Businessman Leandro Leviste has acquired a 7.55 percent stake in cash-strapped Roxas and Company, Inc. (RCI) to become its largest individual shareholder a week after announcing plans to make investments to help local communities in Batangas.

Leviste disclosed to the Securities and Exchange Commission on Tuesday, March 19, that he has purchased 188.89 million shares of RCI equivalent to 7.55 percent of the company.

RCI’s share price has surged in the past week, driven by what market participants had noticed as buying by a large investor.

From RCI’s closing price of P0.59 per share last March 11, it soared 381 percent as of March 19 to P2.25 per share. Based on this, Leviste’s 188.89 million shares have a market value of P425 million.

RCI has recently been in the news regarding two of its businesses. In Nasugbu, Batangas, an estimated 50,000 farmers are protesting a recent Department of Agrarian Reform (DAR) order concerning over 2941 hectares across RCI’s Hacienda Palico, Hacienda Banilad, and Hacienda Caylaway.

The order awards 1,322 hectares to the Agrarian Reform Beneficiaries (ARB’s) and recognizes RCI’s rights to the remaining 1,619 hectares.

Farmer groups have filed a Motion for Reconsideration and a Petition for Revocation on the DAR Order, and have called for a more equitable settlement over RCI’s three haciendas.

These developments follow nearly four decades of legal battles between farmer groups and RCI.

RCI also previously operated the 97-year-old Central Azucarera Don Pedro sugar mill in Nasugbu, Batangas, which announced the closure of its business operations effective on February 28, 2024, with the termination of all its affected employees on March 29, 2024.

The sugar mill’s closure has been said to result in the loss of livelihood for over 13,000 farmers and sugar mill workers.

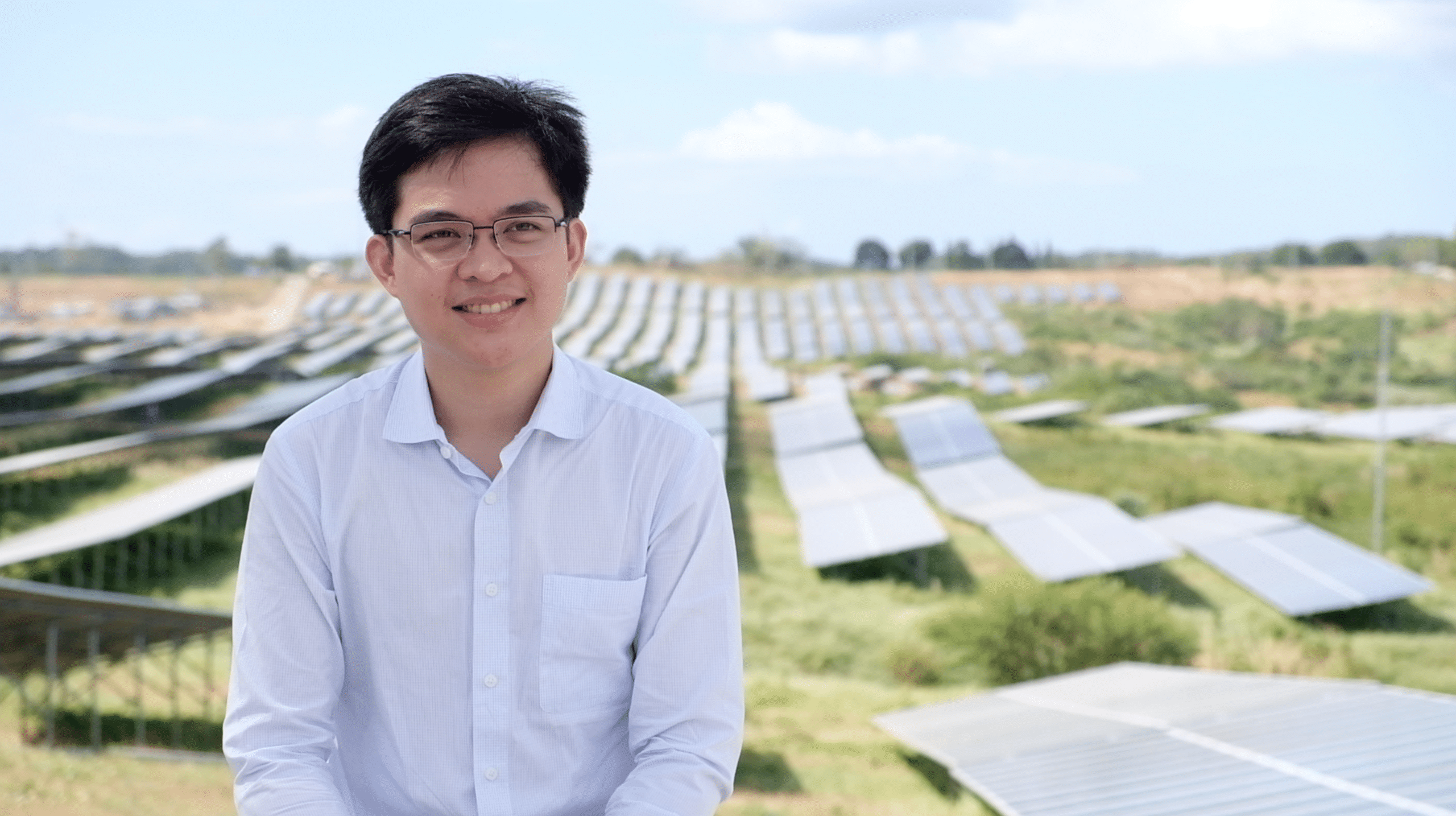

Leviste’s Countryside Investments Holdings Corporation (Countryside) last week announced a plan to invest P5 billion to help propel the development of rural Batangas.

This follows the recent sale of shares of Leviste’s Solar Philippines in SP New Energy Corporation to Meralco PowerGen Corporation and other investors, and other financing for these investments in Batangas.

Countryside stated that its investments are guided by its criteria of solving social and economic issues in ways that are mutually beneficial for investors and local communities.

The firm believes that providing equitable compensation and partnering with local communities is key to ensuring the success of any investment.

The company committed to make investments that would contribute to ushering in a new era of sustainable development and shared prosperity for communities in Batangas.