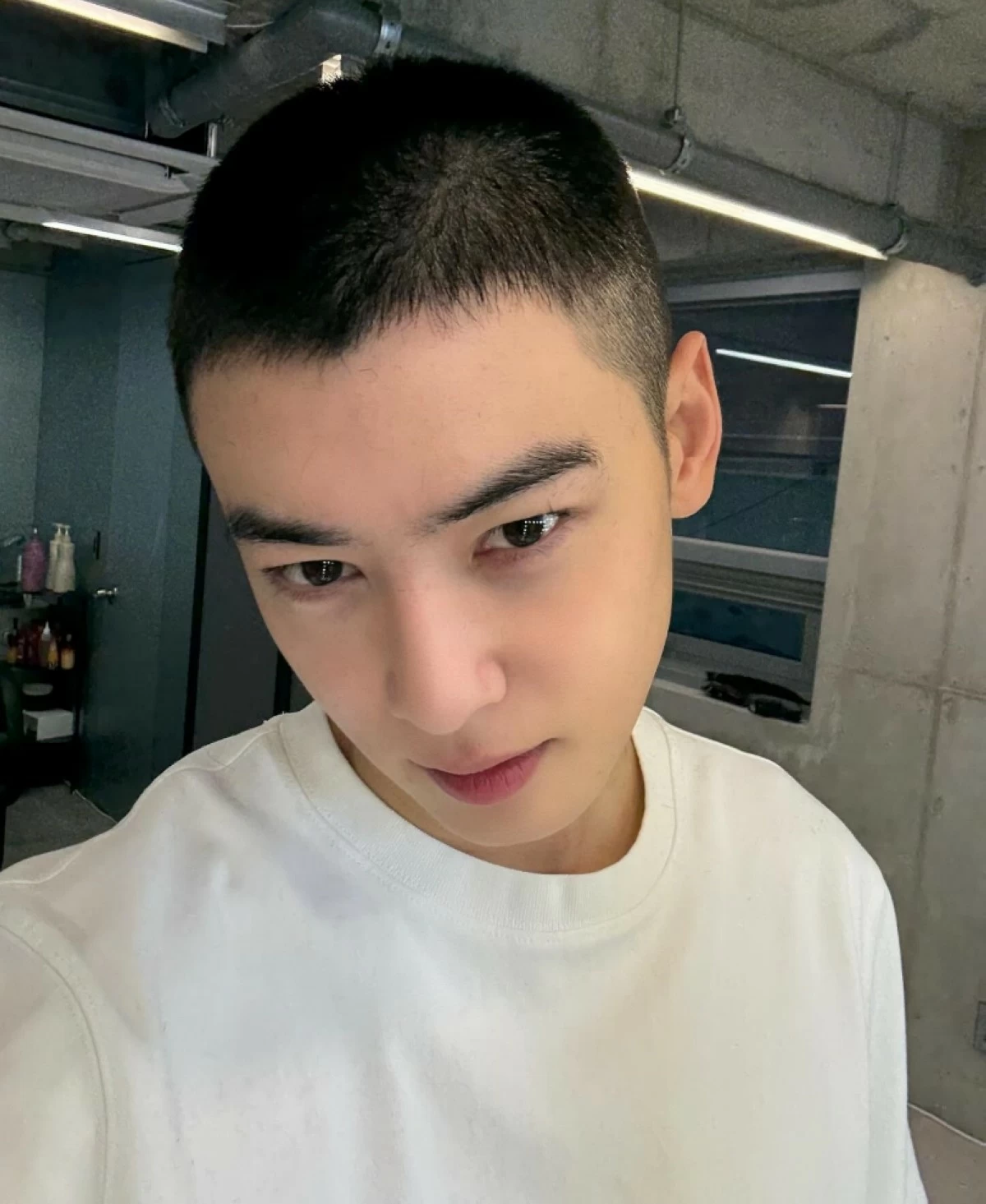

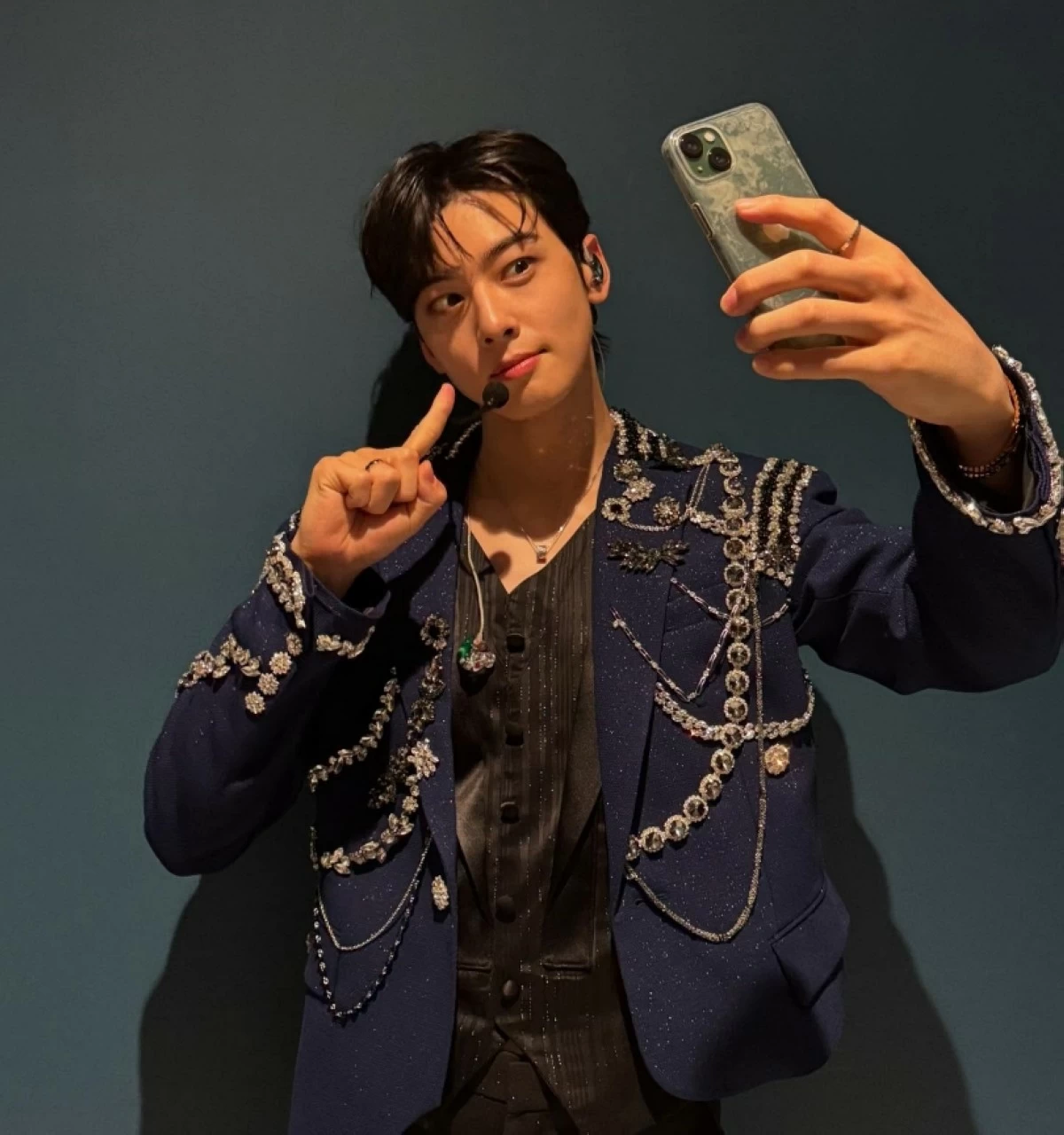

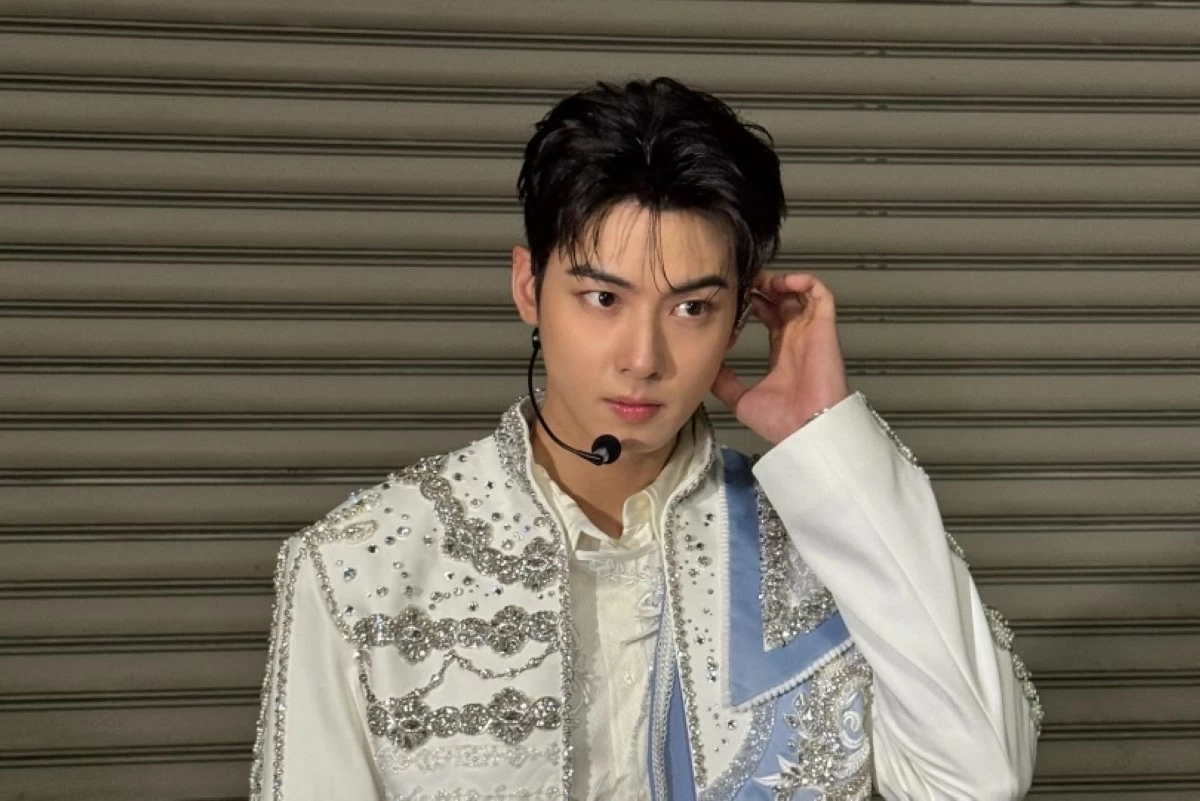

Korean star Cha Eun-woo ordered to pay $13.6-M for tax evasion; his agency seeks clarification

Korean actor and K-pop idol Cha Eun-woo of group ASTRO is facing a 20 billion won (about P13.6 million) surcharge for tax evasion due to a corporation set up by his mother.

Korean media outlet E-daily reported that Korea’s National Tax Service (NTS) notified Cha Eun-woo of a fine of over 20 billion won for income tax evasion, described as the largest surcharge imposed on a celebrity.

Cha Eun-woo is currently fulfilling his military service and is on hiatus from his career.

The report said the fine was the result of a tax investigation on Cha Eun-woo before he enlisted in the military in July last year.

The actor’s side is awaiting the results of a "pre-tax assessment" appeal filed against the NTS decision.

He was investigated by the Seoul Regional Tax Office in the first half of last year on suspicion of tax evasion.

In his case, his mother, Choi, established a corporation. Cha Eun-woo is signed under Fantagio agency.

Fantagio and his mother’s corporation signed a service contract to support the star’s entertainment activities. Since then, his income was divided among Fantagio, the corporation and himself.

