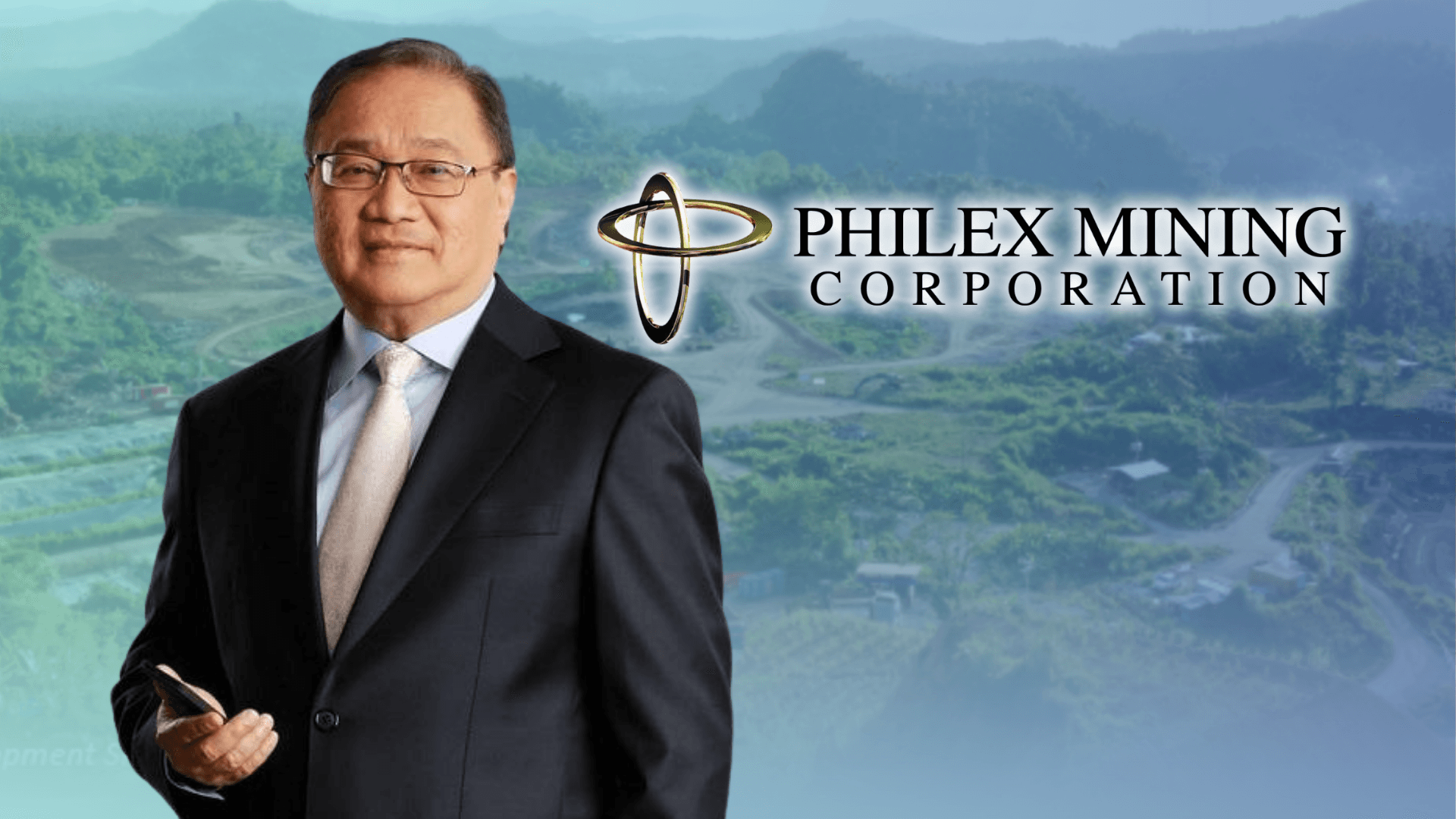

MVP: Silangan mining attracts potential foreign investor for minority stake

Philex Mining Corp. is negotiating with a potential foreign investor that may take a minority stake in its wholly owned subsidiary, Silangan Mindanao Mining Co. Inc.

In an interview, Philex Chairman Manuel V. Pangilinan said the investor will come in directly into Silangan, instead of Philex, since the gold mine of Philex is old and almost depleted, while Silangan is new and has high-grade reserves.

He noted that any new investor will be allowed to acquire only a minority stake since Philex wants to retain control because of the project’s immense potential.

Philex had earlier been discussing a potential investment by a Chinese company, but Pangilinan pointed out that was a long time ago—before the Covid-19 pandemic.

In July last year, he said Philex may raise an additional $400 million to finance the second phase of its Silangan mine gold and copper project, which is slated to start commercial production later this year.

Early in 2024, Philex completed raising the $170 million it needs for the development of its Silangan project.

The firm said it has signed a deed of accession for an additional $70 million with additional lenders who syndicated the credit facility.

The lenders included Philippine National Bank (PNB), Philippine Bank of Communications (PBCOM), and Security Bank Corp., with SB Capital Investment Corp. as mandated lead arranger, and PNB and PBCOM as joint lead arrangers.

Philex noted that the signing of the agreement completes the total loan facility of $170 million needed to bring the Silangan project into commercial operation by the first quarter of 2025.

In 2023, the company signed the omnibus loan and security agreement for a $100 million syndicated debt facility with lenders, namely Union Bank of the Philippines (UnionBank), Security Bank, and Bank of the Philippine Islands (BPI), with BDO Capital and Investment Corp. as mandated lead arranger and UnionBank as co-lead arranger.

Silangan copper and gold project is touted as one of the big three mining projects in the country.