On-site work prompts rise of office, residential spaces in 2024 – Colliers

Professional services and investment management company Colliers projected that office and residential properties will continue to expand and multiply by 2024 as on-site work gradually resumes due to the decreasing impact of the Covid-19 pandemic in the National Capital Region (NCR).

Delivering his report in the third quarter Philippine Property Market Briefing at the Insular Life Building in Makati Central Business District (CBD), Director of Research at Colliers Research Director Joey Bondoc said "local employees gradually returning to on-site work contribute to improved leasing especially in major business districts including Makati CBD, Ortigas Center, and Fort Bonifacio.”

The firm projects a 3.2 percent increase in rents by the end of 2023 as residential leasing continues to improve in the CBDs.

Despite only being able to complete two projects in the third quarter, namely 490 condominium units at Alveo's Cerca Viento Tower 1 in Alabang and Federal Land's Palm Beach Villas Siargao within the Metro Park, delivery of new residential spaces is expected to ramp up to 9,620 new units in 2024, with nearly 70 percent of those new spaces located in the Bay Area.

Around 19,100 condominium units that have been occupied in Metro Manila during the pre-selling stage in the first nine months of the year were from the lower and upper mid-income segments (P3.2 million to P12 million), which is 73 percent of the total condo units sold for the period.

With further reduced interest rates and mortgage rates, the firm said pre-selling demand may rise.

In the third quarter, residential vacancy slightly dipped by 0.1 percent from 17.2 to 17.1 percent due to "improvement in residential leasing in major business hubs." Leasing demand continues to be driven by returning expatriates who are looking for bigger units near offices and international schools, said the firm.

Rents and prices also increased to 1.2 percent in the third quarter from 0.7 percent.

"Colliers retains its earlier forecast that rents and prices will continue to improve for the remainder of 2023 but the substantial completion of new condominium units in 2024 is likely to exert a downward pressure on rents and prices next year. With substantial ready for occupancy (RFO) units, developers are likely to remain cautious with their new project launches in 2024, aside from rising prices of construction materials and land values,” it said.

Colliers also suggests developers to partake in the rising demand for resort or leisure-oriented properties outside Metro Manila as revenge travel increases after the pandemic lockdowns. Among the developers that have leisure-centric properties outside Metro Manila include DMCI, Rockwell, Megaworld, Ayala Land, Robinsons Land, Cebu Landmasters and Damosa Land with projects located in Cebu, Davao, Bohol, Palawan and Batangas.

To develop their new residential projects, the firm advises developers to integrate "green living" in their designs of living spaces, and add "green features and amenities like occupancy sensors, LED lights, optimized air quality and provisions for solar panels and rainwater harvesting systems," as more consumers opt to choose sustainable options.