The report added that the NTS determined the his mother’s corporation was a “paper company” that did not actually provide services.

The NTS determined that Cha Eun-woo and his mother had set up a non-existent corporation to allegedly reduce their 45 percent income tax and distributed the income to a corporate tax rate more than 20 percentage points lower than their income tax rate.

It said the corporation’s address is located in Ganghwa Island in Incheon, South Korea, “a place that doesn't seem appropriate for an entertainment-related business, and it couldn't even be considered an office,” the report quoted a source.

Last August, the NTS imposed an 8.2 billion won (about $5.6 million) fine on Fantagio as it deemed that the agency was responsible for processing “false tax invoices” for the mother’s corporation.

The NTS summoned and questioned Cha Eun-won and his mother and concluded that the profits from the corporation ultimately went to Cha Eun-woo and that the star allegedly evaded income tax by more than 20 billion won.

Cha Eun-woo’s side maintains that the NTS decision was unfair, saying, "Fantagio's CEO changed several times, and out of a sense of insecurity about her son's entertainment career, his mother established the company and began operating the management business herself, driven by a desire to protect him. This is not a paper company with no substance, but a formally registered pop culture and arts planning business."

If the NTS accepts the tax assessment review, Cha Eun-woo will not be required to pay the additional taxes.

The report said the initial police investigation did not target Cha Eun-woo but allegations of tax evasion by the chairman of a company that owns Fantagio.

The police investigated the company, Fantagio and another entity, all companies owned by the chairman. In the process, the corporation of Cha Eun-woo’s mother was subjected to an investigation.

After the report came out, Fantagio issued a statement, saying, “We would like to express our official position regarding the article reported today regarding the tax investigation of our artist Cha Eun-woo.”

“The main point of contention in this matter is whether the corporation established by Cha Eun-woo's mother is subject to actual taxation. As of now, no final decision has been made or notified, and we plan to actively explain the issues related to the interpretation and application of the law through due process. The artist and his tax agent will faithfully cooperate so that the relevant procedures can be concluded quickly. Cha Eun-woo promises to continue to faithfully fulfill his tax reporting and legal obligations as a citizen,” it said.