PSE lifts SPNEC trading suspension

SPNEC plans to raise public float further in anticipation of entry of Meralco as majority shareholder

The Philippine Stock Exchange (PSE) has lifted the suspension on the trading of the shares of SP New Energy Corporation (SPNEC) on Friday, Dec. 1, after the firm reported that its public float has been raised to 20.02 percent to meet the minimum public ownership requirement of 20 percent.

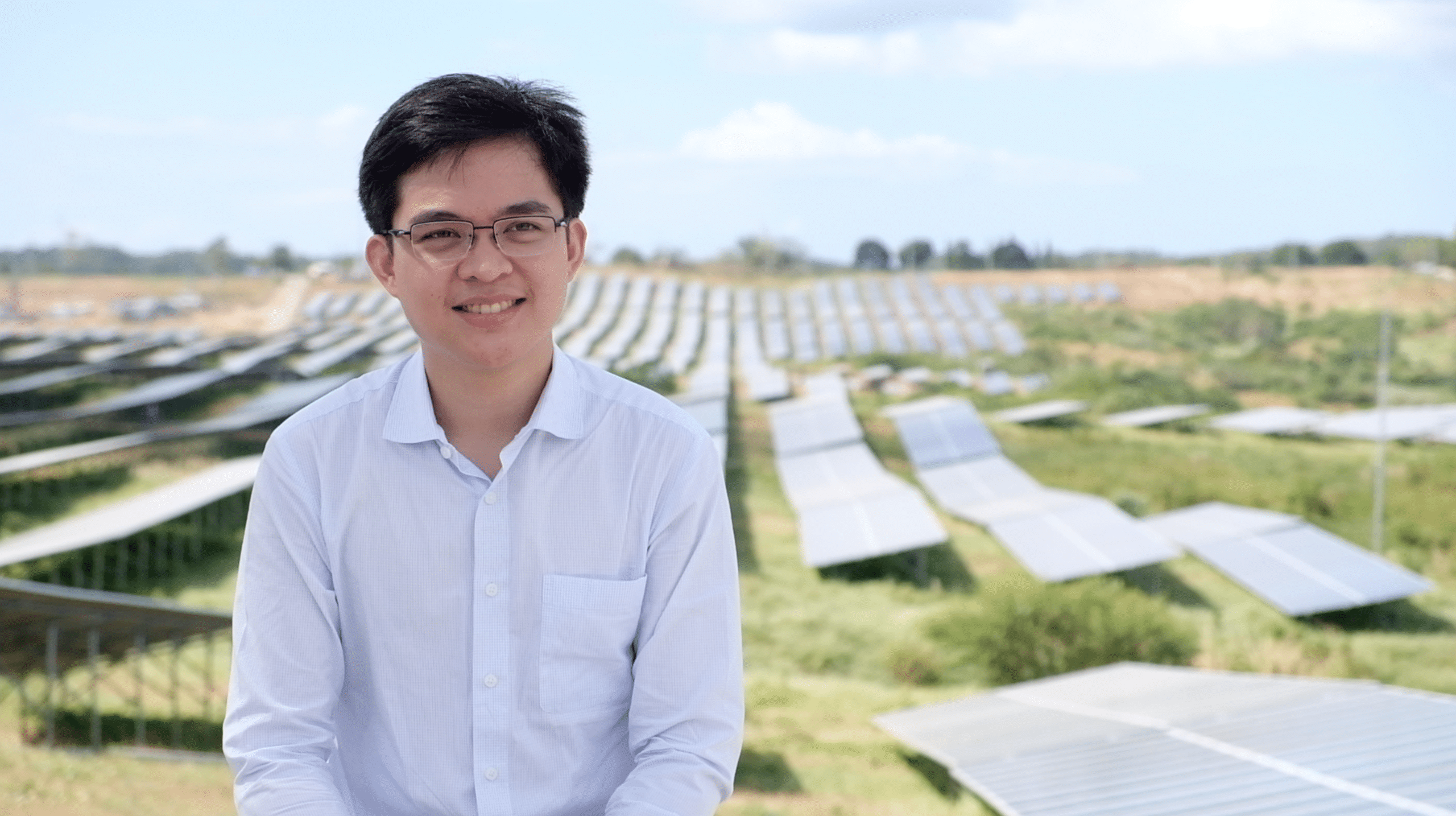

The public now owns 6.88 billion SPNEC shares with non-public shares amounting to 27.49 billion shares. Substantial shareholders are Leandro Leviste’s Solar Philippines Power Project Holdings Inc. (69.79 percent) and Metro Pacific Investments Corporation (4.65 percent).

