Integrated solar developer SP New Energy Corp. (SPNEC), now a member of the Meralco Group, has replaced MREIT Inc. in the exclusive and coveted MSCI Philippines Small Cap Index.

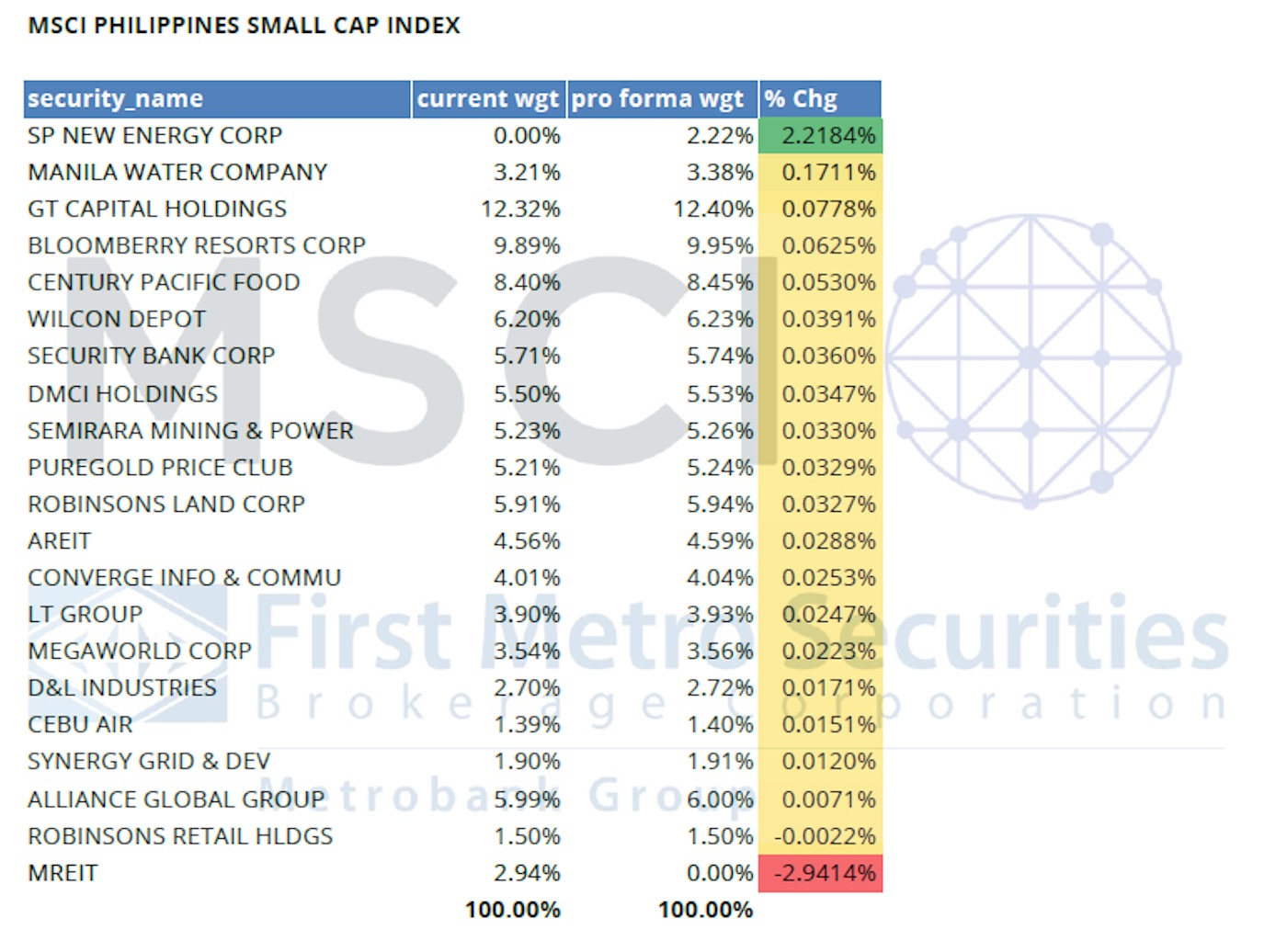

The addition of SPNEC and deletion of MREIT are the only changes in the closely watched gauge in its Feb. 29 review. Global index provider MSCI rebalances its indices semi-annually and quarterly.

The MSCI Global Small Cap Indexes revealed on Monday the changes, which will take place at the close of market on Feb. 29, 2024.

