The Securities and Exchange Commission (SEC) has advised the public against dealing with Hoperices Investment and 99 Dragons PH due to their unauthorized solicitation of investments without the necessary license from the Commission.

In an advisory, the SEC said Hoperices claims that it is an agriculture-sharing and entrepreneurship online platform launched by Liberty Group Limited in the US.

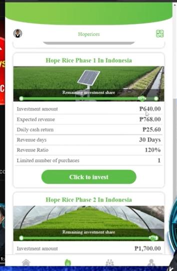

It entices the public to invest in its two investment packages, where prospective investors may earn a 20 percent to 50 percent return on investment for P640 and P1,700 investment amounts, respectively.

“Hoperices Investment’ so-called online investment packages being offered to the public constitutes an offering of securities in the form of an investment contract which is clearly under the Commission’s regulatory power,” noted the SEC.

It added that, “its activities involving the offer and sale of securities to the public where their investors need not exert any effort other than to invest or place money in its scheme in order to earn profit should be registered with the Commission.”

The SEC said Hoperices is not registered with the Commission as a corporation or partnership and it is not authorized to solicit investment/placements from the public nor to issue investment contracts and other forms of securities since it has not secured prior registration or license from the Commission.

On the other hand, 99Dragons solicits investments from the public, which it claims to be managed by professional traders and asset managers.

Accordingly, prospective investors are guaranteed 125 percent up to 200 percent profit from a minimum amount of P1,000 up to P1 million within 10 to 30 days, respectively.

“The public is made aware that, an ‘investment contract,’ which is a kind of security, exists when there is an investment or placement of money in a common enterprise with a reasonable expectation of profits to be derived primarily from the efforts of others which is prominent in the scheme of 99 Dragons PH,” said the SEC.

It pointed out that, “as such, the SRC requires that securities must be first registered with this Commission before it can be offered or sold to the public and that the concerned entity or its agents should have the appropriate registration or license to offer or sell such securities to the public.”

Based on the Commission’s database, 99 Dragons is not registered as a corporation or partnership and operates without the necessary license or authority to solicit, accept or take investments/placements from the public nor to issue investment contracts and other forms of securities defined under Section 3 of the Securities Regulation Code (SRC).

“Some of these groups' investment schemes or actions resemble a pyramid/Ponzi scheme, where investors earn through recruitment fees instead of the sale of actual products/services, and investors are paid using the contribution of new members,” said the SEC.

It added that, “the Commission remains unwavering in its efforts to stamp out illegal investment-taking activities through financial literacy campaigns and advisories to the public.”