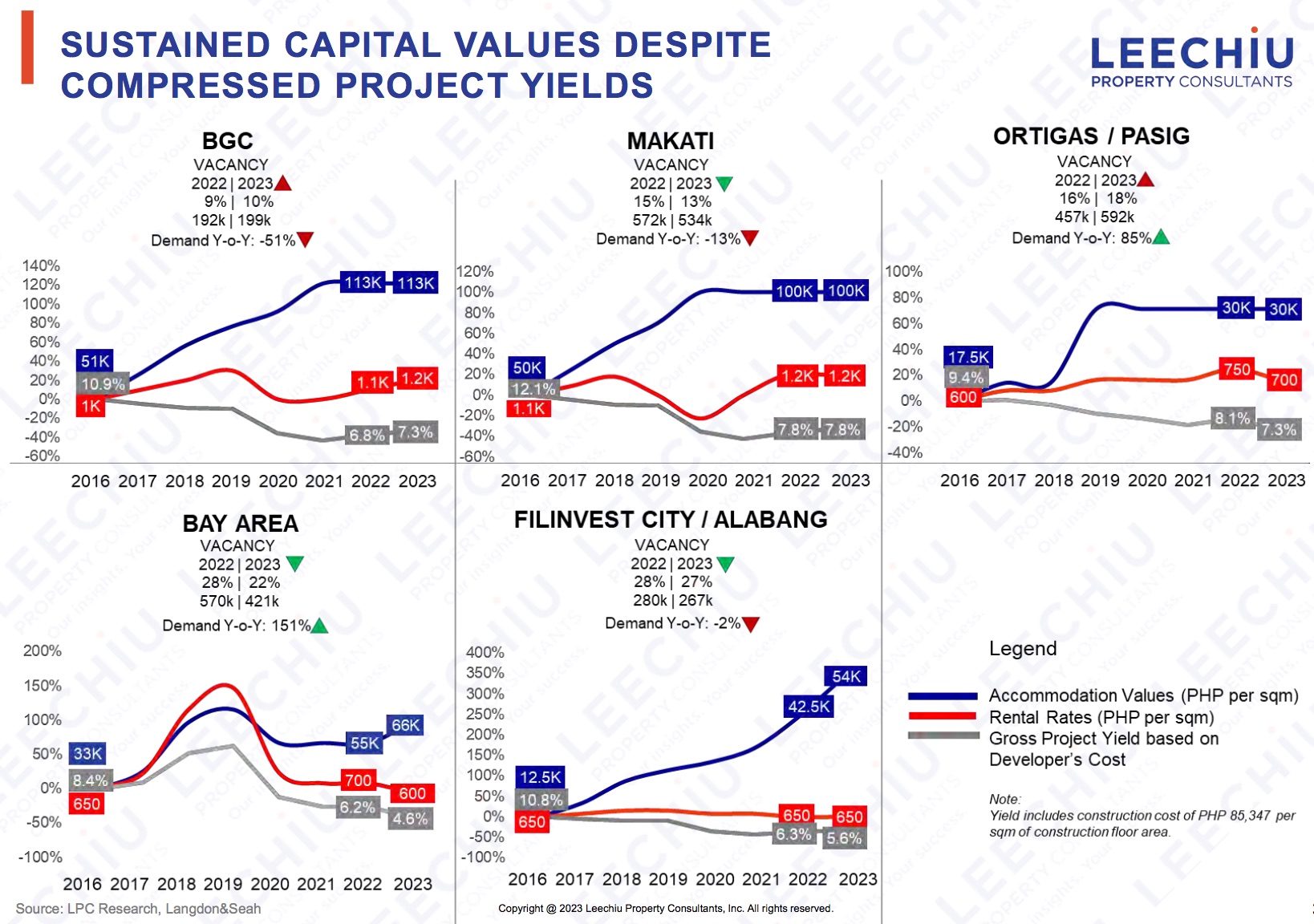

The property market proved its resilience as capital values across Metro Manila’s commercial districts sustained their levels throughout 2023 despite local and global headwinds.

In a media presentation, Leechiu Property Consultants Inc. Senior Manager for Investment Sales Erika Manasan said some landmark deals in 2023 include a P1 million per square meter commercial lot in Legazpi Village, Makati and another commercial lot at the center of Makati transacting at over P1.5 million per square meter.

In the Bay Area, a commercial lot traded hands at P400,000 per square meter while Filinvest City cements itself as the main CBD in the south, posting a 15 percent year-on-year increase in transaction values.

