Rizal Commercial Banking Corporation’s (RCBC) Executive Vice President and Chief Innovations and Inclusion Officer Lito Villanueva, stressed the importance of adapting Artificial Intelligence technologies and strengthening public-private task forces to accelerate the fight versus fraud and scams during a dialogue held at the GSMA Digital Nation Summit Manila at Shangri-La The Fort.

GSMA research reveals that 29 percent of Filipino consumers have fallen victim to financial crimes like identity theft and security breaches. Similarly, the Digital Nations report shows a 4,500 percent surge in deepfake cases in the Philippines.

The fintech visionary bannered RCBC’s use of AI to elevate the bank’s overall productivity, customer engagement, and management of risks. The emergent innovative technology is taking not only the developed world by storm, but even developing countries such as the Philippines. Villanueva shared that the country’s leading digital challenger bank continues to prioritize upskilling of all its top officers in the field of AI.

“In fraud detection, AI's use of anomaly detection and behavioral biometrics has increased accuracy rates to as much as 85 percent. To bolster these efforts, under the leadership of our President and CEO Eugene S. Acevedo, we’ve prioritized upskilling—ensuring all senior officers undergo AI certification to strengthen expertise and align with our vision of building a workforce adept in data science and AI,” Villanueva said.

Aside from AI-powered initiatives, Villanueva also said that the bank is committed to contributing to collaborative initiatives with other private sector players, members of civil society, and the Philippine government to address the rise of fraud and empower ordinary citizens.

“Our collaboration with industry players and government agencies through Fintech Alliance.Ph has been instrumental in championing public awareness and financial literacy. Last year, we launched the “#WagMagpaLokoMagingScamAlerto” campaign. This advocacy promotes financial literacy and fraud awareness through multi-channel efforts, including social media, school partnerships, and community outreach programs,” Villanueva added.

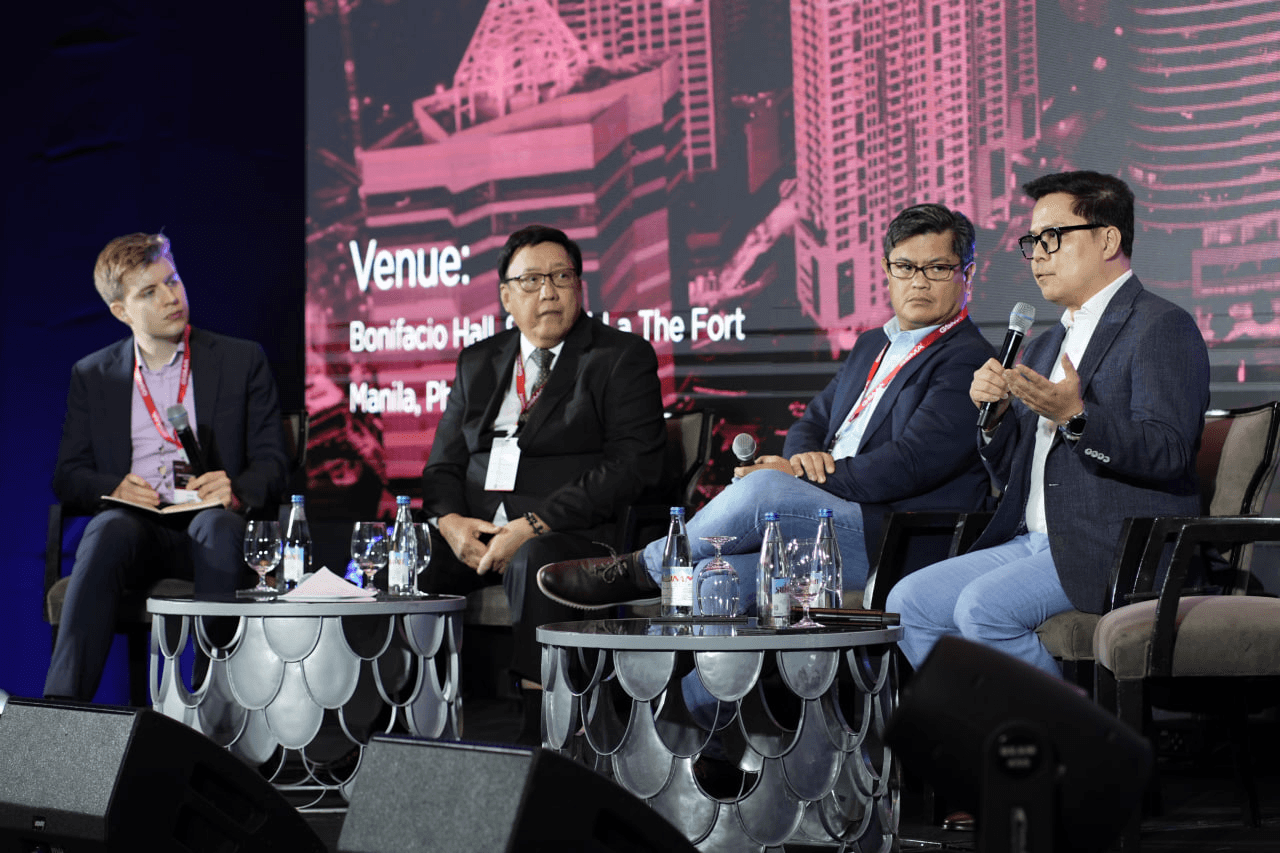

Villanueva joined other leaders such as Ret. Justice Andres Reyes Jr., a consultant of the Cybercrime investigation and Coordinating Center, and Mr. John Gonzales, President and CEO, PLDT ClarkTel, and FVP of Strategic Business Development for PLDT Enterprise in a panel discussion entitled “United Against Scams: Technological Solutions and Partnerships” moderated by Ewan Lusty, Director at Flint Global.

The one-day summit gathered leaders from the Philippines’ Department of Information and Communications Technology (DICT), Globe Telecom, Smart Communications, Meta, the Asian Development Bank, and RCBC to discuss the critical role of technology and collaboration in safeguarding consumers and sustaining trust in digital platforms.