The Securities and Exchange Commission (SEC) is warning the public against two more firms that are not authorized to solicit investments as they do not have the necessary license.

In separate advisories, the SEC named that two firms as Dermacare-Beyond Skin Care Solutions, Beyond Skincare Solutions, or Beyond Skin Care Ventures Inc. and Mono Mall.

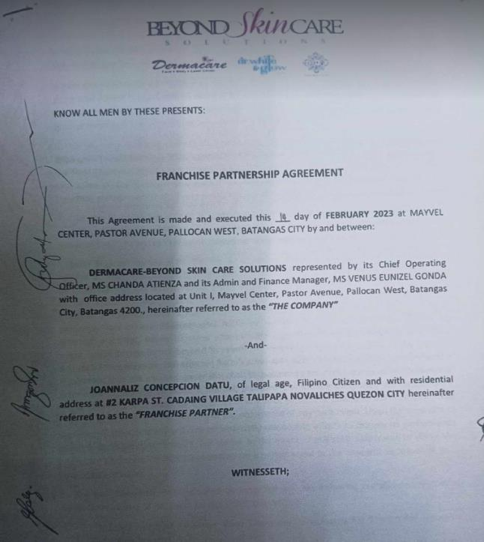

The commission said Beyond Skincare entices the public to invest in its business scheme through a "Franchise Partner Agreement” amounting to P250,000.

The said franchise offers prospective investors a guaranteed return of 12.6 percent quarterly interest for five years, along with other complimentary services.

“The public is hereby informed that Dermacare-Beyond Skin Care Solutions or Beyond Skincare Solutions or Beyond Skin Care Ventures Inc. is not authorized to solicit investments from the public, not having secured prior registration and license to sell securities or solicit investments as prescribed under Section 8 of the Securities Regulation Code (SRC),” said the SEC.

It added that, the “Financial Products and Services Consumer Protection Act” (FCPA) also prohibits investment fraud which is defined under the law as “any form of deceptive solicitation of investments from the public which includes Ponzi Schemes and such other schemes involving the promise or offer of profits or returns sourced from the investments or contribution made by the investors themselves and the offering or selling of investment schemes to the public without a license or permit from the SEC.”

“In view thereof, the public is hereby advised to exercise caution in dealing with any individual or group of persons soliciting investments for and on behalf of Dermacare-Beyond Skin Care Solutions, Beyond Skincare Solutions, or Beyond Skin Care Ventures Inc. and not to invest or to stop investing in the investment scheme being offered by the subject entities or its representatives,” said the SEC.

Meanwhile, the SEC said Mono Mall “posts a fake SEC registration certificate online as a means to entice the public to invest in their business scheme.”

Mono Mall claims that it can help merchants increase their product sales and promote their business online by merely following a certain Tiktok user and completing "tasks." By completing the said tasks, merchants will be entitled to commissions ranging from 30 percent to 60 percent.

“At the same time, you can also participate in mall tasks distributed by the merchants to get additional commissions, and upgrade to VIP level where you can earn higher commissions,” said the SEC.

Based on information gathered by the Commission, individuals or group of persons claiming to represent Mono Mall, are enticing the public to invest in said entity.

“Their tasking and recharging scheme works by luring unsuspecting victims to participate in fake online jobs, supposedly in partnership with large e-commerce platforms such as Lazada. Here, they complete tasks such as helping complete e- commerce orders to earn commissions,” it noted.

The SEC also warned against investing in Mono Mall for possible investment fraud under the FCPA such as deceptive solicitation of investments from the public which includes Ponzi schemes and such other schemes involving the promise or offer of profits or returns sourced from the investments or contributions made by the investors themselves and the offering or selling of investment schemes to the public without a license.