FROM THE MARGINS

Civil rights leader Mahatma Gandhi once said, “The best way to find yourself is to lose yourself in the service of others.” Abundia Manabes, former president of the first microinsurance mutual benefit association (mi-MBA) in the country, agrees. Her experiences with the association taught her to share her blessings with others. “My MBA taught me how to manage money wisely so I was able to help not only my family, but also my relatives by sending them to school,” she explains, adding: “Now, I am imparting these lessons to my grandchildren.”

Mi-MBAs are the leading providers of microinsurance in the Philippines. Usually affiliated with microfinance institutions (MFIs) that offer financial and other services to the poor, mi-MBAs are drivers of financial inclusion, operating in communities that are unserved or underserved by banks and insurance companies.

Empowerment is built into the mi-MBA structure. They are 100 percent member-owned, with everyone participating in the management through their elected Board of Trustees (BOT) and appointed managers. Members have a voice in policy-making and product design. They all share in the benefits of having affordable microinsurance products as safety net in times of need for members and their families.

“Poverty is not a deterrent to having insurance,” says Virginia Baldo. “Unlike bigger insurance companies, our MBA caters to class C, D, and E. That we were able to break this barrier is quite an achievement.” According to Virginia, their MBA innovates products based on members’ needs, primarily considering their capacity to pay. She explains: “As the former BOT president, I was the representative of the members and I was able to voice out our ideas and opinions on how products should be designed. We always looked for ways to help our members.”

Successful mi-MBAs ensure efficient operations through MBA coordinators – elected members who serve as channels of information dissemination. They coordinate with center chiefs and branch/unit managers in validating microinsurance claims and preparing reports. coordinators visit at least six centers a month to assess their situation and help resolve problems. They also perform underwriting functions and monitor membership status. They ensure timely settlement of claims and high-quality feedback mechanism.

May Dawat, former CEO of Abundia’s mi-MBA, believes that coordinators play a major role in the effective and efficient running of the association. “They know the exact needs and concerns of their co-members,” she says, so “having them as leaders ensure better governance.” They are the ones tapped to help and mobilize members during calamities and emergencies. Not surprisingly, most coordinators eventually get elected as BOT members.

Virginia says joining the MBA has taught her selflessness. “In the MBA, I learned to help others without expecting anything in return. After tragic events and catastrophes that left our members without livelihood while in the evacuation centers, I appreciated the chance to help others through our relief operations,” she says, adding, “we did an assessment of affected members right away to provide immediate help. Grocery items and medicines were given to members, while the staff processed microinsurance claims as fast as possible.”

Mylin Mapalad-Chozas from Sta Cruz, Marinduque shared a similar experience. She was a center chief for almost eight years before she became an MBA coordinator. It was very challenging because of the Covid-19 pandemic.

“Mahirap noon, kasi almusal ko na ang makakita ng patay sa umaga (It was a difficult time; every morning, I encountered death for breakfast),” she lamented, remembering the pandemic that took many lives. Mylin coordinated the processing of claims and made sure that microinsurance benefits will be delivered at the soonest possible time to affected families. Community quarantines notwithstanding, she looked for ways to communicate with all the center chiefs and the MBA staff. She was very passionate in fulfilling her role as MBA coordinator and that made her popular in their area.

To this, Mylin shyly replies: “Noong tinanggap ko ang pagiging MBA coordinator, balik-pasasalamat ko iyon sa MBA/MFI kasi maraming blessing sa aming pamilya simula noong naging miyembro ako (My accepting the job of MBA coordinator is my way of giving back to my MBA/MFI for all the blessings that came to my family through them).”

Mylin was eventually elected as board treasurer. She later became their 15th BOT president. “I was glad to meet members and staffs from all over the country. I also welcomed the opportunity to become the bridge between the members and the association,” says Mylin. She is proud that during her term, she was able to make sound and relevant decisions considering both the welfare of the members and the MBA amidst the pandemic.

Kudos to the leaders and members of mi-MBAs across the country! May your tribe increase! I conclude this piece with a quote that I found on the website of the Insurance Commission: “Debunking the myth that insurance is only for the rich, microinsurance is tailor-fitted for the majority of Filipinos, especially the poor.”