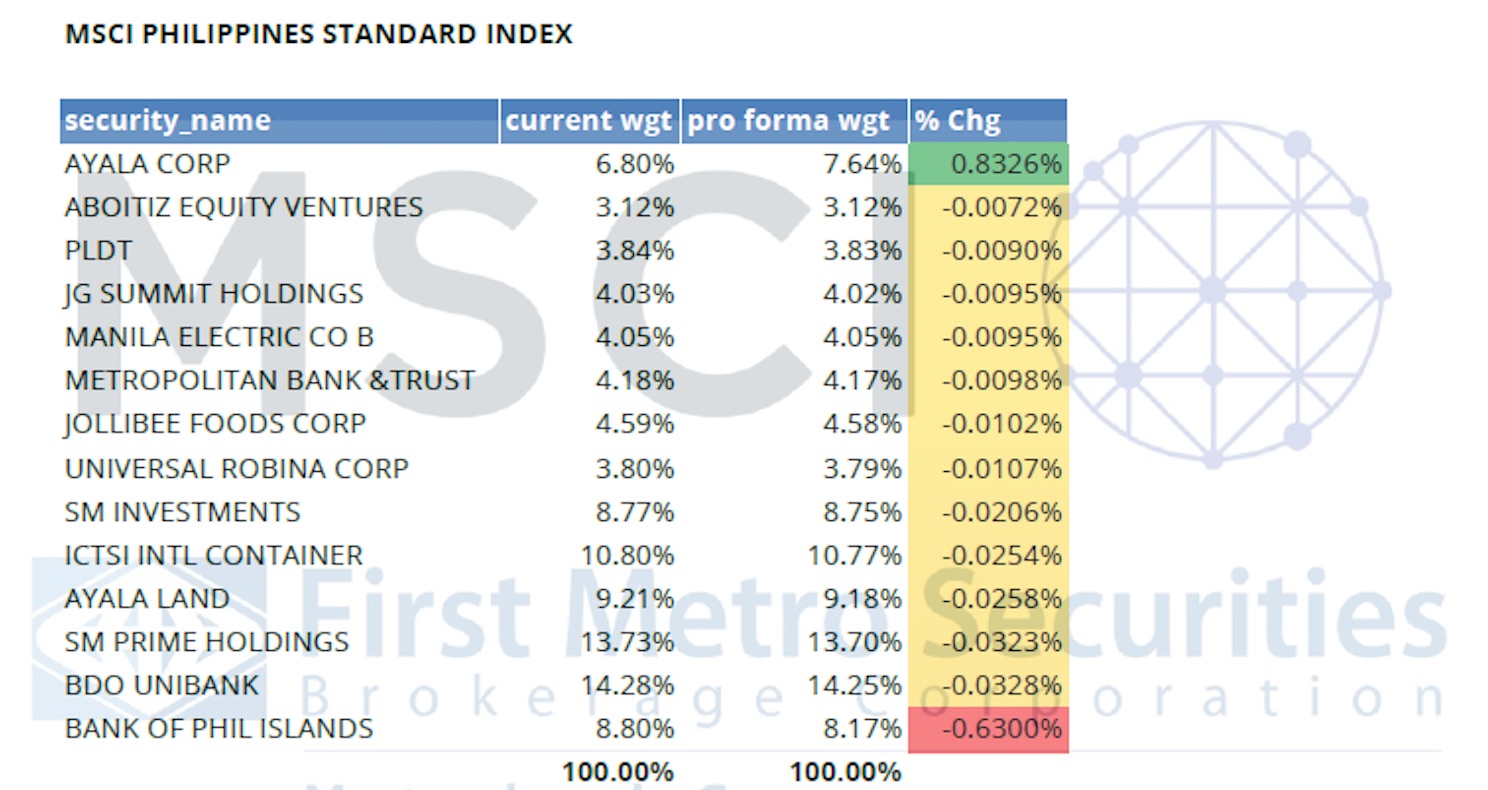

Other changes in the MSCI rebalancing involved mainly weight changes with Ayala Corporation being the only firm increasing its weight in the MSCI Philippines Standard index while its banking unit Bank of the Philippine Islands having the largest weight decrease.

For the MSCI Philippines Small Cap Index, Manila Water Company, GT Capital Holdings, and Bloomberry Resorts Corporation saw the biggest weight increases while the weight of Robinsons Retail Holdings Inc. saw a slight dip.

Amid the inclusion of SPNEC in the MSCI Philippines Small Cap Index, investors gobbled the stock, with shares rising by 6.03 percent as of mid-day Feb. 13. It closed at P1.16 per share on Monday and the positive development for SNPEC is expected to further stimulate interest in the stock.

New York-listed MSCI has helped global investors build and manage portfolios using its research-based tools and insights on risks and performance.

SPNEC has recently been acquired by the Pangilinan Group, through MGen Renewable Energy Inc. (MGreen), a wholly-owned subsidiary of Meralco Powergen Corporation.

Just recently, MGreen raised its stake in the company, acquiring 2.17 billion shares of SPNEC from Solar Philippines Power Project Holdings Inc. for P2.50 billion, representing 4.34 percent of its outstanding capital.

The latest acquisition raises MGreen and its affiliates' stake in SPNEC to 55.96 percent from 50.53 percent previously.

Prior to this, the Pangilinan-led company bought for P15.9 billion a total of 15.70 billion common shares of SPNEC, representing 31.4 percent of the company's total outstanding common shares, as well as 19.40 billion preferred shares, resulting in MGreen and affiliates' 50.53 percent stake.

In May last year, Metro Pacific Investments Corp. (MPIC), an affiliate of MGreen made an initial purchase from Solar Philippines of 1.60 billion shares of SPNEC for P2 billion.

MGreen is a wholly-owned subsidiary of Meralco Powergen Corp., which in turn is a wholly-owned subsidiary of Meralco, the country's largest power distributor whose parent firm is MPIC.

As a result of the entry of the Pangilinan Group, SPNEC elected tycoon Manuel V. Pangilinan as its chairman while Leviste is vice chairman.

Prior to the change in ownership, SPNEC was majority-owned by Solar Philippines, founded by young businessman Leandro Leviste. Solar Philippines continues to own 18.993 billion shares of SPNEC, with other shareholders and the public owning the remaining shares.

SPNEC is touted to be developing the world's biggest solar project through 100 percent-owned subsidiary Terra Solar Philippines Inc., which is targeted for completion by 2027.

The P200-billion Terra solar development in Nueva Ecija and Bulacan which will consist of 3,500 megawatts (MW) of solar panels and 4,000 megawatt-hours of battery storage, would be completed in two phases.

The first phase is eyed for completion by 2026 with a target capacity of 2,500 MW. On the other hand, the second phase is targeted to be finished by 2027. It has a target capacity of 1,000 MW.