The Philippine office market is seen to grow by 16 percent to achieve a net take-up of 490,000 square meters by the end of 2025 and is off to a good start in the first quarter of the year.

In a media briefing, Leechiu Property Consultants’ Director for Commercial Leasing Mikko Barranda said this growth will be fueled by strong leasing activity, particularly from the IT-BPM sector, and a continued slowdown in space contractions.

Contractions are largely due to the tapering of Philippine Offshore Gaming Operator (POGO) exits that had previously dampened market performance.

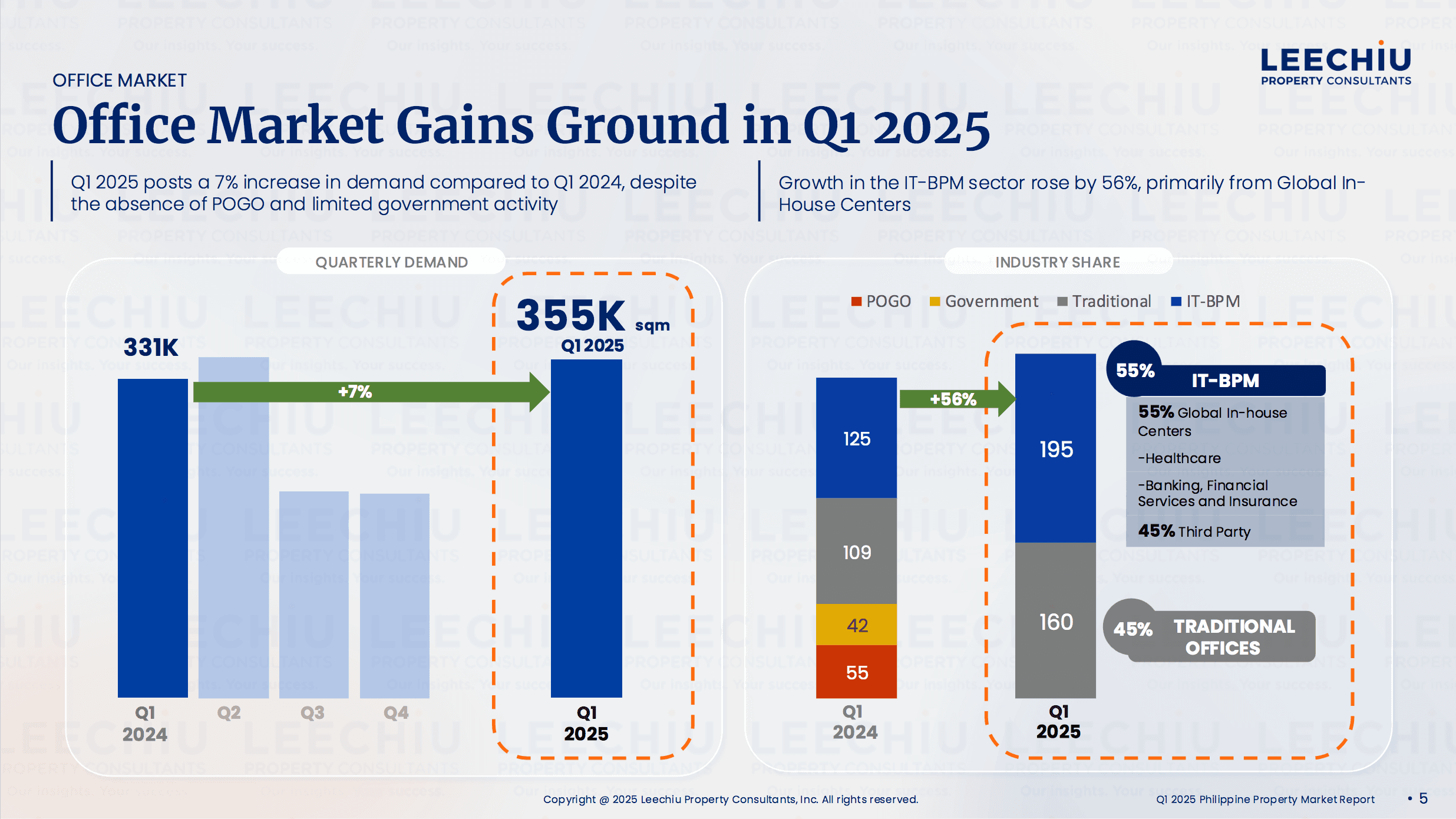

For the first quarter of 2025, the office market posted a seven percent increase increase in year-on-year demand of 355,000 square meters, largely driven by the IT-Business Process Management (IT-BPM) sector, predominantly from Global In-House Centers (GICs).

Barranda said the IT-BPM sector is expanding as it continues to view the Philippines as a strategic outsourcing destination. Notable sub-sectors include companies that are in the healthcare and financial industries.

Its growth is making up for the absence of POGOs and demand from government-related deals in the Philippine office market.

“The office market in the Philippines continues to show grit in the face of global and local challenges. The IT-BPM sector remains to be a reliable key driver of growth, while traditional office tenants are also increasingly active. With a promising outlook for the rest of the year, we expect resiliency amidst potential headwinds,” said Barranda.

He noted that Metro Manila is leading the country in leasing activity, with the Ortigas-Mandaluyong-San Juan area recording the highest number of lease transactions, totaling 59,000 sqm in the first quarter of 2025, reflecting growing interest in emerging submarkets offering competitive rental rates.

Meanwhile, Bonifacio Global City has already absorbed 51,000 sqm—equivalent to 40 percent of its total demand from 2024 (126,000 sqm)—within the first quarter of 2025 alone.

In terms of vacant spaces, Barranda said the number has declined from 312,000 sqm to 277,000 sqm, primarily driven by the continued exit of POGOs.

“With the pace of these exits tapering off, we expect contractions to ease further in the coming quarters,” he added.

The nationwide office vacancy rate held steady at 17 percent in the first quarter of 2025, marking a slight improvement from the previous quarter’s 18 percent.

“While vacancy remains in double digits, the decline reflects a gradual recovery, driven by sustained demand and a slowdown in space contractions.

“Vacancy is expected to trend further downward in the coming quarters, particularly in core central business districts such as Makati and BGC, as active leasing requirements begin to convert into signed deals,” said Barranda.