Office vacancy inches up

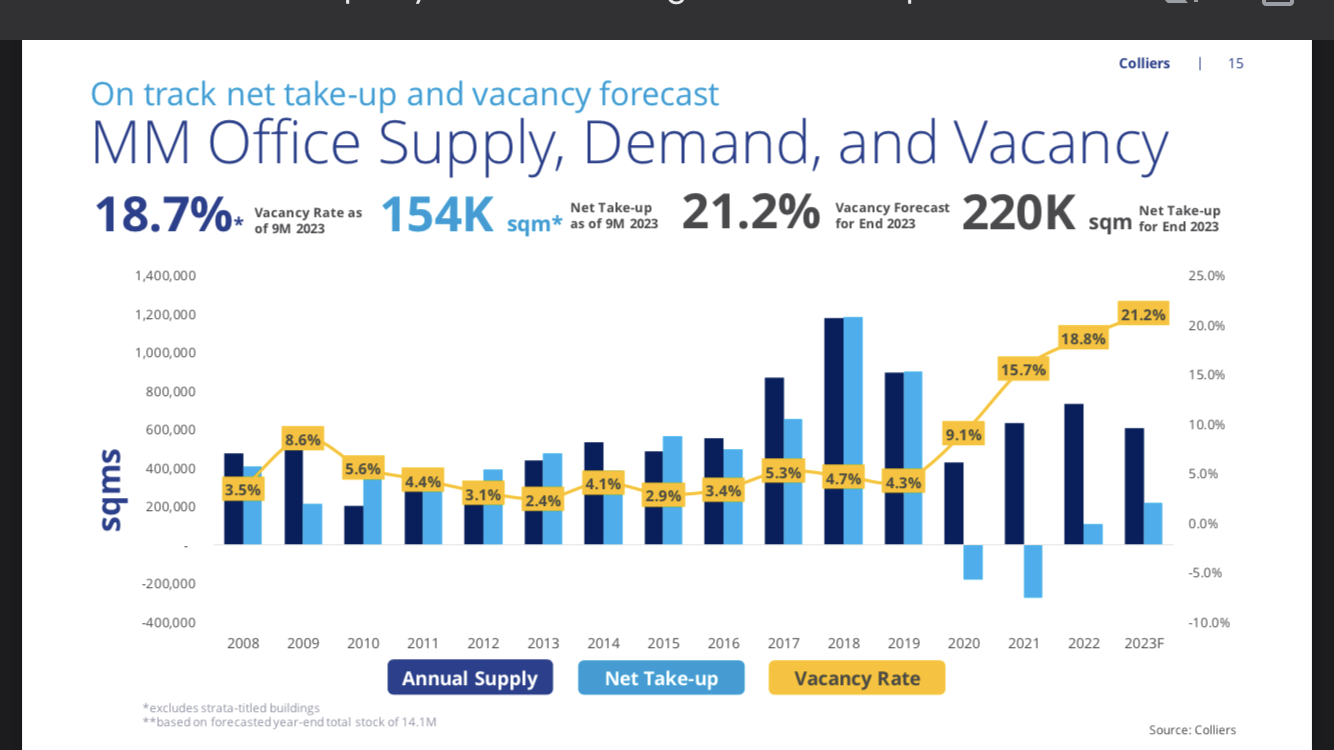

In terms of the office sector, the firm's report said there was an increase in office vacancy by 18.7 percent in the third quarter of 2023 from 18.4 percent in the same period in 2022 due to the completion of new office buildings and rise in vacated spaces.

Colliers said that "vacancy is still likely to remain elevated in 2024 as we project new supply to continue outstripping demand."

Office space that has been occupied in the first nine months of the year was 154,000 square meters, and is forecasted to reach 220,000 net absorption by the end of the year.

Notably, Colliers' survey indicated that 80 percent of occupiers still preferred using Office spaces in Philippine Economic Zone Authority (PEZA)-accredited zones, citing the ease of doing business due to PEZA's one-stop shop (OSS).

Around 202,100 square meters of new office spaces were built in the third quarter, including the Corporate Finance Plaza in Ortigas CBD, GH Tower in Others-San-Juan, SM Fairview Tower 1 and GBF 1 in Quezon City. The firm is expecting to complete a total of 607,900 square meters in the remainder of the year, which is notably lower than its initial forecast of 668,400 square meters.

New 276,400 square meters of office spaces in Fort Bonifacio and Quezon City are also expected to be completed by the fourth quarter of this year.

"From 2023 to 2025, we see the annual delivery of about 507,900 square meters. This is half of the almost one million square meters of new supply completed annually from 2017 to 2019, a period wherein office demand and supply was positively influenced by take-up from Chinese offshore gaming companies," read the report.

However, office lease rates are expected to decline further to two percent by the end of the year, despite recovery in rents in some areas such as the Fort Bonifacio and Makati CBD.

Meanwhile, office space deals increased by two percent in the third quarter, with deals from the Bay Area, Ortigas CBD, and Makati CBD garnering the most transactions, including space occupied by the Philippine Amusement and Gaming Corporation (PAGCOR) and TSA Group in the Bay Area, Bytedance in Fort Bonifacio, Gratwork in Ortigas CBD, and Singa Ship Management in Makati CBD.

Provincial deals rose three percent in the first nine months of the year, with Cebu accounting for nearly half the total deals, followed by Pampanga (22 percent) and Laguna (eight percent).

According to Kevin Jara, Associate Director of Office Services – Tenant Representation, "moving forward, we see greater opportunities for expansion in key areas outside Metro Manila as occupants maximize the second and their tier cities’ skilled talent pool and improving infrastructure network."

"Colliers encourages occupiers to continue complementing their workplace strategies with flexible workspace options," he added.

"As companies are now encouraging their employees to return-to-office, landlords have a role to play in rekindling the attractiveness of return-to-office, which can be done through tenant engagement events that promote the well-being of employees," said Colliers. It recommended the creation of events around the coming holidays and other occasions.