The Securities and Exchange Commission (SEC) exempted the Philippine Stock Exchange (PSE) from the 20 percent cap of ownership so it can acquire full ownership of the Philippine Dealing System Holdings Corporation (PDS Group).

In a statement, the SEC said it has approved the application of the PSE for exemptive relief in its acquisition of additional shares in PDS.

In a meeting on Dec. 19, the Commission En Banc has allowed the PSE to exceed the mandatory limit of 20 percent on ownership and voting rights in an exchange by an individual or an industry, granting it leeway to own up to 100 percent of the PDS Group, subject to certain conditions.

The Commission En Banc also approved the transfer of the shares of stock of an exchange controller, in order to allow the PSE to acquire PDS shares currently held by other PDS shareholders.

In light of the approval, the Commission En Banc directed PSE to submit the status of its negotiation on its acquisition of additional PDS shares every two months, including share offer price, among others.

The PSE must also submit its operational and developmental plans and timeline in relation to the fixed income market.

In addition, the PSE has been directed to submit regular updates, including updates on timelines of concrete plans, on its commitments, such as reduction in fees, valuation, enhancements of systems, and launch of new products every three months following the acquisition.

Currently, the PSE owns 20.98 percent of the issued and outstanding capital stock of the PDS Group. The stock exchange intends to acquire up to 100 percent of the operator of the country’s sole fixed-income exchange.

Under Section 33.2(c) of Republic Act No. 8799, or The Securities Regulation Code (SRC), no person may beneficially own or control, directly or indirectly, more than five percent 5 percent of the voting rights of the exchange and no industry or business group may beneficially own or control, directly or indirectly, more than 20 percent of the voting rights of the exchange.

The SEC, however, may adopt rules, regulations or issue an order, upon application, exempting an applicant from the ownership limit if such ownership or control will not negatively impact on the exchange’s ability to effectively operate in the public interest.

Meanwhile, Section 33.2(c).3 of the SRC provides that no shares of stock of an exchange or exchange controller may be transferred without prior approval from the SEC.

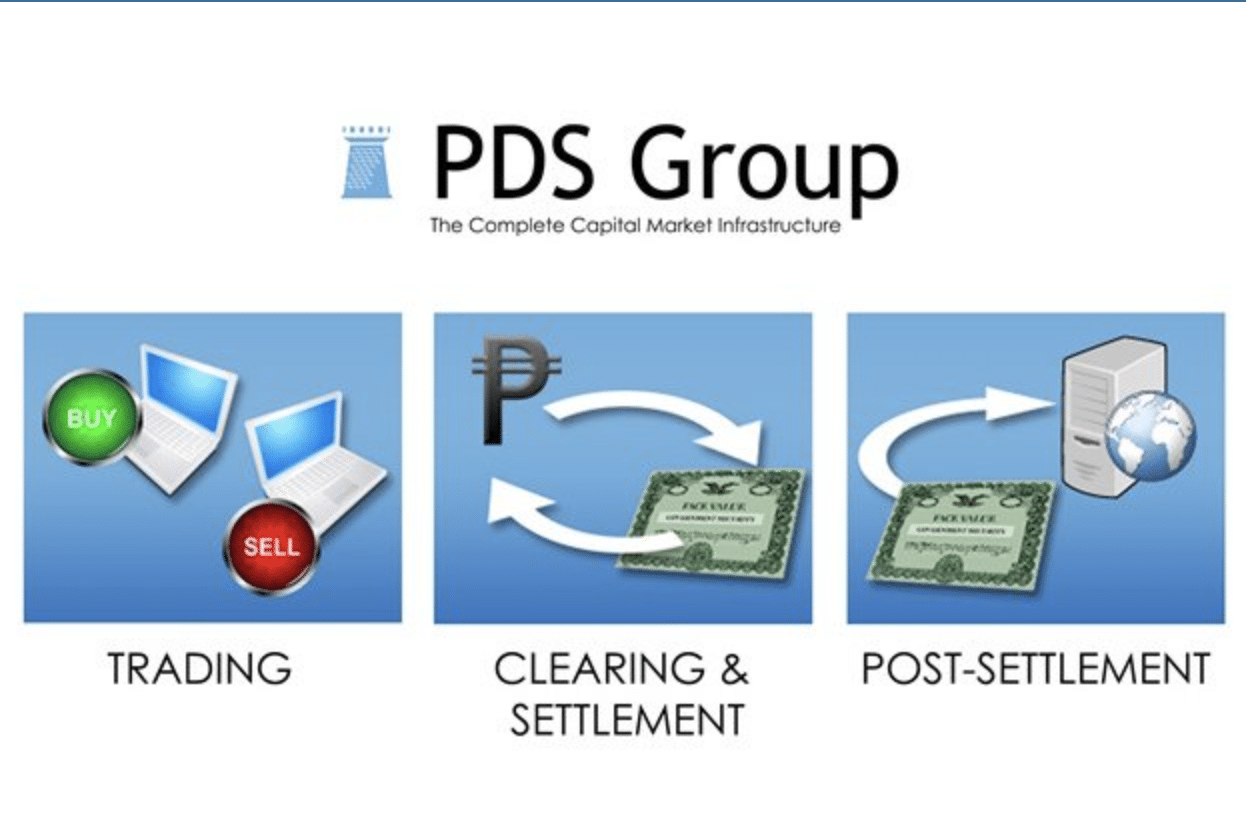

The PDS Group includes the Philippine Dealing & Exchange Corp. (PDEx). Incorporated in 2003, PDEx operates the organized secondary market for the trading of fixed-income securities issued by corporations, as well as the government.

PDEx also calculates the Philippine Dealing System Treasury Reference Rates, which form the basis for valuing and marking-to-market interest rate-sensitive instruments.

In its initial submissions to the Commission, the PSE committed to ensuring that the acquisition will operate in the public interest, as the resulting integration of the country’s equity and fixed-income exchanges would allow for the delivery of more efficient and more types of products, services and better risk management systems for financial services.

The SEC directed PSE to submit and present a detailed, concrete and time-bound operational plan, which shall be subject to a separate review and approval by the Commission to ensure that the proposed integration of PSE and the PDS Group will lead to greater access to both fixed-income and equity products for retail investors, reduced cost of trading securities, and similar efficiencies and benefits for issuers and other market participants.