Despite these landmark deals, transaction volumes are still thin as investor outlook remains cautious on the back of the 100-basis point increase in Bangko Sentral ng Pilipinas key policy rates this year from 5.5 percent to 6.5 percent.

“Should the anticipated interest rate cuts materialize in 2024, we may see improvement in transaction volumes,” said Manasan.

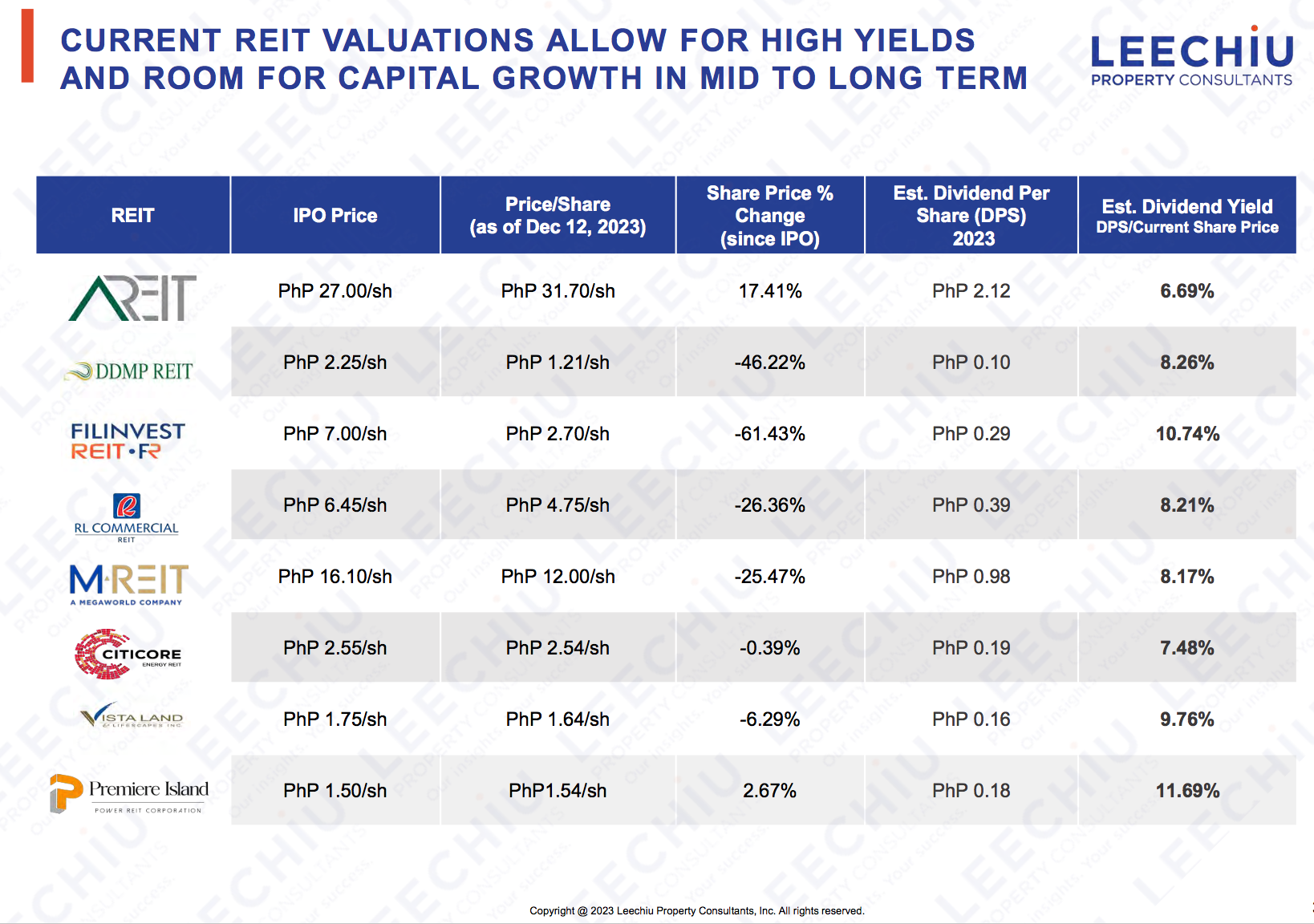

Meanwhile, she said Philippine property real estate investment trusts (REITs) have grown total portfolio coverage to an impressive 2.43 million sqm since the first local REIT launched in 2021.

