The Securities and Exchange Commission (SEC) has advised the public against dealing with Sprhy Gold Investment or Sprhy Cash Paluwagan and Secret for Elimination of Rampan Poverty Worldwide (SERP Worldwide) due to their unauthorized solicitation of investments without the necessary license from the SEC.

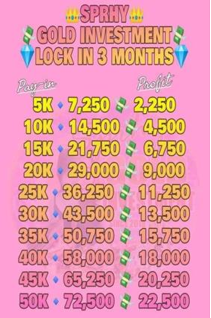

According to the SEC, Sprhy “entices the public to invest in its alleged business scheme for a minimum amount of P5,000.00 up to P500,000.00, to secure a guaranteed earning of 15 percent up to 30 percent after 30 days.”

“Based on the Commission’s database, SPRHY GOLD INVESTMENT/SPRHY CASH PALUWAGAN, is NOT REGISTERED as a corporation or partnership and OPERATES WITHOUT THE NECESSARY LICENSE AND/OR AUTHORITY to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC),” said the SEC.

Meanwhile, the SEC said SERP Worldwide entices the public to invest in its business scheme, which allegedly aims to eliminate poverty and provide lucrative earnings to its members.

To become a member, a prospective investor should avail of its SGEP10-10K Package.

This package will entitle them to earn in eight ways: through Direct Selling, Direct Sales Bonus, Pairing Sales Bonus, Reorder rebates, Uni-level sales bonus, Daily profit share, Overriding commission, and Royalty income.

An investor only needs to pay P10,000 for the said package and he can earn about 30 percent to 60 percent profit plus additional bonuses.

“Records of the Commission show that while SECRET FOR ELIMINATION OF RAMP AN POVERTY WORLDWIDE CORPORATION is registered with the Commission as a corporation, it is not authorized to solicit investments from the public as it did not secure prior registration and/or license to solicit investments from the Commission as prescribed under Section 8 and 28 of the SRC,” the SEC stressed.

The SEC also noted that both of these groups' investment schemes or actions resemble a pyramid or Ponzi scheme where investors earn through recruitment fees instead of the sale of actual products or services, and investors are paid using the contribution of new members.