How to reinvigorate the Philippine auto parts sector

Learning from the past and our neighbors

By Inigo Roces

The Philippine automotive industry has faced significant challenges over the years. Some policy decisions have left lasting impacts on the sector, some good, some not so great. More recently, the Philippine Parts Maker Association sounded the alarm over the dwindling numbers of its members, which supply parts to vital locally assembled vehicles. With fewer of these companies operating, our prospects of attracting automakers to invest in local manufacturing dwindles too.

AUV excise tax

The group cites one particular government decision which may have hurt local automotive manufacturing momentum. In the early 2000s, the government’s decision to impose excise taxes on the AUV (Asian Utility Vehicle) category. At its peak, AUVs accounted for nearly 30% of total vehicle sales in the Philippines. It was populated by models like the Toyota Tamaraw, Mitsubishi Adventure, Isuzu Crosswind, Mitsubishi L300 and even Honda CR-V. These vehicles were not only affordable and practical for Filipino families and businesses but also relied heavily on locally manufactured parts, with up to 60% local content.

Ferdi Raquelsantos, President of the Philippine Parts Maker Association (PPMA), reflected on this critical moment. “The imposition of excise taxes on AUVs was a turning point for the industry, but not in a positive way,” he said. “AUVs had a high percentage of local content, which meant that when their sales dropped, the local auto parts industry suffered as well. This single policy decision disrupted the growth trajectory of both the AUV segment and the local manufacturing ecosystem.”

Granted, this may have been imposed, in part, to curb certain brands from passing off vehicles only fit to transport 7-passengers as 10-seater vehicles, among several other loopholes exploited.

Following the tax imposition, AUV sales plummeted by over 40% within two years, leading to a corresponding decline in demand for locally produced auto parts. This downturn forced many small and medium-sized auto parts manufacturers to scale back operations or shut down entirely, resulting in significant job losses across the sector.

Today, the local auto parts industry remains ailing. Companies like Ford, Honda, and Nissan no longer manufacture vehicles locally, resulting in a huge loss of business for Philippine parts makers. The PPMA is urging the government to implement policies that can revive it. Nonetheless, the group has a few suggestions on how to bring things back on track.

One such policy is the promotion of the PUV Modernization Program, which aims to replace outdated and inefficient public transport vehicles with safer, more environmentally friendly alternatives. Modern PUVs, such as jeepneys and mini-buses, have a high percentage of local content, with estimates suggesting that up to 50% of their components can be sourced domestically. Raquelsantos believes that this program, if properly supported, can serve as a catalyst for the revival of the local auto parts industry.

Modern PUVs

“Modern PUVs are not just about improving public transportation; they are also about creating opportunities for local manufacturers,” Raquelsantos explained. “By supporting this program, the government can help generate jobs, boost local manufacturing, and reduce our reliance on imported parts.” The PPMA estimates that the PUV Modernization Program could create up to 100,000 new jobs in the auto parts manufacturing sector and generate billions of pesos in economic activity.

Raquelsantos also emphasized the importance of learning from past mistakes and adopting a more strategic approach to supporting the automotive industry. “We cannot afford to repeat the mistakes of the past,” he said. “The excise tax on AUVs was a well-intentioned measure, but it failed to consider the broader implications for the local industry. Moving forward, we need policies that balance revenue generation with the need to nurture and grow our domestic manufacturing capabilities.”

If the Philippines wants to position itself as a competitive player in the global automotive manufacturing industry, the lessons from the AUV excise tax debacle serve as a stark reminder of the need for careful planning and stakeholder engagement. By promoting initiatives like the PUV Modernization Program and supporting the local auto parts industry, the government can help ensure a brighter future for the sector. “The automotive industry has the potential to be a major driver of economic growth and job creation in the Philippines,” Raquelsantos said. “But we need the right policies in place to unlock that potential. Let’s learn from the past and work together to build a stronger, more resilient industry for the future.”

The PPMA also proposes yet another idea to help restart our parts manufacturing industry: learning from Malaysia.