The REITs continue to grow their portfolios despite valuation compression due to the high interest rate market.

For investors, however, REITs are viewed as an attractive investment alternative with its significantly higher yields than traditional real estate assets.

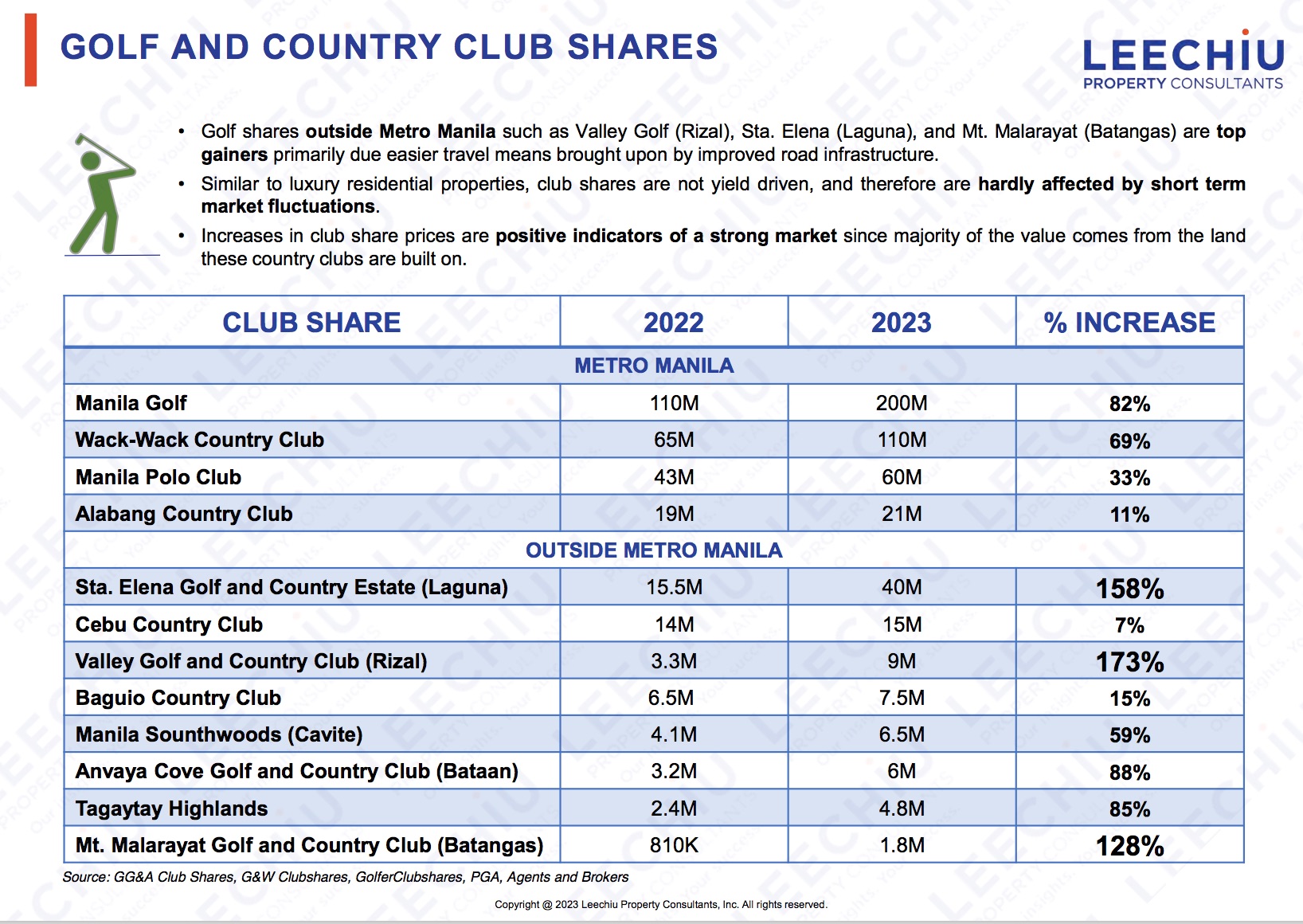

On the other hand, share prices in golf and country clubs outside Metro Manila showed high double to triple-digit growth in 2023, propelled by improved road infrastructure.

Valley Golf and Country Club in Rizal emerges as the standout performer outside Metro Manila, growing by 173 percent, while Manila Golf takes the spotlight in Metro Manila with a substantial 82 percent increase.