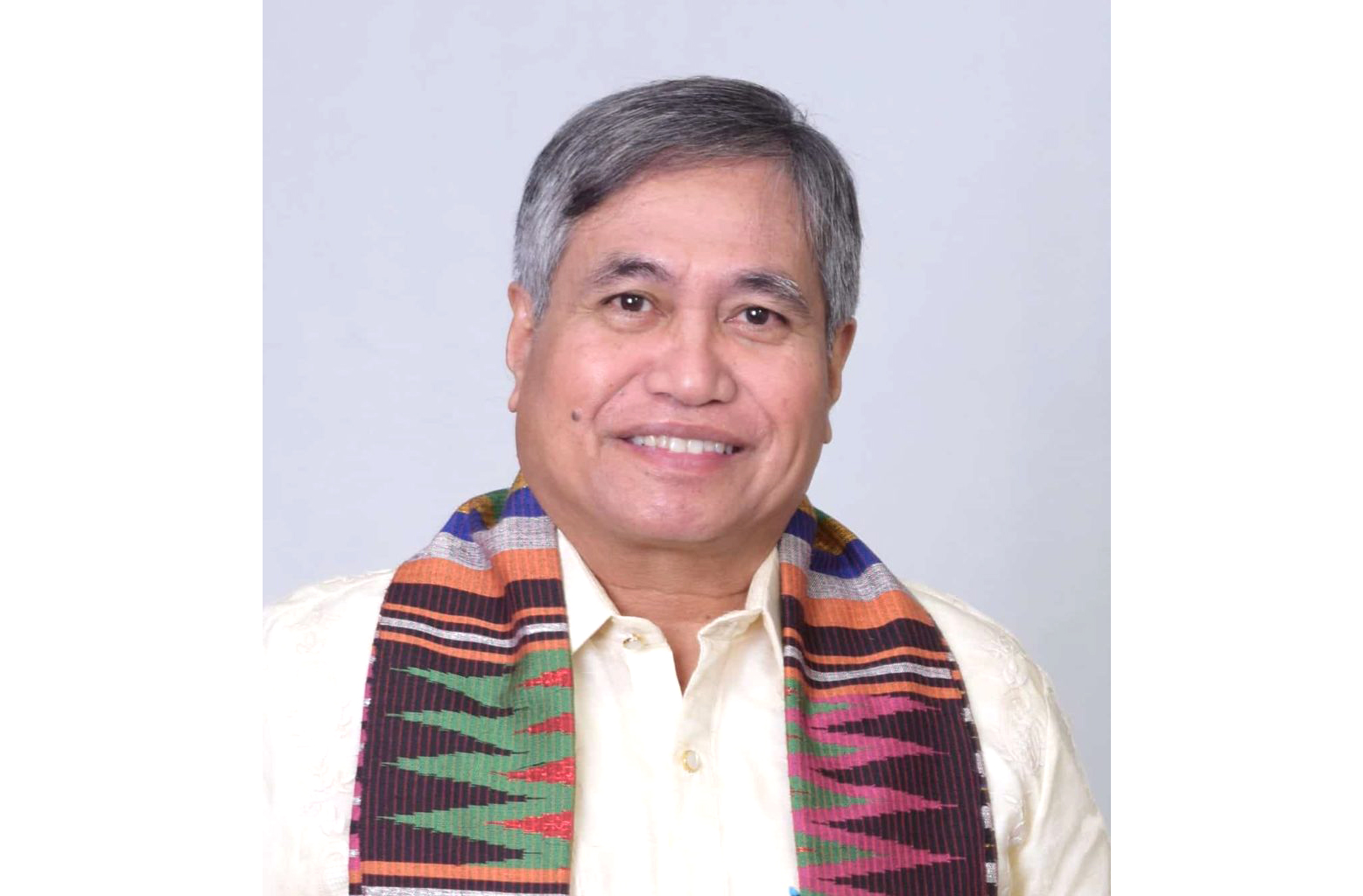

(Dr. Jaime Aristotle B. Alip is a poverty eradication advocate. He is the founder of the Center for Agriculture and Rural Development Mutually-Reinforcing Institutions (CARD MRI), a group of 23 organizations that provide social development services to eight million economically-disadvantaged Filipinos and insure more than 27 million nationwide.)