Marcos signs law on automatic LGU income classification

At A Glance

- Under RA 11964, municipalities shall be classified into five classes, based on their income ranges and the average annual regular income for three fiscal years preceding a general income reclassification.

- The first general income reclassification shall be made within six months after the effectivity of the law and every three years from then on.

- RA 11964 states the first income reclassification of provinces, cities, and municipalities will take effect on January 1st of the immediately succeeding year following the issuance of the table of income classification by the Finance Secretary.

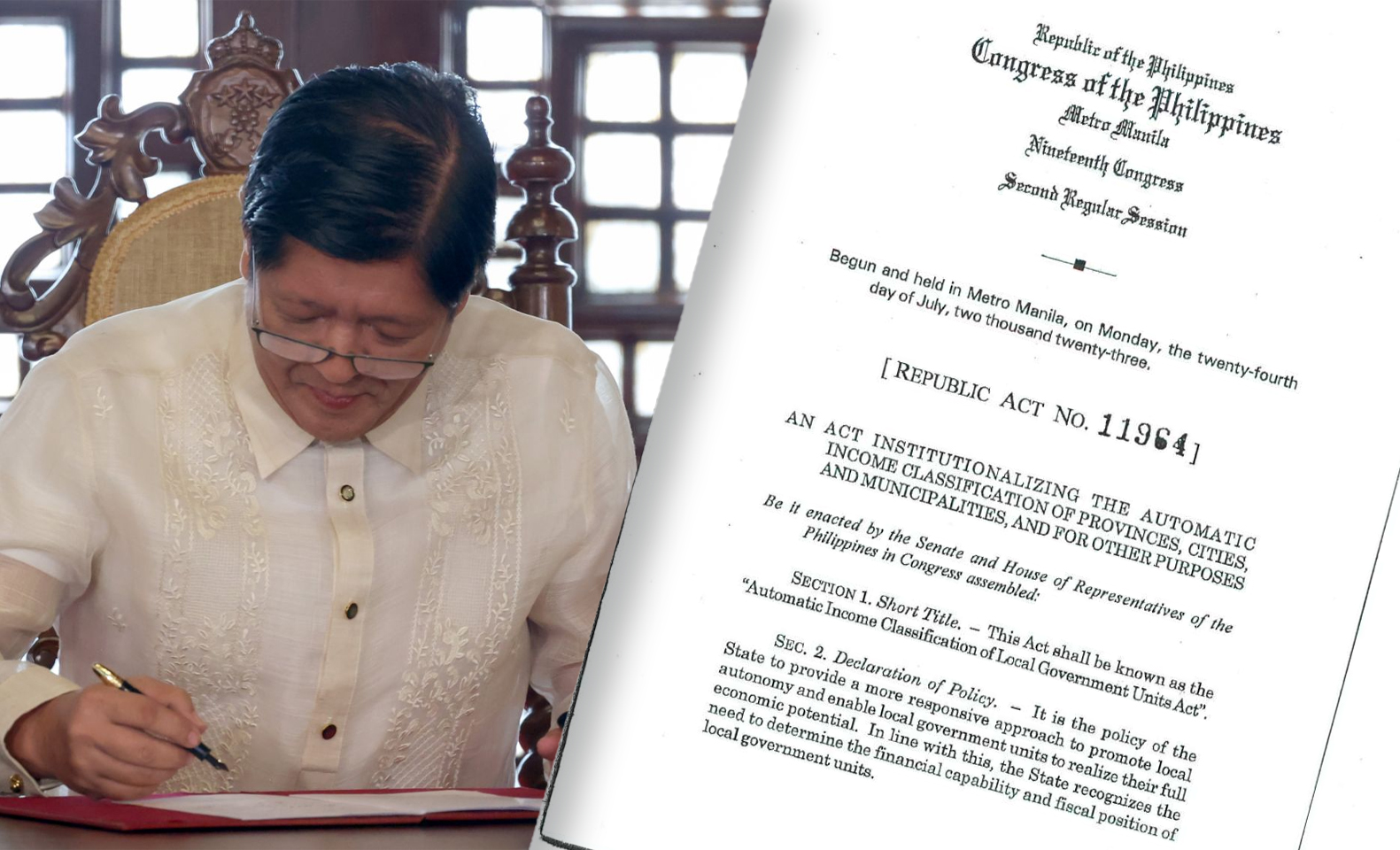

President Marcos has signed into law the measure which institutionalizes the automatic income classification of local government units (LGUs) to promote local autonomy and enable LGUs to realize their full economic potential.

Marcos signed Republic Act (RA) No. 11964, also known as the “Automatic Income Classification of Local Government Units Act," on Oct. 26, 2023. It aimed to provide LGUs with a more responsive approach to promoting local autonomy and local development.

Under RA 11964, municipalities shall be classified into five classes, based on their income ranges and the average annual regular income for three fiscal years preceding a general income reclassification.

The LGUs will be classified as the following:

- First Class: Municipalities earning an annual average income of P200,000,000

- Second Class: Municipalities earning an average annual income of P160,000,000, or more but less than P200,000,000

- Third Class: Municipalities earning P130,000,000 or more, but less than P160,000,000

- Fourth Class: Municipalities with an annual average regular income of P90,000,000 or more, but less than P130,000,000

- Fifth Class: Municipalities with an average annual income of less than P90,000,000

The Secretary of Finance, in consultation with the National Economic and Development Authority (NEDA) and the concerned LGUs League, shall have the authority to adjust the income ranges based on the actual growth rate of the annual regular income from the last income reclassification and undertake regular income reclassification once every three years so that LGU income reclassification conforms with the prevailing economic conditions.

The first general income reclassification shall be made within six months after the effectivity of the law and every three years from then on.

Based on the new law, the LGU income classification will serve as the basis for the identification of administrative and statutory aids, financial grants, and other forms of assistance to LGUs, the determination of LGU capability to undertake development programs and projects, total annual supplemental appropriation for personal services of an LGU, and compensation adjustment for LGUs personnel.

It could also serve as the basis for the creation of the new LGU, setting of the number of elective members in the Sangguniang Panlalawiagn and the Sangguniang Bayan, issuance of a free patent title to residential lands, minimum wage of domestic workers, insuring LGU properties with the Government Service Insurance System (GSIS), and for setting the limitation on the percentage of agricultural land area that can be reclassified and the manner of their utilization.

RA 11964 states the first income reclassification of provinces, cities, and municipalities will take effect on January 1st of the immediately succeeding year following the issuance of the table of income classification by the Finance Secretary.

The Department of Finance (DOF), in coordination with the Department of Budget and Management (DBM) and consultation with LGU Leagues, will craft the law’s implementing rules and regulations (IRR) within three months from its effectivity.