Ayala Group to sell up to $400 M assets from smaller non-core businesses

To build warchest for investment in high-growth sectors

The Zobel-controlled Ayala Group continues to beef up its warchest and hopes to raise $250 million to $400 million from the divestment of its smaller investments as it focuses on the expansion of its ventures into renewable energy, electric vehicles, healthcare, and logistics.

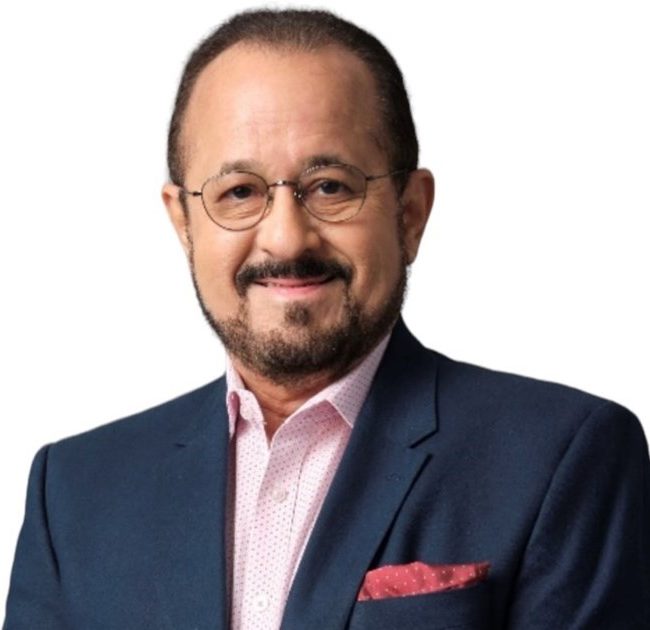

In an interview, Ayala Corporation Chief Finance Officer Alberto M. de Larrazabal said they hope to conclude in four to six months, or at least within 2024, the $1 billion divestment program the conglomerate started in 2021.

Assets that are on the selling block include the group’s remaining stake in Manila Water Company of a about 22.5 percent. At current market price, it is worth about $200 million.

“There are quite a few,” he said pointing to “some of the smaller assets in the industrial portfolio” as well as Ayala’s investment in Light Rail Manila Corporation (LRMC) which has already gained more interest after getting approval for a fare hike.

De Larrazabal noted that billionaire Enrique K. Razon Jr., now their partner in Manila Water after buying control from Ayala, remains interested in their remaining stake and Ayala might sell more shares this year.

“He's extremely committed to the business. He sees the potential and he's always indicated the desire to consider if, and when, we sell. He’s a partner so we will obviously take that into consideration,” De Larrazabal said.

Meanwhile, for LRMC, he said their partner in the consortium, tycoon Manuel V. Pangilinan’s Metro Pacific Group is among those that have indicated interest in acquiring Ayala’s share and Ayala hopes to be able to seal a deal with a buyer in four to six months or at least within the year

The Ayala Group has also had “casual conversations” with richest Filipino Manuel B. Villar Jr. who had also shown interest in acquiring an interest in the company.

Noting that the railway will pass through Villar’s vast land holdings, De Larrazabal said the real estate mogul has “a natural interest in in this. But, you know, we've not really had a serious conversation.”

He said the Ayala Group is cautiously optimistic about the Philippine economy and is continuing to invest in growth industries while still expanding its core business such as real estate, banking and telecommunications.

Despite issues such as US inflation and interest rates, De Larrazabal said “the Philippines should do relatively well. I think the interest in the local stock market is starting to pick up.”

He added that the better performance amid higher interest in the local market will continue towards end of the year into next year.

Because of this bullishness, De Larrazabal said the Ayala Group continues to invest noting that, “we’re cautious but we’re investing a lot more.”