Elevated office vacancy rate to continue – report

Elevated office space vacancy rate in Metro Manila is expected to continue, although marginally, this year due to new completions and surrenders from non-renewals of pre-pandemic leases, according to the latest report by a real estate management services firm.

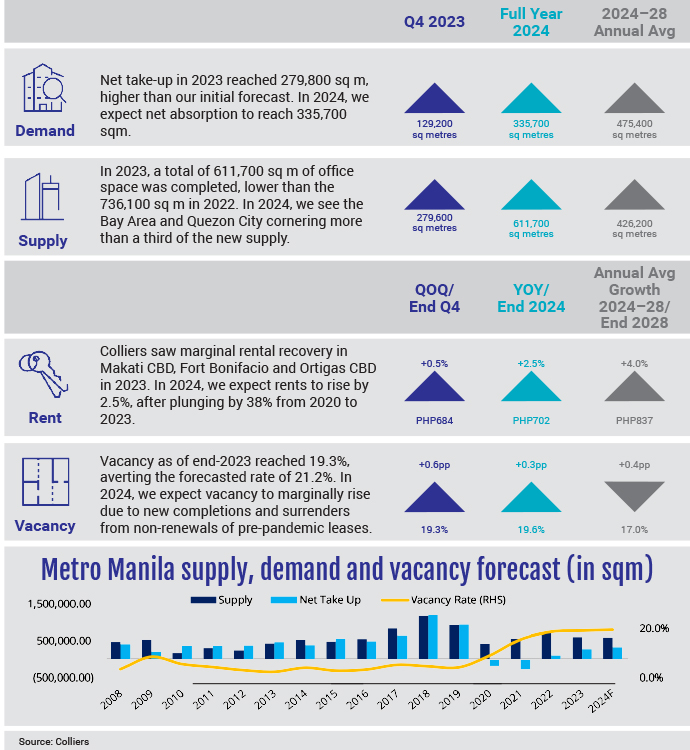

Colliers, in a report released Monday, Feb. 12, said that vacancy as of end-2023 reached 19.3 percent, averting the forecasted rate of 21.2 percent as absorption was higher at 279,800 sqm. But in 2024, the report said, “We expect vacancy to marginally rise due to new completions and surrenders from non-renewals of pre-pandemic leases.”

While vacancy is mainly driven by expansion of notable providers such as KMC Solutions and Regus, Colliers stressed that the projected more than 20 percent vacancy rate still remains to be an improvement from the 40 percent vacancy posted in 2020, at the peak of Covid disruptions.

In 2023, Colliers said a total of 611,700 square meter (sqm) of office space was completed, lower than the 736,100 sqm m in 2022. Of this figure, Colliers said the Bay Area and Quezon City are expected to corner more than a third of the new supply this year.

Overall absorption this year is also expected to reach 335,700 sqm with marginal rental recovery in Makati CBD, Fort Bonifacio and Ortigas CBD in 2023.

Despite higher supply, the report also cited of improvement in demand that could translate to increase in rents by 2.5 percent, after plunging by 38 percent from 2020 to 2023.

Demand in office space would be driven by the projected 50 percent expansions of firms and 10 percent increase from new entrants. Colliers already noted of deals from traditional and outsourcing firms implementing a mix of flight-to-quality and flight-to-cost measures.

Some notable industry profiles of flexible workspace users are contact centers, multinational companies, software development firms as well as shipping, start-up and fintech firms.

The report recommends that occupiers look for new and high-quality workspaces especially in major business districts such as Makati CBD, Fort Bonifacio and Ortigas CBD that provide tenants with flexible workspace options.

For occupiers considering opening provincial microsites for their employees, Colliers recommends that they partner with serviced office providers. With the continued clamor for hybrid work arrangements, Colliers encourages landlords to offer non-traditional leases (i.e. flexible workspace scheme) in their office buildings to capture this demand. Landlords may also look into joint venture agreements with serviced office providers.

“The office market has demonstrated remarkable resilience as it avoided reaching a vacancy of 20%. To maintain its upward trajectory, emphasis must be placed on nurturing the growth drivers, particularly the education and upskilling of the labor force amidst technological advancement. As we forge ahead, the clarity and stability of regulatory framework and business environment remain critical in dictating the pace of office market‘s rebound moving forward.”

As part of its recommendations, Colliers encourages occupiers to continue taking advantage of the current market conditions and investing in modern workspaces for the benefit of their employees. With sustainability now becoming a minimum requirement, it said “Landlords are encouraged to incorporate green features and secure certifications in both existing and future developments. Some landlords with presence in betterperformingsubmarketsmayconsiderbuildingmorequalityandgreenspacestocapture future demand.”

In 2023, Colliers recorded 327,100 sqm of office space transacted in green buildings with LEED1, EDGE2, WELL3 and BERDE4 certifications or pre-certifications. The transacted office space was 36 percent higher compared to 240,000 sqm transacted in 2022.

Given the heightened importance of sustainability in occupiers’ office requirements, landlords are encouraged to incorporate green features into their portfolio. This may be done through retrofitting, shifting to renewable or clean energy and implementing efficient water systems as well as securing certifications to ensure baseline standards are met.

Lastly, Colliers urged occupiers to exercise flight-to-value strategy. Based on Colliers’ Q4 2023 data, 40 percent of transactions were driven by relocations. Out of these relocations, 60 percent implemented flight-to quality/value strategies.