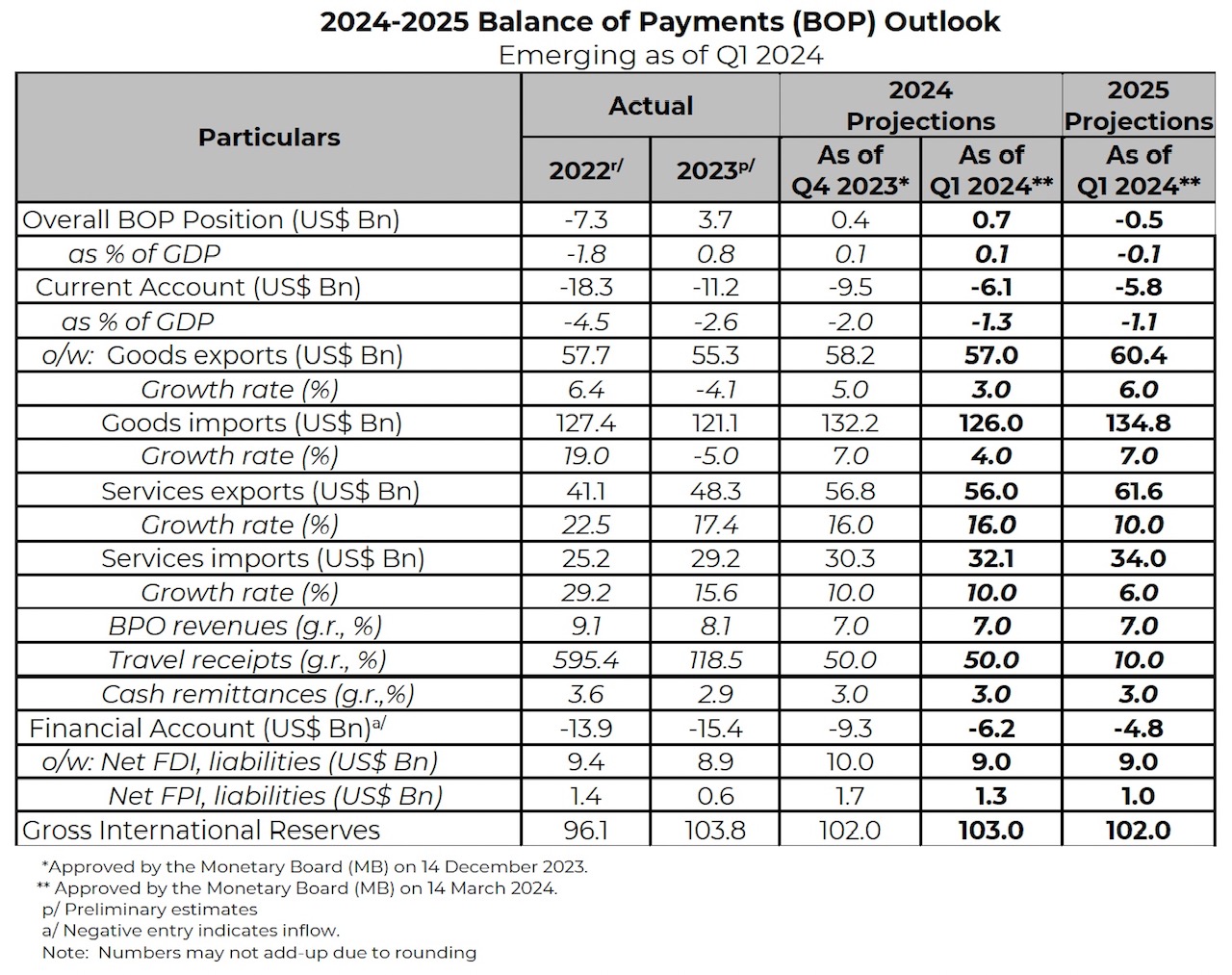

The country’s balance of payments (BOP) is seen to register a slight surplus this year, but will reverse into a deficit in 2025, based on the latest projections approved by the Monetary Board that incorporate most recent data and developments.