SPNEC’s public ownership fell below 20 percent after the approval of its increase in authorized capital stock from 10 billion to 50 billion shares, to support the expansion of its project portfolio.

Meanwhile, Manila Electric Company’s subsidiary MGen Renewable Energy Inc. (MGreen) and SP New Energy Corporation (SPNEC) have signed a Subscription Agreement on Nov. 30, 2023 for a total investment of P15.9 billion.

SPNEC received from MGreen an initial payment of P7 billion on Nov. 30, 2023, with the balance payment of P8.9 billion to be paid by the closing date.

Upon closing, MGreen will own 15.7 billion common shares and 19.4 billion preferred shares of SPNEC, translating to a total voting interest of 50.5 percent.

MGreen is the renewable energy development arm of Meralco Powergen Corporation, a wholly-owned subsidiary of Meralco, the country’s largest private sector electric distribution utility company.

MGreen and Solar Philippines have agreed to use SPNEC as the primary vehicle to develop 3500 MW of solar and 4000 MWh of battery storage in Luzon.

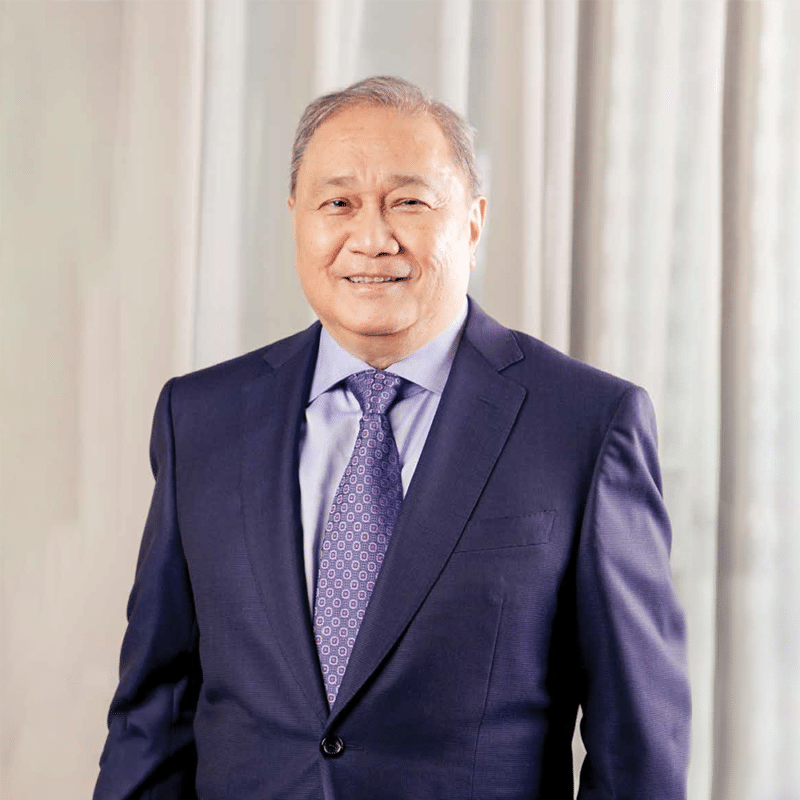

“This will be one of the largest solar projects not just in Asia, but in the world,” said Meralco Chairman and CEO Manuel V. Pangilinan.

He noted that, “the Department of Energy’s vision is to have about 35percent of the country’s energy come from renewable energy, and this is one of Meralco’s major contributions to this goal.”

UBS acted as financial advisor for MGreen's investment in SPNEC. SyCip Salazar Hernandez and Gatmaitan and Gulapa Law acted as legal advisors to both Meralco and MGreen. King & Spalding and Picazo Law acted as legal advisors to SPH and SPNEC.

Meanwhile, to ensure it remains compliant to the minimum public owernship rules, SPNEC said it is planning several measures with SPH to increase the public ownership of its shares, including a follow-on offering and private placements.

SPNEC disclosed that it is having discussions with investors, its advisors and potential underwriters for these potential transactions.