Learning from Malaysia

Malaysia’s automotive parts manufacturing industry has become a regional success story, contributing over US$4 billion annually to its economy and accounting for 30% of its total automotive output. With a well-defined policy framework and strong government support, Malaysia has transformed its auto parts sector into a vibrant and globally competitive industry. For the Philippines, which currently generates only US$1.2 billion from its auto parts sector, Malaysia’s achievements offer a roadmap for revival and growth.

PPMA President Raquelsantos is urging the government to adopt similar strategies to breathe new life into the country’s ailing auto parts industry. “Malaysia’s success didn’t happen overnight. It was the result of clear policies, targeted incentives, and a commitment to innovation. The Philippines can achieve the same if we take decisive action now.”

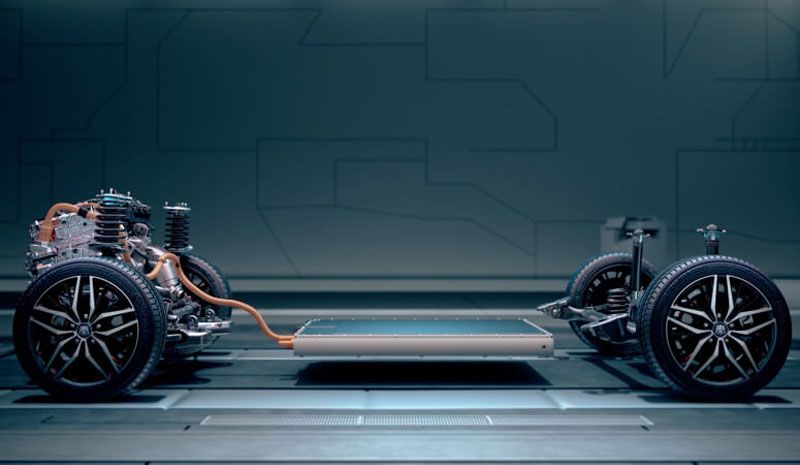

Moving to electrified vehicles

One of Malaysia’s key strategies is its National Automotive Policy (NAP), which prioritizes technology adoption, sustainability, and market expansion. By focusing on energy-efficient vehicles (EEVs), Malaysia has attracted over US$2.5 billion in investments and created 50,000 jobs in the auto parts sector. Raquelsantos emphasized that the Philippines could replicate this approach by incentivizing the production of EEV components, such as batteries and lightweight materials. “With the global shift toward green technology, we have a unique opportunity to position the Philippines as a hub for sustainable auto parts manufacturing,” he added.

According to GlobalData, the Philippines was the world’s second-largest producer of nickel in 2023. The Philippines accounts for 11% of global production, with the largest producers being Indonesia, the Philippines, Russia and New Caledonia. Nickel is a key ingredient in batteries, particularly those that power electrified vehicles. Incentivizing EV battery production would take great advantage of our abundance of nickel and put the country in a powerful position in the new energy vehicle market.

Back to Malaysia, their local content requirements have also played a crucial role to their success. By mandating that a significant percentage of vehicle components be sourced locally, Malaysia has strengthened its domestic supply chain and reduced its reliance on imports.

In contrast, the Philippines’ local content rate stands at a mere 20%, leaving the industry vulnerable to external pressures. Raquelsantos proposed implementing a similar policy, coupled with tax incentives for compliance. “If we can increase our local content rate to 40%, we could add US$1 billion to the industry’s annual output and create 30,000 new jobs,” he explained.

Export promotion

Another lesson from Malaysia is its focus on export promotion. Through tax exemptions and grants, Malaysia has encouraged its auto parts manufacturers to tap into global markets, with exports now accounting for 25% of its total production. The Philippines, meanwhile, exports less than 10% of its auto parts. Raquelsantos believes that with the right support, the country can boost its export revenue to US$500 million annually within five years.

Malaysia’s success proves that with the right policies, a struggling auto parts industry can be transformed into a thriving economic driver. For the Philippines, the time to act is now. As Raquelsantos aptly put it, “We have the talent and the potential. What we need is the will to take bold steps and learn from those who have succeeded before us.”

By adopting Malaysia’s strategies—clear policies, local content rules, export incentives, and a focus on innovation—the Philippines can unlock the full potential of its auto parts sector, create jobs, and boost economic growth. The road to success is clear; all that’s needed is the courage to take the first step.