP) with 19 Mi-MBA members. CARD MBA, the first licensed Mi-MBA, remains the largest microinsurer in the country, insuring 29 million lives.

First staff to CEO

The first microinsurance staff member was a woman. May Dawat had just graduated from college when she started working as a Finance Officer at CARD in 1999. It was an auspicious beginning, as their informal insurance-like program called Members’ Mutual Fund (MMF) was then transitioning into a separate member-owned non-stock, non-profit organization called CARD MBA. She was later joined by Alex Dimaculangan, a seasoned insurance manager who worked at the Philippine Crop Insurance Commission for a long time. Together, they worked toward securing CARD MBA’s license from the Insurance Commission and nurtured the organization in its first decade of operation.

May was promoted to assistant manager just two years after joining CARD. In 2012, after Alex retired as CARD MBA general manager, she took over the rein of leadership and played a pivotal role in steering the organization towards unprecedented growth. She became the chief executive officer of CARD MBA in 2017. She held this position until 2021, when Joy Dequito took over as part of the leadership succession.

Enduring legacy

May’s enduring legacy is well-recognized. Under her leadership, CARD MBA membership grew, from 1.58 million in 2012 to 6.17 million in 2021. There was also an unprecedented increase in the number of lives insured, from 7.91 million in 2012, to 21.90 million in 2021. Operations expanded, with provincial offices increasing from 41 to 74, staff growing from 260 to 476, and MBA Coordinators from 945 to 2,003. This led to growth in assets, from P4.7 billion in 2012, to P25.6 billion in 2021.

It was during her term that the joint venture between Pioneer Insurance and CARD MBA was forged: CARD-Pioneer Microinsurance, Inc. (CPMI) became the first microinsurance non-life insurance company in the country. This enabled them to offer more microinsurance products. Apart from life insurance, loan insurance, and retirement fund, the joint venture allowed them to provide members with disaster insurance, crop assistance program, health insurance, group accident insurance, and hospital care insurance, among others.

A study done by the University of Cambridge in 2019 showed that CARD MBA is contributing to the achievement of UN's Social Development Goals, such as gender equality, poverty eradication, health and nutrition and women empowerment. CARD MBA also became a top-performing insurance company with regards to good corporate governance. Year after year, it was recognized as a “2-Golden Arrow Awardee” by the Institute of Corporate Directors and the Insurance Commission.

Industry leader

May also served as President of RIMANSI from 2013-2017. She steered the transformation of RIMANSI, from a microinsurance resource center into a formal association of microinsurance MBAs known as MiMAP. Her leadership paved the way for the membership of more Mi-MBAs, and the development of strategic programs, like the Mutual Security Fund, which is a third line of defense for outstanding claims/obligations in case one of the Mi-MBA participants goes bankrupt. A precursor to self-regulation, the Solvency and Risk Protection Process was also put in place as a mitigation strategy to avoid a call to the fund. An ambitious target of putting up a P30M endowment fund was also adopted during her term, as well as a Code of Conduct for Mi-MBAs.

May is tireless in her pursuit of excellence. She pursued her masteral degree in Economic Community Development from the Southern New Hampshire University and attended the Executive Program in General Management by the Massachusetts Institute of Technology. She also completed many local and international training programs.

May became the Executive Vice-President of CARD Bank in June 2021. She is a true woman-leader, with unlimited reserves of energy that originate from a genuine desire to make a positive difference in the lives of poor and vulnerable women.

* * *

“Amazing things happen when women help other women.” – Kasia Gospoś

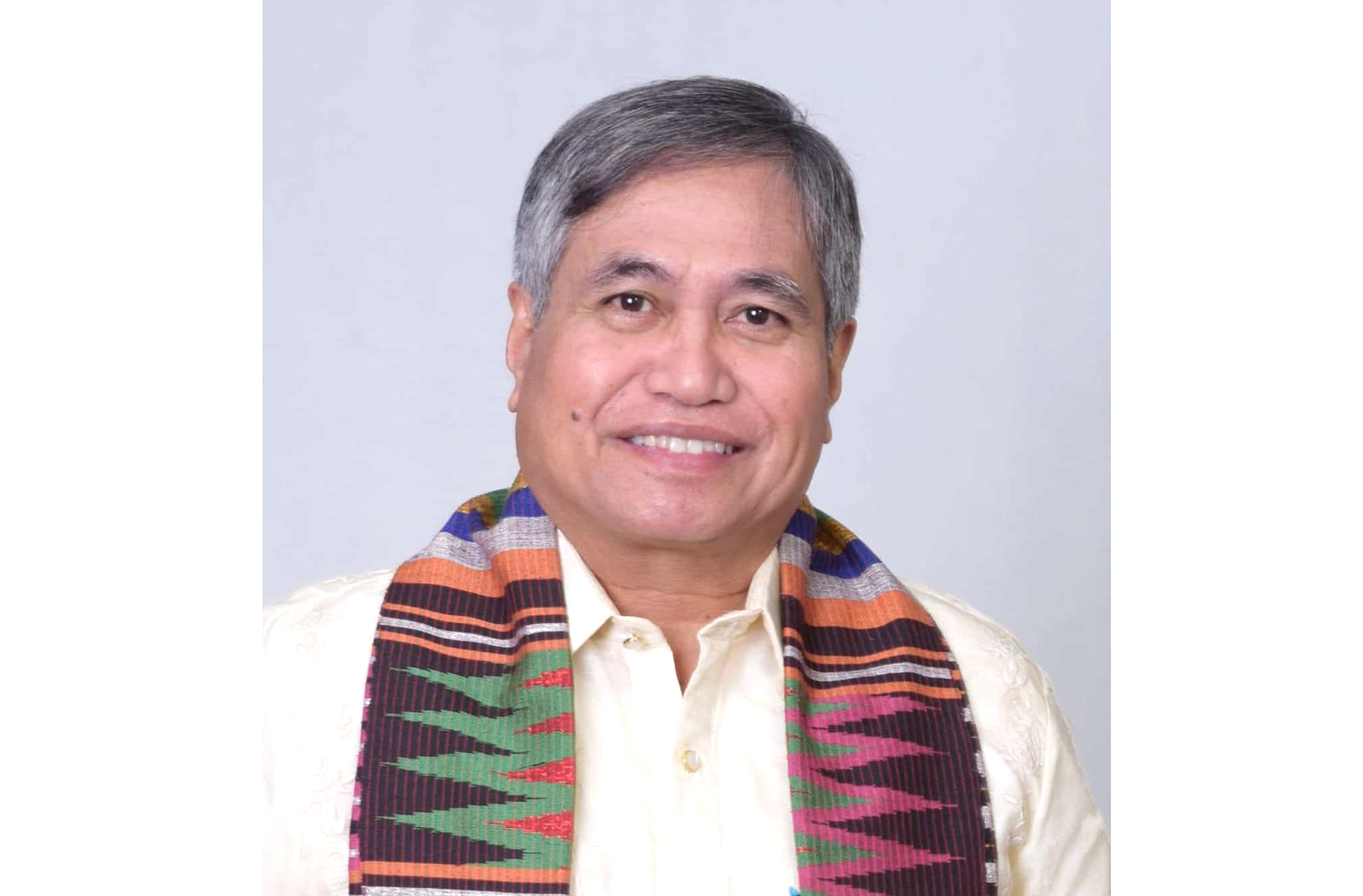

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI).)