SM Investments Corporation (SMIC), the Sy family’s flagship and one of the leading conglomerates in the country, continues to provide growth opportunities to its micro, small and medium enterprise (MSME) partners across its core businesses of retail, property, and banking.

In a statement, the conglomerate also known as SM Group said it recognizes the potential of MSMEs for nation-building as “every time an MSME succeeds, it helps the country’s economy.”

“With over 99 percent of business enterprises operating in the Philippines listed as micro, small, and medium enterprises, the opportunity for growth posts so much potential,” SMIC said.

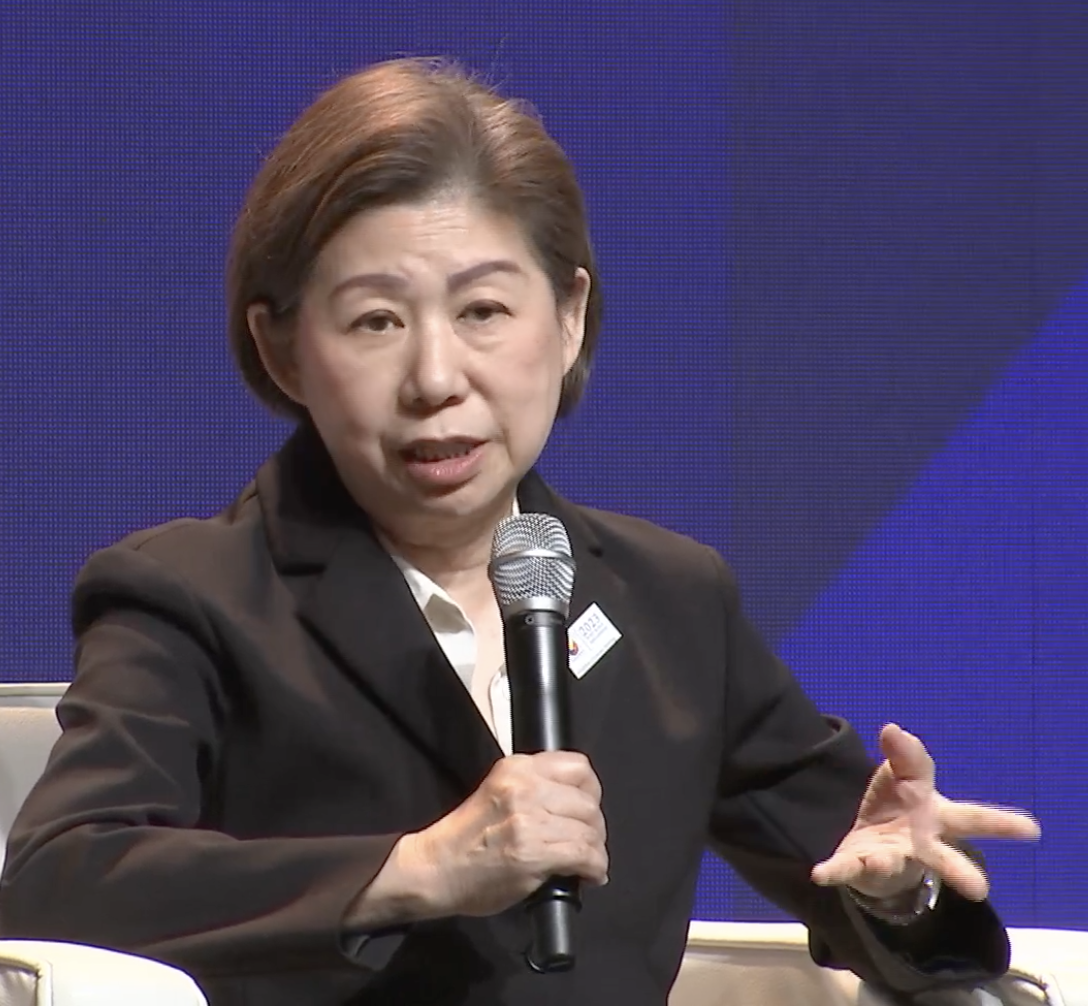

During the panel discussion at the 2023 National MSME Summit held recently, SMIC Vice Chairperson Teresita Sy-Coson noted the importance of working together when asked how MSMEs are integrated into the company.

“Starting as a small enterprise ourselves, we recognize MSMEs as a driving force for innovation. They are the ones who bring new ideas, new concepts, new offerings to the consumers. That’s why we remain committed to supporting the growth and empowerment of MSMEs,” she said.

Philippine Center for Entrepreneurship–Go Negosyo Founder Jose Ma. A. Concepcion III noted the important role of both the government and the private sector during a panel discussion at the MSME Summit.

“The integration between government and the private sector will create a faster car. Crucial to this are our big brothers in retail, agriculture, and many others. I am glad that many of our big brothers are taking an active role to embrace MSMEs into their value chain,” said Concepcion.

Among these big brothers is SM Supermalls which counts 68 percent of its tenants as belonging to the MSME sector. Additionally, SM's role as a marketplace for over 90,000 MSMEs helps its communities navigate the changing landscape of modern retailing.

In terms of financial support, SM extended additional funding to MSMEs through its banks BDO Unibank Inc. and China Banking Corporation. The two banks combined accounted for over P62 billion in outstanding loans to MSMEs in 2022.

SM StartUp Market, one of SM’s MSME support initiatives recently launched its second batch of new businesses that joined the program in SM City Fairview earlier this year.

The first batch of these budding enterprises launched in October 2021 to help online businesses set up their first physical stores. The package comes with start-up-friendly rates and the use of kiosks or carts free of charge.