“The emerging external outlook for 2024 and 2025 is largely underpinned by expectations of a slight improvement in global economic conditions, particularly for this year; and improvements in domestic demand conditions over the next two years,” said the Bangko Sentral ng Pilipinas in a statement.

The overall BOP position in 2024 is projected to settle at a slightly higher surplus relative to the previous forecast, on the back of the estimated narrower current account gap for the year and modest inflows of non-resident investments.

The lower current account deficit reflects the revision of both goods imports and exports growth forecasts relative to the previous forecast round, with the latter factoring in the latest insights by major export industry associations, including the semiconductors and electronics industries, which projects a flat growth in electronics exports for 2024.

The lower CA deficit likewise considers waning pent-up demand and lingering upside risks to domestic inflation alongside the impact of monetary tightening which could dampen overall economic activity over the near term.

Meanwhile, prospects for business process outsourcing (BPO) revenues, travel receipts and overseas Filipino (OF) remittances also remain positive as demand for high-contact services continue to rebound.

Foreign directed investments (FDIs) as well as foreign portfolio investments (FPIs) are projected to register moderate net gains, supported by the government’s thrust to fully implement key amendatory laws that eased rules on foreign investor participation in key industries as well as its plan to keep infrastructure spending at above 5.0 percent of GDP.

For 2025, the projected BOP deficit is attributed to the foreseen widening of the trade-in-goods gap and further reduction in the projected financial account inflows. The larger shortfall in goods trade is primarily due to the faster increase in goods imports mainly on account of the strong growth in public infrastructure investments.

Given that merchandise trade is roughly 2.3 times the level of services trade (based on 2023 figures), the estimated sustained positive performance of both travel and BPO sectors, manages to only partially offset the trade-in-goods deficit.

Meanwhile, capital inflows are expected to moderate further in 2025 on the back of more subdued inflows of non-resident investments, as next year will be a transition year for many major economies, particularly the US and the UK, following the conduct of elections in the latter part of this year.

On the global front, BSP said, risks to the outlook during this review period are seen to be broadly balanced and less tilted to the downside relative to the previous forecast round.

The upside risks to global growth prospects for this year are emanating mainly from the recent upgrades in the growth forecasts for the United States, China, and the ASEAN bloc.

These upward adjustments are mainly reflective of the stronger-than-expected growth outcome of these economies in 2023 as well as the role of fiscal policy support in the case of China.

Higher GDP output for these economies, which are among the country’s key trading partners, could yield positive spillover effects to the country’s external sector.

In addition, the stronger-than-anticipated performance of major advanced and emerging market economies in 2023 provides a source of optimism and a firm foothold for the latest growth forecasts.

Demand for services-related transactions, particularly pertaining to travel and tourism, likewise continue to move towards surpassing the pre-pandemic levels beginning this year and is likely to maintain the same trend over the medium term.

World trade is seen to remain below historical average amid rising trade distortions and geoeconomic fragmentation.

However, new potential supply-side pressures resulting from weather and geopolitical shocks are surfacing and warrant close monitoring. The latter include the continued conflict in Gaza and relatedly the attacks in the Red Sea, among others.

These issues, if left unresolved, could weigh down on overall business and market sentiment, and dampen external demand anew.

Domestically, overall demand conditions are expected to improve this year and the next, aided in part by the government’s commitment to forge new growth strategies to steer the economy back to its pre-COVID growth trajectory.

The expected easing of inflation to within the target band beginning this year should likewise support improved consumer and investment demand.

The BSP continues to emphasize limitations to the forecasts, particularly given the continued buildup of external challenges. The BSP will continue to monitor closely emerging external sector developments and risks and how these may impact the BSP’s fulfillment of its price and financial stability objectives.