The Bureau of Customs (BOC) padlocked a Malabon City warehouse containing an estimated ₱1.2 billion worth of illicit vapes and counterfeit goods on Tuesday, March 11.

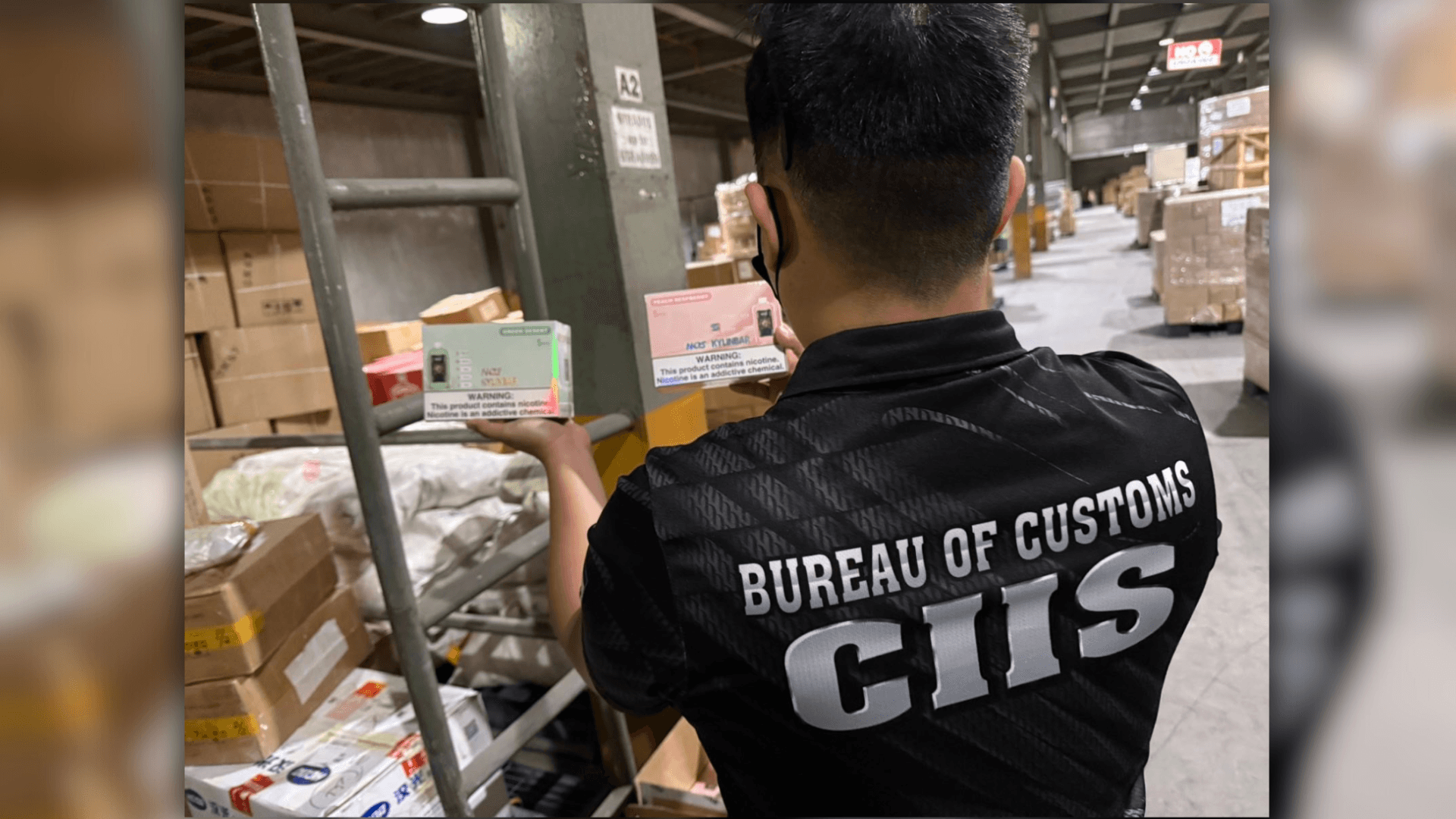

The operation, conducted by the BOC-Customs Intelligence and Investigation Service (CIIS), targeted a warehouse in Barangay Tanong, Malabon City.

The raid followed the issuance of a Letter of Authority (LOA) by BOC Commissioner Bienvenido Y. Rubio, after intelligence indicated the presence of suspected illegal goods.

Inside the warehouse, CIIS-Manila International Container Port (CIIS-MICP) agents discovered a significant quantity of disposable vape brand Kylinbar, which lacked Bureau of Internal Revenue (BIR) and Department of Trade and Industry (DTI) ICC stickers.

Additionally, the team found counterfeit shoes from brands like Nike, New Balance, and Adidas, as well as fake Apple AirPods, headsets, and luxury brand bags from Louis Vuitton and Gucci.

Other seized items included appliances, garments, cosmetics, household products, and general merchandise.

Rubio urged the public to be cautious of counterfeit goods, noting the health risks associated with unregulated products.

“We see here some fake cosmetics being sold as branded goods. So, if these goods did not go through the proper testing and licensing, imagine the risk you are taking,” Rubio said.

“Unfortunately, the global marketplace allows access to these goods, which unscrupulous vendors sell to unsuspecting customers. They profit from these at the risk of consumers’ health and safety,” he added.

The warehouse was temporarily sealed, and Customs examiners, agents from the CIIS, Enforcement and Security Service (ESS), and storage representatives are scheduled to inventory the seized goods.

The warehouse owners and operators have 15 days to provide documentation proving the legitimacy of the imported goods and the payment of appropriate duties and taxes, as mandated by Section 224 of the Customs Modernization and Tariff Act (CMTA).

Failure to comply could result in charges for violations of Section 117, Section 1400, and Section 1113 of the CMTA and Republic Act 8293, the Intellectual Property Code of the Philippines.